Last updated on Feb 17, 2026

Get the free Loan Plan for Key Employees template

Show details

This sample form, a detailed Loan Plan for Key Employees document, is a model for use in corporate matters. The language is easily adapted to fit your specific circumstances. Available in several

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan plan for key

A loan plan for key is a document that outlines the terms and conditions under which a loan is offered, including repayment schedules and interest rates.

pdfFiller scores top ratings on review platforms

Works well with 2 exceptions. There was an odd small "box" on the left-hand side of the saved document that I was able to erase with the erase tool. There were also signature verification notifications superimposed on the signatures.

Intuitive, yet too many options I don´t have a clue how to take advantage of them

It has been simple, free, extremely valuable as a meeting planner being able to take copious amounts of data and be able to edit and compile it in one place.

worked great! just cannot afford this service

i love pdf filler it akes my job as an hr rep so much easiern

There was a big learning curve for me, but think I have a fair handle on it now

There was a big learning curve for me, but I think I'm getting the hang of it now, once I've finally finished a Fax Form cover sheet.

Who needs loan plan for key?

Explore how professionals across industries use pdfFiller.

How to Effectively Utilize a Loan Plan for Key Employees

How does a loan plan for key employees work?

A loan plan for key employees serves as a financial resource designed to aid essential personnel in securing the necessary funds to exercise their stock options. This type of plan is pivotal for enabling key employees to benefit from the equity offered by the organization, ensuring that they can convert their stock options into shares, ultimately enhancing their investment in the company’s success. Understanding the mechanisms of such a plan is essential for both employees and employers.

-

The primary purpose of a loan plan is to provide crucial financial support that helps key employees manage and exercise their stock options efficiently.

-

Supporting key employees in this way not only aids in their financial well-being but also helps maintain their loyalty and motivation towards the company.

-

Common stock option plans included in loan agreements may vary, including incentive stock options (ISOs) and non-qualified stock options (NSOs).

What are the employee stock option plans at Xidex Corporation?

Xidex Corporation offers structured employee stock option plans that target selected employees, allowing them to acquire shares at predetermined prices. Each plan has its unique features, crafted to attract and retain top talent by providing attractive financial incentives. Understanding the specifics of these plans helps employees make informed decisions regarding their participation.

-

The stock option plan grants employees the right to purchase a certain number of shares at a set price, often lower than market value.

-

This includes clauses regarding vesting schedules, which dictate when employees can exercise their options.

-

Aside from standard options, Xidex may offer restricted stock units (RSUs) or performance-based options, enhancing their flexibility.

Who qualifies for financial assistance in a loan plan?

Eligibility for financial assistance through a loan plan is typically reserved for key employees who play significant roles within a company. This qualification ensures that those with cardinal responsibilities have the resources necessary to maximize their investments in the company through stock options. Detailed criteria have been established to streamline the loan application process and select candidates.

-

Key employees often include executives, directors, and certain skilled professionals whose contributions are crucial to the company.

-

Employees must demonstrate a vested interest in the company’s stock to qualify for the loan.

-

Company officers are typically involved in assessing the loan applications and ensuring compliance with the organization's policies.

How is the loan plan administered?

The administration of the loan plan is often orchestrated by the Board of Directors or a designated committee. Their responsibilities include overseeing the loan application process, making key decisions regarding approvals, and ensuring adherence to associated regulations. This structured approach minimizes risks and guarantees fair treatment across all applicants.

-

The Board of Directors typically approves the loan plan’s guidelines while a committee manages application reviews and approvals.

-

This group possesses final say in loan approvals, ensuring that due diligence is conducted.

-

Clear guidelines are established to govern the loan administration process, protecting both the employees and the company.

What are the steps to apply for a loan under the plan?

Applying for a loan under the loan plan involves a systematic process that includes filling out an application form, supplying necessary documentation, and awaiting a decision. It is crucial for applicants to understand the required documentation and anticipated timelines to ensure a smooth application experience.

-

Employees must complete the loan application form accurately and submit it to the appropriate committee.

-

Required documents may include proof of employment, income verification, and specifics about the stock options.

-

The application process may take several weeks, depending on the volume of applications and internal reviews.

What criteria are used for loan approval and what are the terms?

Loan approval is often contingent upon factors such as an individual’s creditworthiness, employment status, and the overall company financial condition. Meeting these criteria leads to a typical package of favorable loan terms, with options tailored to employee needs and market conditions.

-

The decision criteria often include the employee's current financial status and their role within the company.

-

Terms may include fixed interest rates and specified repayment periods based on individual circumstances.

-

Employees may have the flexibility to repay their loans through salary deductions or other specified methods.

What are the key differences between a loan agreement and a promissory note?

Understanding the distinction between a loan agreement and a promissory note is crucial for employees engaged in the loan process. While both documents facilitate borrowing funds, the loan agreement encompasses a more detailed contract outlining terms and conditions, whereas a promissory note primarily serves as a formal acknowledgment of a loan.

-

A loan agreement is comprehensive and includes various terms beyond the promise to pay, while a promissory note is simpler and serves as a commitment to repay.

-

A loan agreement is ideal for complex arrangements, whereas promissory notes are sufficient for simple loans.

-

Understanding these differences aids employees in knowing their rights and responsibilities while navigating loan processes.

What additional resources are available for understanding the loan plan?

Utilizing various resources can greatly enhance knowledge regarding loan plans for key employees. From company handbooks to dedicated financial advisors, having accurate information at hand empowers employees to navigate their options effectively.

-

Consulting HR representatives can provide insights into specific loan plan features and eligibility criteria.

-

Official documents often outline all pertinent details regarding loan applications and repayment.

-

Leveraging online platforms, such as pdfFiller, helps in managing loan-related documentation with ease.

How to utilize pdfFiller for loan plan management?

pdfFiller offers an outstanding platform for editing, filling out, and signing loan application forms online. With its cloud-based capabilities, employees can collaborate and manage their documents effortlessly and securely, ensuring that they have access to necessary details from anywhere.

-

Users can easily modify PDFs, making filling out applications straightforward and efficient.

-

Employees can work together through shared documents, enhancing the overall efficiency of the loan application process.

-

Accessing documents from any device ensures seamless workflow and timely loan submissions.

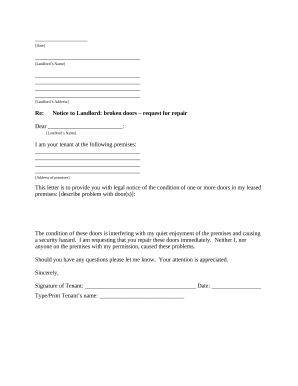

How to fill out the loan plan for key

-

1.Start by downloading the loan plan for key template from pdfFiller.

-

2.Open the document in pdfFiller and check for the fields that need to be filled in, such as personal information and loan details.

-

3.Fill in your full name, address, and contact information in the designated fields.

-

4.Specify the loan amount you are applying for in the relevant section.

-

5.Provide details regarding the purpose of the loan; this could be for a vehicle, home, or personal expenses.

-

6.Enter the desired repayment term and interest rate if applicable, based on your discussion with the lender.

-

7.Review all the entered information for accuracy and completeness.

-

8.Utilize the built-in validation features of pdfFiller, which highlight any missing or incorrect entries.

-

9.Once confirmed, save your changes, and then choose the option to print or email your completed loan plan for key.

-

10.Ensure you keep a copy for your records before submitting it to the lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.