Get the free Letter to Stockholders regarding authorization and sale of preferred stock and stock...

Show details

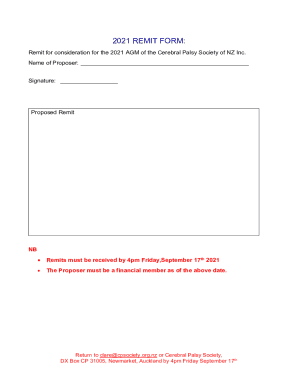

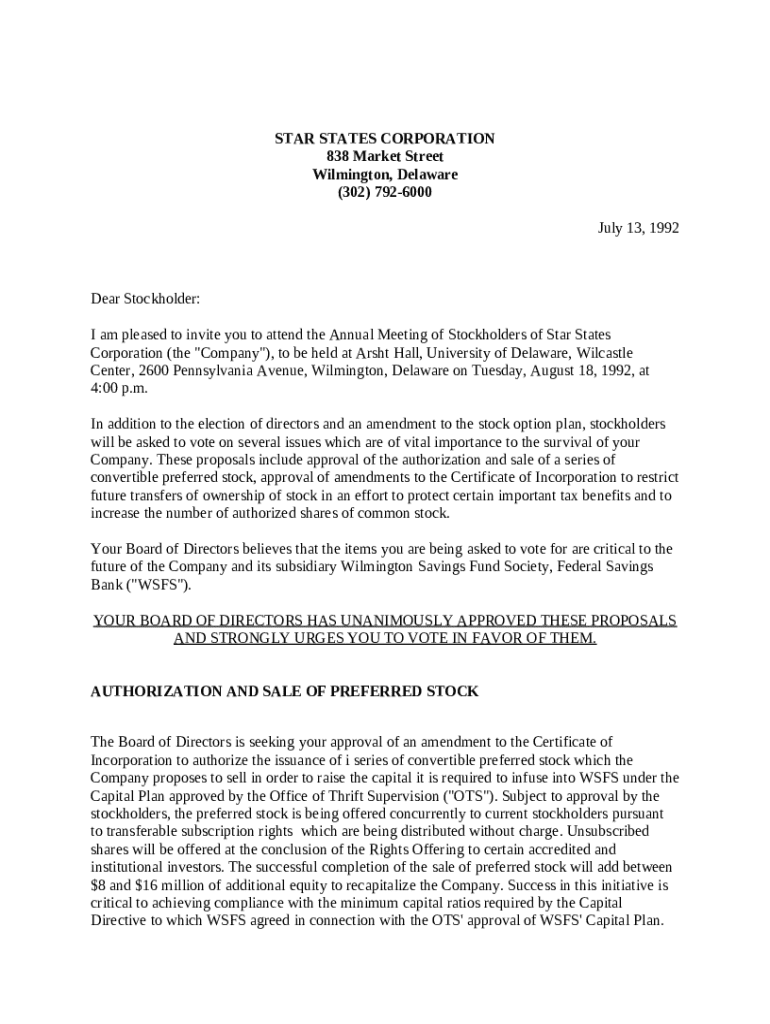

This sample form, a detailed Letter to Stockholders Re: Authorization and Sale of Preferred Stock and Stock Transfer Restriction to Protect Certain Tax Benefits document, is a model for use in corporate

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter to stockholders regarding

A letter to stockholders regarding is a formal communication from a company to its shareholders, typically providing updates on financial performance and strategic direction.

pdfFiller scores top ratings on review platforms

very easy to use and saves so much time, fantastic

The forms I was able to pullup store and print

práctico

It is extremely user friendly.

Very efficient and simple to get all the documents you need filled out right away.

limited knowledge

Who needs letter to stockholders regarding?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Crafting a Letter to Stockholders Regarding Form Form

What is the purpose of a shareholder letter?

A shareholder letter serves as a critical aspect of corporate communication, enabling companies to provide vital updates and insights to their stockholders. These letters typically include key disclosures regarding financial performance, strategic objectives, and operational developments. By fostering transparency and trust, shareholder letters contribute significantly to a company's relationship with its investors.

-

Shareholder letters are formal communications meant to inform stockholders about a company's status and strategic direction. They build investor trust and engagement.

-

Typical disclosures include recent financial results, updates on corporate strategy, and information on any pending major decisions affecting the stockholders.

-

These letters help create a culture of openness, allowing stockholders to feel informed and valued, ultimately strengthening their loyalty and confidence.

What are the essential elements of a shareholder letter?

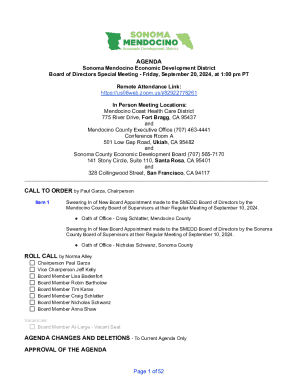

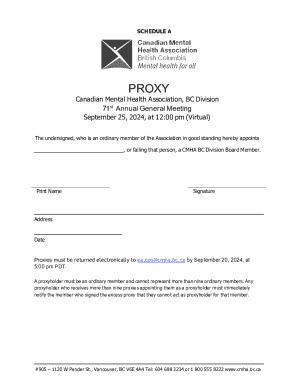

A well-structured shareholder letter should include several key elements that provide stockholders with necessary information while maintaining a professional tone. Starting with a formal salutation, the letter introduces the stockholder to the agenda for the upcoming Annual Meeting, including crucial details such as date, time, and location.

-

Begin with a respectful greeting to establish credibility and professionalism.

-

Outline when and where the meeting will take place to allow stockholders ample time to prepare.

-

Clearly articulate the proposals that will be voted on, emphasizing their significance to the company's future.

-

Provide insights into the board's position on these proposals, guiding stockholder voting decisions.

How to detail key proposals for stockholder voting?

Detailed explanations of key proposals are essential for informed shareholder voting. Proposals often include significant corporate actions such as the authorization and sale of convertible preferred stock, amendments to the company's Certificate of Incorporation, and their potential impacts on shareholders' interests.

-

Explain the intention and benefits of issuing these financial instruments, considering how they affect equity structure.

-

Clarify the proposed changes and their implications for corporate governance.

-

Discuss how these proposals could influence stock prices, dividends, or control over the company.

How can interactive tools enhance stockholder engagement?

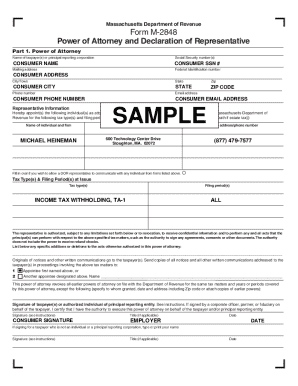

Leveraging interactive tools significantly enhances stockholder engagement when crafting and delivering shareholder letters. pdfFiller, for example, provides essential tools for editing and customizing the shareholder letter, along with capabilities for eSigning to streamline approvals. Collaborative features also enable team review, ensuring that the letter is well-prepared and accurately reflects the company's message.

-

Utilize pdfFiller's advanced editing capabilities to tailor the letter to specific shareholder needs.

-

Facilitate quick approvals through integrated eSign options, which speed up the process.

-

Encourage team input and modifications to ensure the letter meets corporate standards.

What are the formatting and design considerations for the shareholder letter?

Formatting and design play a crucial role in the effectiveness of a shareholder letter. A professional layout and clear structure facilitate easy comprehension, while the tone and language used convey respect and clarity. It's also essential to adhere to accessibility guidelines and corporate compliance standards to maintain professionalism.

-

Ensure that the letter is well-organized, with headings and subheadings that guide the reader effortlessly through the content.

-

Choose words that are straightforward yet respectful to promote understanding.

-

Adhere to guidelines that ensure readability for all shareholders, including those with disabilities.

How to navigate compliance and regulatory requirements?

Compliance with legal standards is paramount when crafting a shareholder letter. Companies must be aware of relevant laws and regulations governing shareholder communications, particularly in Delaware, which has specific requirements. Including necessary disclaimers and disclosures not only fulfills regulatory obligations but also builds company credibility.

-

Understand state and federal laws that impact shareholder communications.

-

Be aware of state-specific rules, especially for companies incorporated in Delaware.

-

Always include relevant disclaimers to inform shareholders about their rights and the implications of voting.

What are customization tips for different situations?

Tailoring the letter's content can be beneficial for addressing the unique needs of different shareholder meetings and demographics. Adjusting your approach based on the audience—whether they're institutional investors or retail stockholders—can improve engagement and response rates.

-

Modify the letter's focus depending on whether it's for an annual meeting, a special meeting, or a quarterly update.

-

Consider varying the language and details to resonate more with diverse groups of stockholders.

-

Leverage pre-designed templates from pdfFiller that cater to different types of shareholder communications.

How to fill out the letter to stockholders regarding

-

1.Open pdfFiller and upload the letter template or create a new document using the provided tools.

-

2.Begin by entering the date at the top of the letter to ensure it reflects the correct timeline for communication.

-

3.Clearly address the letter to 'Dear Stockholders' or use specific names if appropriate for a personal touch.

-

4.Include the main body content which should cover key financial metrics, strategic initiatives, and any relevant updates that shareholders need to know.

-

5.Conclude with a summary statement encouraging engagement and inviting questions or feedback.

-

6.Add a closing line such as 'Sincerely' or 'Best regards' followed by the name and title of the person sending the letter.

-

7.Review the letter for clarity and accuracy before finalizing.

-

8.Once satisfied, save the document and either print it for distribution or send it electronically to shareholders via email.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.