Get the free Employees Savings Thrift Plan template

Show details

22-118E 22-118E . . . Employee Savings Thrift Plan under which three types of contributions can be made: (a) those permitted under a qualified Cash Or Deferred Arrangement ("CODA") under Section 401(k)

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is employees savings thrift plan

An employees savings thrift plan is a retirement savings plan that allows employees to set aside a portion of their salary for future financial needs, often with matching contributions from employers.

pdfFiller scores top ratings on review platforms

So Far its a decent program

So Far its a decent program. Very simple to load documents and sigh.

very gud

this is quite satisfactory appto work online so ue this

very easy to use and does everything I…

very easy to use and does everything I need

It's great

It's great, I love it

Lifesaver

Create a fillable document and send it out for signature - simple, efficient, affordable. I am in Real Estate and needed an uncommon document for a client, this website saved me hours of tedious re-typing!

Very helpful

Who needs employees savings thrift plan?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Employees Savings Thrift Plan Form

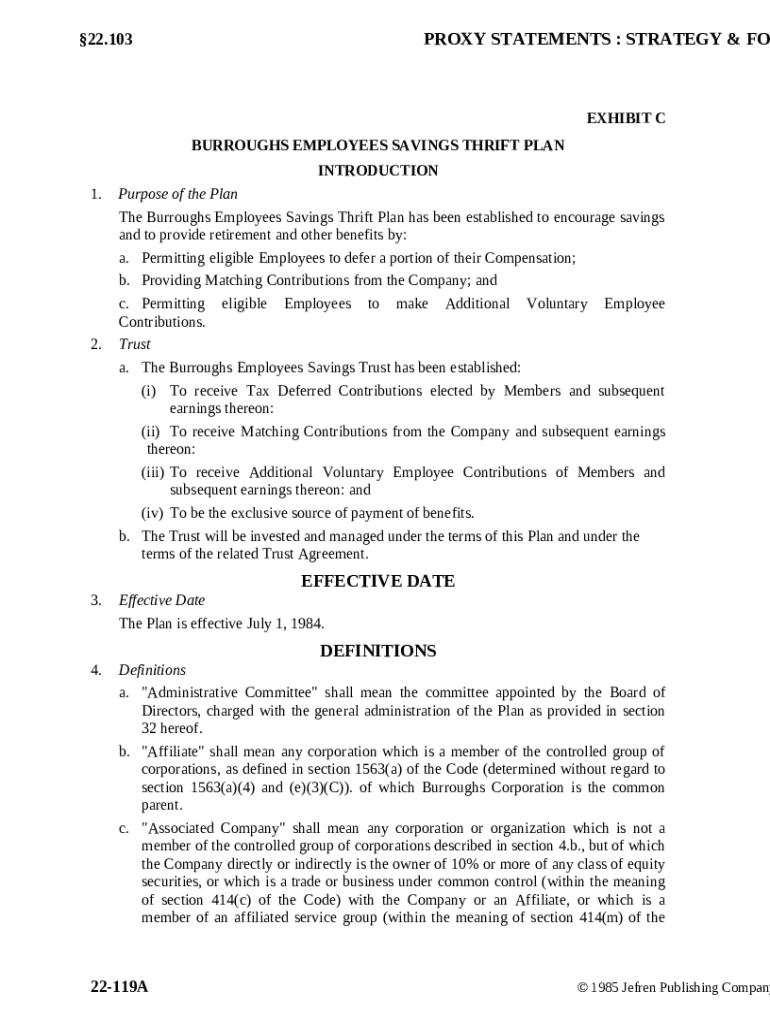

What is the Employees Savings Thrift Plan?

The Employees Savings Thrift Plan (TSP) is a retirement savings and investment plan designed for federal employees and members of the uniformed services. It allows participants to contribute a portion of their earnings towards retirement savings, thereby enhancing their financial security and preparing for their future. Through TSP, employees can benefit from various investment options and employer contributions.

-

The primary purpose of the TSP is to encourage federal employees to save for retirement by providing an easily accessible and tax-advantaged way to invest their pay.

-

Participation benefits employees with matching contributions and tax deferral, while employers benefit from increased employee satisfaction and retention.

-

Establishing a solid retirement savings plan is crucial for financial security, ensuring employees can maintain their standard of living post-retirement.

Who is eligible for the Thrift Savings Plan?

Eligibility for the Employees Savings Thrift Plan includes specific age and employment criteria that dictate who can contribute. Generally, any federal employee or member of the uniformed services is eligible to participate, allowing them to benefit from tax-sheltered growth on their investments.

-

Only federal employees and members of the Uniformed Services are eligible, ensuring that TSP is accessible to a specific group.

-

There are no age restrictions; however, individuals must be employed by the federal government to participate.

-

Employees can contribute a set percentage of their salary, with additional voluntary contributions permitted within limits set by the IRS.

How can employees save with the Employees Savings Thrift Plan?

Employees can effectively leverage the Thrift Savings Plan by deferring a portion of their salary into the plan. Understanding the company's matching contributions further enhances the benefit of participating in the plan.

-

Employees can elect to have a specific percentage of their pay automatically transferred into their TSP account before taxes are taken out.

-

Many employers provide matching contributions, which significantly boosts retirement savings compared to personal contributions alone.

-

Making additional voluntary contributions allows employees to maximize their savings, fostering a more comfortable retirement.

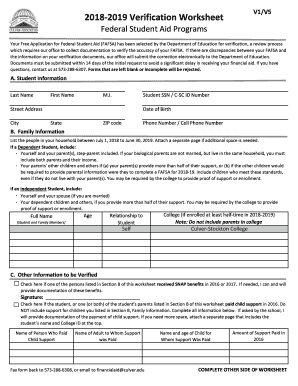

How to manage your TSP contributions?

Managing contributions to the Employees Savings Thrift Plan involves completing the required form correctly. Tools like pdfFiller assist users in editing, signing, and submitting their forms without confusion.

-

Accurate completion of the Employees Savings Thrift Plan form is essential for processing contributions and ensuring compliance with plan rules.

-

pdfFiller simplifies the process, offering tools for easily filling out, editing, and signing necessary documents.

-

Regularly monitoring contributions and making informed investment choices help ensure that your retirement savings grow effectively.

When can employees withdraw from the Thrift Savings Plan?

Withdrawal conditions apply to the Employees Savings Thrift Plan and depend on specific life events, such as retirement or financial hardship. The process of initiating a withdrawal requires employees to provide particular documentation to ensure compliance.

-

Employees may only withdraw funds under certain conditions, such as reaching retirement age or facing a financial emergency.

-

Initiating a withdrawal involves submitting a form along with appropriate documentation to validate the request.

-

Withdrawals can have tax consequences and potential penalties, so it’s crucial to understand these factors before proceeding.

What is the role of the Administrative Committee in TSP management?

The Administrative Committee oversees the management of the Employees Savings Thrift Plan, ensuring that the plan operates within legal constraints while also serving employees' interests. Understanding the various components like the Trust Agreement is critical for participants.

-

The Administrative Committee plays a key role in maintaining the integrity and efficiency of the TSP.

-

The Trust Agreement outlines the responsibilities and operations of the plan, protecting participant interests.

-

In cases of disputes related to TSP, the Committee’s guidance can assist in navigating legal challenges.

Where can Thrift Savings Plan participants find resources?

Accessing forms and relevant information is essential for Thrift Savings Plan participants to manage their accounts effectively. Platforms like pdfFiller provide valuable resources and guides that simplify this process.

-

Participants can easily access all necessary forms required for managing their TSP account through pdfFiller.

-

Comprehensive guides are available, assisting users in accurately completing related paperwork.

-

Resources related to legal and compliance matters ensure that employees stay informed about their rights and responsibilities.

How do court orders affect the Thrift Savings Plan?

Court orders can significantly impact the Employees Savings Thrift Plan, particularly during divorce or other legal proceedings. Understanding the necessary steps and resources available for legal assistance is crucial.

-

Court orders may dictate how funds in a TSP account are divided, making it essential for participants to understand their implications.

-

In the event of legal proceedings, participants should follow specific steps to ensure the integrity of their TSP assets.

-

Legal assistance resources can help clarify the complex interactions between TSP and court orders.

What should you know about death benefits claims?

Death benefits available through the Employees Savings Thrift Plan are designed to support beneficiaries and help them navigate the claims process. Understanding eligibility and required documentation can smooth the claim experience.

-

The TSP offers death benefits to designated beneficiaries, providing financial support after an account holder passes away.

-

Beneficiaries must meet specific criteria to claim death benefits, which should be clearly identified by the account holder.

-

Proper documentation must be submitted to support the claim, ensuring that the process is efficient and compliant.

How to fill out the employees savings thrift plan

-

1.Begin by obtaining the employees savings thrift plan form from your HR department or download it from the company's website.

-

2.Fill in your personal information at the top of the form, including your name, address, and employee ID.

-

3.Next, indicate the percentage of your salary you wish to contribute to the plan each pay period.

-

4.If applicable, specify any employer contribution that might match your savings.

-

5.Review the investment options provided in the plan and select your preferred choices.

-

6.Complete any additional sections, such as beneficiary designations and additional contact information.

-

7.Carefully review all the information you've provided to ensure accuracy.

-

8.Sign and date the form to confirm your participation in the plan.

-

9.Submit the completed form to the appropriate department, ensuring you keep a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.