Last updated on Feb 17, 2026

Get the free Demand Promissory Note Board Approval template

Show details

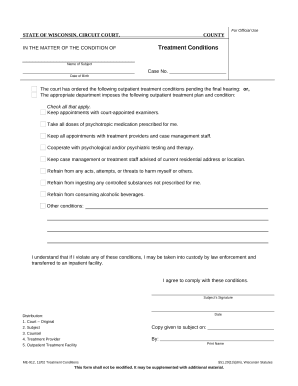

A Demand Promissory Note Board Approval form allows the Board of a company to approve the company issuing debt.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is demand promissory note board

A demand promissory note board is a document that specifies the terms under which a borrower agrees to repay a sum to a lender on demand.

pdfFiller scores top ratings on review platforms

I've tried others, but PDFFiller is the best I've used.

I had some trouble at first (yesterday), but support was able to help. Now things are going smoothly on my end. It still remains to see how my signers interact with PDF Filler.

So far, so good. Nice feature that long ago MS in word offered something similar. If marketed correctly, it should be very successful - God willing.

at times its complicated and doesn't produce a clear copy when editing, but okay for blank documets

I just closed escrow on two homes, and the PDF filler allowed me electronically edit/sign/date all the forms necessary to sale and buy our properties. It saved a tremendous amount of time and paper because I saved the forms to my desktop and then returned the completed forms electronically.

somewhat slow at times but it meets all my data/clerical needs

Who needs demand promissory note board?

Explore how professionals across industries use pdfFiller.

How to complete a demand promissory note board approval form

TL;DR - How to fill out a demand promissory note board approval form

To fill out a demand promissory note board approval form, collect necessary information from the board members, accurately enter company details, and ensure that all signatures are obtained. Carefully follow the required steps to ensure compliance with legal standards.

What is a demand promissory note?

A demand promissory note is a legal document that serves as a promise to pay a specified amount upon request. It is widely used in financing arrangements between businesses and lenders, ensuring clear terms and quick repayment options. The importance of such notes comes into play especially when businesses require immediate funds and lenders seek a degree of security.

-

Definition and purpose: It outlines the borrower's promise and the terms of repayment.

-

Importance for businesses: It provides a streamlined process for obtaining funds, facilitating growth opportunities.

How do board approval requirements work?

The board of directors plays a critical role in the issuance of debt, ensuring that all corporate governance protocols are followed. Board approval is often obtained through a unanimous written consent process, which streamlines decision-making without the need for a physical meeting.

-

Key roles: The board is responsible for approving financial commitments that can impact the firm's viability.

-

Unanimous consent requirements: All board members must agree, emphasizing collective responsibility.

What does the demand promissory note form include?

A demand promissory note form typically includes several key sections that need to be filled out accurately. This ensures that all necessary details are provided for both legal and record-keeping purposes.

-

Header: Identify the document as 'Action by Written Consent of the Board of Directors.'

-

Company name and date fields: Ensure that the correct name and current date are entered.

-

Approval section: Clearly state the terms and record any resolutions made by the Board.

What are the key components of a demand promissory note?

The components of a demand promissory note are essential for defining the terms agreed upon between the borrower and lender. Misunderstandings can lead to legal disputes, so clarity is paramount.

-

Terms and conditions: Outline the obligations of both parties, which is crucial for enforceability.

-

Lender details: Include the lender's name, contact information, and specific loan specifications.

-

Maximum principal value clause: Specify the total amount that can be borrowed under the note.

How to execute the note: authorizations and signatures

Proper execution of the demand promissory note is essential to validate the agreement. Knowing who can sign on behalf of the company and following best practices for document handling will ensure legal compliance.

-

Who can sign: Authorized personnel, such as the CEO or CFO, must ensure the note is legally binding.

-

Attaching exhibits: Include all relevant documentation that supports the loan terms.

-

Best practices: Store documents securely and consider digital options for better organization and access.

What additional considerations exist for demand promissory notes?

When handling demand promissory notes, other aspects must also be considered. These include understanding interest accumulation, loan repayment schedules, and the overall impact on shareholders.

-

Accrued interest: Be aware of how interest accumulates over time and its implications for payments.

-

Impact on shareholders: Analyze how debt affects company valuation and shareholder equity.

-

Legal considerations: Ensure compliance with existing financial regulations and obligations.

How to edit and manage your demand promissory note document

After creating your demand promissory note, efficient management and editing become key. Tools like pdfFiller make the process seamless, enabling easy document revisions and collaboration.

-

Edit using pdfFiller: Access intuitive tools for modifying PDF forms as needed.

-

Collaboration tools: Engage team members in real-time to ensure that all inputs are incorporated.

-

eSigning benefits: Utilize electronic signatures for quick approval, reducing turnaround time.

Conclusion

Completing a demand promissory note board approval form is a critical task that requires attention to detail and compliance with legal standards. By understanding the inherent components, board approval requirements, and utilizing platforms like pdfFiller for document management, individuals and teams can effectively manage their financial agreements. Mastering this process empowers you to facilitate crucial funding initiatives while ensuring that all involved parties are properly protected and informed.

How to fill out the demand promissory note board

-

1.Open the pdfFiller website and log into your account or create a new one.

-

2.Search for 'demand promissory note board' in the template library.

-

3.Select the appropriate template and click on 'Fill' to open the editing interface.

-

4.Begin by entering the lender's information, including name and address, in the designated fields.

-

5.Next, input the borrower's details, ensuring all names and addresses are accurate.

-

6.Specify the loan amount clearly in the section labeled 'Loan Amount'.

-

7.Set the repayment terms, indicating if the payment is due on demand or within a specific time frame.

-

8.Include any interest rate, if applicable, in the terms section of the document.

-

9.Review all entries for accuracy and completeness before finalizing the document.

-

10.Once reviewed, save the filled document or directly print it for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.