Get the free Credit and Your Consumer Rights template

Show details

This is information directly from the Federal Trade Commission. No changes can be made to this information. All FTC Information is free.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is credit and your consumer

'Credit and Your Consumer' is a document that outlines the responsibilities and rights of both lenders and borrowers in the context of consumer credit.

pdfFiller scores top ratings on review platforms

I love the features and ease of navigation for this site.

I needed a form from the IRS that I could not download and here it is on PDFfiler-ready for me to complete online and print. Wonderful!

I was impressed by all the wonderful features that PDF filler has. I would recommend it to anyone. I use it to fill out the PDF forms that have. I don't generate forms, just need the ability to fill them out and sign them. This works so much better than any of the other services I have tried. (both free and paid)

Seems a bit slow, not entirely intuitive which I why the webinar might be informative. Although, I should have used the help feature probably.

very happy. Don't understand oll features yet

My cousin Eileen helped me but once I got the hang of it. It was easy.

Who needs credit and your consumer?

Explore how professionals across industries use pdfFiller.

Understanding credit and your consumer form form

Filling out a credit and your consumer form form requires accuracy and knowledge of your credit rights. This guide will explore the essentials of credit, legal protections, credit reports, common problems and solutions, the forms you'll encounter, and how pdfFiller can assist you.

What is the importance of credit?

Credit is crucial in modern financial systems, serving as a measure to evaluate an individual’s trustworthiness. It affects not just borrowing capacity but also employment opportunities, insurance rates, and housing applications.

-

Credit definition and significance: Credit refers to the ability to borrow funds based on an individual's promise to repay. Its significance lies in how it influences financial transactions.

-

Role of credit history: A solid credit history can enhance employment prospects, lower insurance premiums, and facilitate housing applications.

-

Impact of credit rating: Good credit ratings open up financial opportunities, while poor ratings may limit access to loans and higher interest rates.

What are the legal protections for consumers' credit rights?

Consumers are protected under various laws that aim to ensure fair treatment in credit reporting and lending practices. Understanding these protections is vital for safeguarding your credit.

-

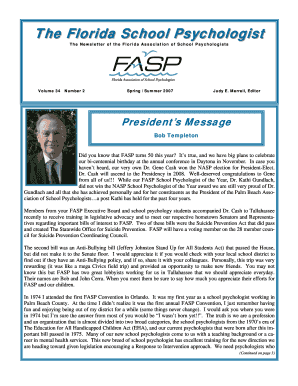

Overview of the FTC: The Federal Trade Commission (FTC) oversees and enforces laws protecting consumers from unfair practices related to credit.

-

Consumer rights under FCRA: The Fair Credit Reporting Act guarantees consumers the right to access their credit reports and dispute inaccuracies.

-

Importance of fair treatment: Transparency in disclosures helps protect consumers from discriminatory practices.

What should you know about your credit report?

A credit report contains critical information about your financial behavior and credit history. Understanding its components can empower you in managing your financial health.

-

Components of a credit report: This includes personal information, account history, outstanding debts, and any public records.

-

Responsibilities of consumer reporting agencies: These agencies must ensure the accuracy, fairness, and privacy of consumer information.

-

Rights to access credit reports: Consumers are entitled to obtain free copies of their credit reports annually.

What are common credit problems and solutions?

Encountering credit problems can be stressful, but understanding common issues and their resolutions can make the process more manageable.

-

Types of credit errors: Common issues include inaccuracies, accounts in collections, and identity theft.

-

Steps to address errors: Consumers should dispute inaccuracies by contacting the reporting agency and providing supporting documentation.

-

Resources for resolving disputes: Organizations and credit counselors can assist consumers in navigating the dispute process and communicating with credit bureaus.

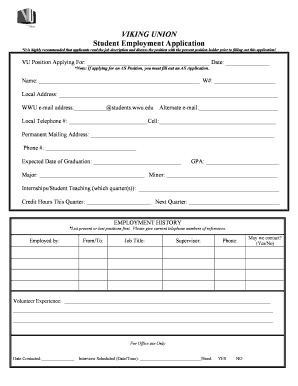

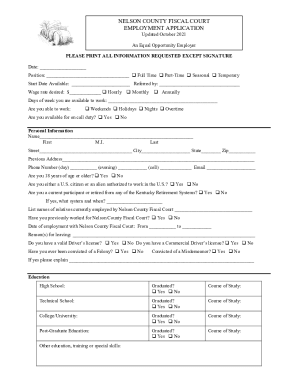

How can you understand credit-related forms?

Navigating various credit forms is essential for maintaining control over your financial documentations. Knowing how to fill them out correctly can significantly aid your credit journey.

-

Consumer Assistance Forms: These forms help consumers in resolving credit-related issues and serve as a bridge between clients and lenders.

-

Model credit application forms: Understanding all required fields ensures a complete and correct application.

-

Sample notification forms: Familiarize yourself with notifications related to credit disputes to ensure timely responses.

How can pdfFiller assist in managing your documents effectively?

pdfFiller stands out as a solution for managing credit forms, allowing users to edit, eSign, and secure shared documents seamlessly. It's a powerful tool for anyone navigating credit and consumer forms.

-

Streamlined document management: pdfFiller simplifies the process of filling out and managing various credit forms.

-

Editing documents: Their robust editing tools make form completion straightforward, ensuring accuracy.

-

Secure sharing: pdfFiller allows for secure sharing and eSigning of completed documents, ensuring privacy and efficiency.

How to address consumer questions and concerns?

It’s common to have questions regarding your credit rights or the forms you encounter. Knowing where to seek assistance can save time and stress.

-

Asking about rights: Consumers should feel empowered to ask questions about their rights concerning credit forms.

-

Common concerns: Issues like how to obtain a credit report or dispute inaccuracies often arise among consumers.

-

Sources for assistance: Government agencies, credit counseling services, and advocacy organizations can provide further guidance.

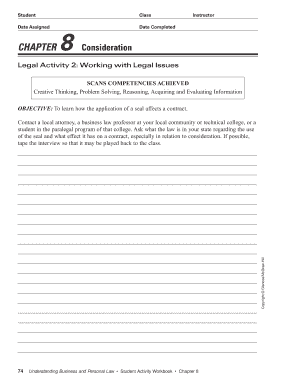

How to fill out the credit and your consumer

-

1.Open the 'Credit and Your Consumer' document on pdfFiller.

-

2.Read the introduction to understand the purpose of the document.

-

3.Identify sections that pertain to your situation, such as loan types or credit terms.

-

4.Begin filling in your personal information, including your name, address, and contact details.

-

5.Carefully review the terms outlined in the document and select any applicable options or checkboxes that align with your credit situation.

-

6.If you're unsure about specific terms, refer to the definitions provided within the document.

-

7.Ensure that any sections requiring input, such as questions or statements, are answered accurately and completely.

-

8.Once all relevant sections are filled out, review the entire document for completeness and accuracy.

-

9.Save your progress frequently to avoid losing any information.

-

10.After reviewing, finalize the document and use the 'Submit' or 'Download' option to save a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.