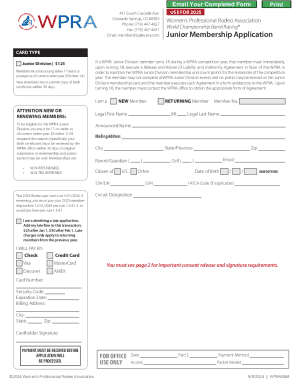

Get the free Indemnification - Long- Provision template

Show details

This form brings together several boilerplate contract clauses that work together to outline the procedures, restrictions, exclusivity and other aspects of an indemnity provided for under the terms

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

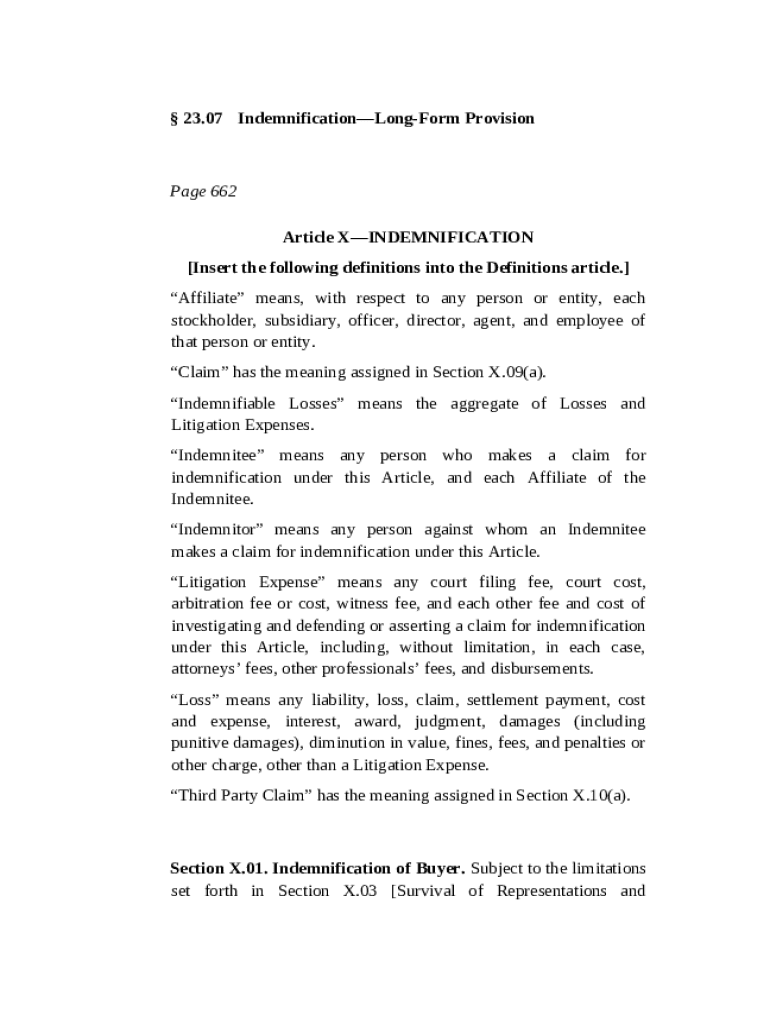

What is indemnification - long-form provision

An indemnification long-form provision is a contract clause that outlines the circumstances under which one party agrees to compensate another for losses or damages incurred.

pdfFiller scores top ratings on review platforms

Easy to use, but too many pop-up tools get in the way of when you're trying to work.

It's easy to use and offers the options I need to get my documents where they need to be.

I', just finishing the first form so it's still a work in progress but so far so good

So far, it has been awesome. I stumbled through it and eventually got through it. I think this webinar would be super helpful.

Easy to use. Highly recommend it. The price could be bette

So far, this product is meeting our needs better than competing products at a fraction of the cost. The biggest downside is that most of our forms are already fillable PDFs and your product does not recognize any of the fields set up, and will also not detect fields the way that Adobe Acrobat does.

Who needs indemnification - long- provision?

Explore how professionals across industries use pdfFiller.

Indemnification - Long-Form Provision Guide on pdfFiller

How can you understand indemnification clauses?

An indemnification clause is a contractual provision aimed at protecting one party from loss or damage that may arise from certain activities or events. It serves a vital role in contracts by shifting potential financial burdens from one party to another. Such clauses are commonly found in various agreements, where the need for risk management and liability protection is prevalent.

What are the key definitions in indemnification?

-

An affiliate in this context refers to entities that are related or connected, which could impact indemnification responsibilities, especially when dealing with related claims.

-

A claim is any assertion by a party that they are entitled to a remedy, often linked to damages or losses, as stipulated in the indemnification clause.

-

The indemnitee is the party protected by the indemnification, while the indemnitor is the party providing that protection. Understanding these roles is crucial for effective risk management.

-

These are the costs associated with pursuing or defending a legal claim, highlighting the potential financial implications of indemnification.

-

These refer to losses that are covered under the indemnification clause, which can encompass a wide range of defined damages.

What are the elements of an effective indemnification clause?

An effective indemnification clause should include explicit terms detailing the scope of protection offered. It is also beneficial to incorporate provisions such as survival clauses, which specify that indemnity obligations continue even after a contract ends, and limitations on indemnity to manage potential liabilities.

-

Using clear language helps prevent misunderstandings and ensures all parties are aware of their responsibilities.

-

These clauses ensure that specific obligations persist beyond the end of a contract, offering long-term protection.

-

Establishing clear responsibilities mitigates risks that may arise from ambiguous interpretations.

What are examples of indemnification clauses?

-

Indemnification clauses can vary based on the industry, with sample language tailored for sectors like construction, technology, and healthcare.

-

One-sided clauses protect only one party, while mutual indemnity clauses offer protection reciprocally, making negotiations more balanced.

-

Exploring real-life applications of indemnification clauses can provide valuable insights into their practical use.

What are the benefits of indemnification clauses?

Indemnification clauses serve as crucial safeguards against unexpected liabilities, helping businesses manage risk effectively. Moreover, these clauses enhance trust between parties, fostering smoother negotiations and agreements, thereby facilitating long-term partnerships.

-

They shield parties from financial setbacks resulting from unforeseen claims, which can be crucial in high-stakes environments.

-

When parties agree to indemnification terms, it builds confidence in business relationships.

-

Clear indemnification terms can streamline discussions, as parties understand their obligations upfront.

How can you manage indemnification clauses?

Managing indemnification clauses requires strategic oversight. Tools like pdfFiller can assist users in document collaboration and version control, enabling teams to maintain compliance while managing indemnified documents effectively.

-

Implementing document management strategies helps accommodate growth and changing demands within organizations.

-

These tools facilitate collaboration on legal documents, ensuring that all stakeholders can contribute effectively.

-

Monitoring changes in legal requirements is essential to ensure that indemnity clauses remain compliant with regulations.

What are the risks and limitations of indemnification clauses?

Indemnification clauses, while protective, come with risks that must be navigated carefully. Common pitfalls include vague wording, which can lead to legal challenges, and potential over-reliance on these clauses as a primary risk management strategy instead of broader organizational controls.

-

Ambiguities in contract language can create legal challenges and disputes over interpretation.

-

Identifying and clarifying ambiguous terms is essential to avoid misunderstandings and enforceability issues.

-

Focusing solely on indemnification without broader risk management strategies can expose organizations to additional vulnerabilities.

What are best practices for drafting indemnification clauses?

For effective drafting of indemnification clauses, consulting with legal experts ensures the language is tailored appropriately for specific needs. Furthermore, reviewing state regulations can aid in compliance, and incorporating stakeholder feedback can refine clause effectiveness.

-

Engaging with legal professionals helps tailor indemnification clauses to specific business needs and risks.

-

Understanding local legal frameworks ensures that indemnity clauses meet compliance standards.

-

Engaging stakeholders in the documentation process helps to create more effective and inclusive indemnification provisions.

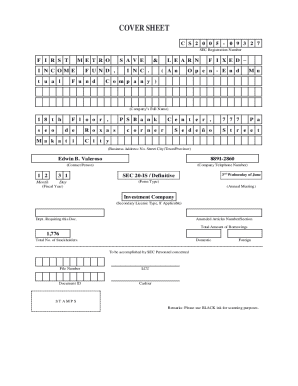

How to fill out the indemnification - long- provision

-

1.Open the indemnification long-form provision template on pdfFiller.

-

2.Begin by entering the names of all parties involved at the top of the document.

-

3.In the first section, outline the responsibilities of each party regarding indemnification.

-

4.Specify the types of claims or losses covered under the indemnification clause in the next section.

-

5.Clearly state any limitations or exclusions to the indemnification coverage elsewhere in the document.

-

6.Include a section for signatures to finalize the agreement at the bottom of the template.

-

7.Review the completed form for clarity and completeness before saving or printing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.