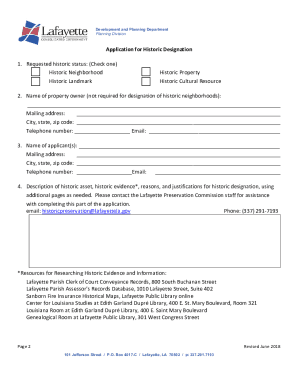

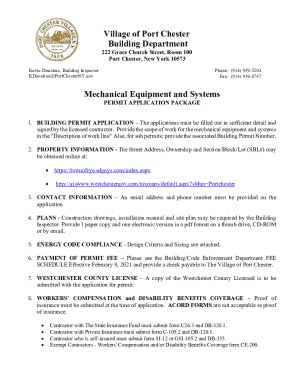

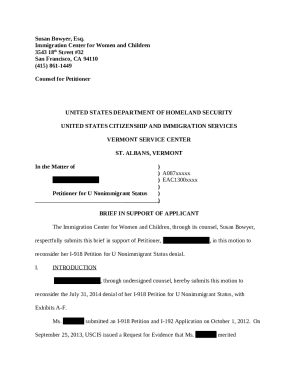

Get the free Equity Incentive Plan template

Show details

This is a multi-state form covering the subject matter of the title.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is equity incentive plan

An equity incentive plan is a compensation strategy that offers employees ownership interest in the company, typically through stock options or restricted stock units.

pdfFiller scores top ratings on review platforms

second time using and it has become easier to use.

it has enabled me to meet dead lines in applying to job opportunities.

This software is a blessing! I would love to be able to utilize it even more.

was very easy to fill out documents & print

This is my 2nd time using PDFfiller. Like so far.

Very helpful but would like to understand more

Who needs equity incentive plan template?

Explore how professionals across industries use pdfFiller.

How to fill out an equity incentive plan form

Understanding equity incentive plans

Equity incentive plans are programs designed to attract, retain, and motivate employees by offering them an ownership stake in the company. These plans typically involve giving employees options or shares that can increase in value, aligning their interests with those of the organization.

-

Equity incentive plans facilitate employee ownership and contribution to business success.

-

They enhance employee motivation and align their efforts with company performance.

-

They serve as a powerful tool for businesses to secure the best talent in competitive markets.

What are the key components of an equity incentive plan?

An effective equity incentive plan includes various components that determine how awards will be granted and managed. It must cater to different types of equity awards and outline eligibility and performance metrics.

-

These variations allow flexibility in how ownership is shared with employees.

-

Clearly defined eligibility ensures that the right employees are incentivized.

-

These determine when and how employees receive their equity, aligning rewards with performance.

How is the equity incentive plan administered?

Proper administration of an equity incentive plan is crucial for its success and compliance with policies. The Compensation Committee often plays a central role.

-

They evaluate performance, approve awards, and monitor compliance with the plan.

-

These criteria provide transparency and equity in how awards are allocated.

-

The committee has the authority to interpret plan provisions and establish necessary rules.

How do you fill out the equity incentive plan form?

Completing the equity incentive plan form is crucial for properly implementing a plan. Here’s how you can efficiently fill it out.

-

Follow each section diligently to ensure accuracy and completeness.

-

Utilize templates and fillable forms to simplify the process.

-

Double-checking entries can prevent costly errors or misinterpretations.

What are the best practices for managing and editing the equity incentive plan document?

Successful management of the equity incentive plan document ensures that it remains relevant and compliant with regulations. pdfFiller offers tools for seamless document management.

-

Manage documents conveniently from any device, ensuring accessibility.

-

Facilitate teamwork to refine plan details and gather necessary feedback.

-

Speed up the approval process with secure electronic signatures.

What compliance and legal considerations should you be aware of?

Navigating compliance is essential for equity incentive plans. Local laws and tax implications can vary significantly based on region.

-

Stay updated on regulatory changes to ensure the plan remains compliant.

-

Understand the tax burdens that employees may face when they receive equity.

-

Uphold standards that foster trust and fairness when distributing equity.

When should an equity incentive plan be utilized?

Implementing an equity incentive plan can provide substantial advantages in various scenarios, particularly during phases of growth or when market competition is fierce.

-

Companies aiming to grow and scale often benefit immensely from equity plans.

-

Assess how equity incentives stack up against traditional salary or bonuses.

-

Research indicates that effective compensation strategies increasingly incorporate equity.

What are the next steps for implementing an equity incentive plan?

Having learned how to fill out an equity incentive plan form, it’s time to take actionable steps towards implementing such a plan in your organization.

-

It can drive performance and engagement significantly when done correctly.

-

Utilize pdfFiller's services for seamless document management and collaboration.

-

Invest time in research to refine your plan continuously.

How to fill out the equity incentive plan template

-

1.Start by accessing the equity incentive plan template on pdfFiller platform.

-

2.Read through the entire document to understand the sections required to complete.

-

3.Input the company name and details in the specified sections, including the incorporated state and date.

-

4.Specify the maximum number of shares subject to the plan, ensuring it aligns with company policies.

-

5.Outline the eligibility criteria for participants, detailing who can receive equity awards.

-

6.Provide the types of equity incentives being offered, such as stock options or restricted stock.

-

7.Detail the awards' vesting schedule, including time-based or performance-based criteria.

-

8.Review any tax implications for both the company and participants, explaining responsibilities.

-

9.Finally, ensure that all signatories review and sign the document, capturing the necessary approvals.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.