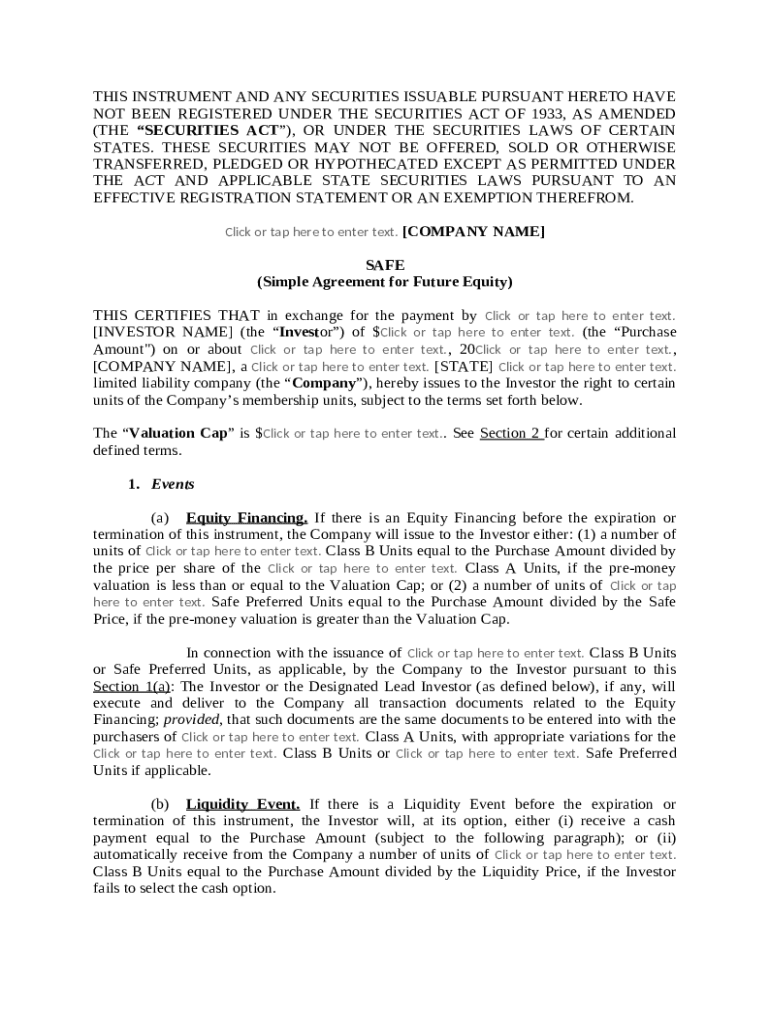

Get the free Simple Agreement for Future Equity template

Show details

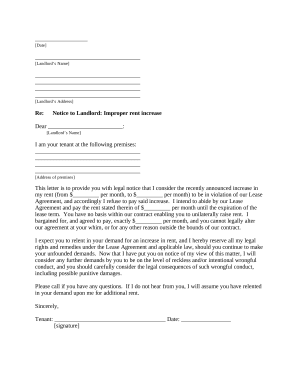

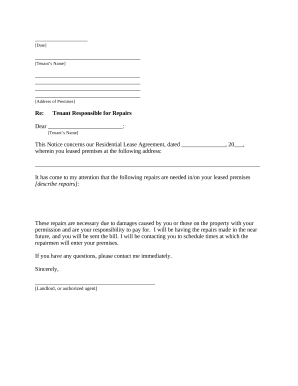

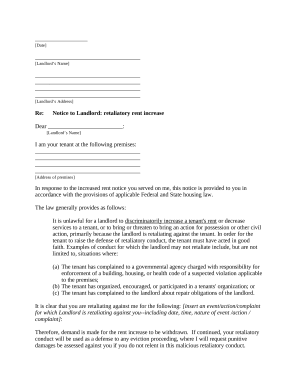

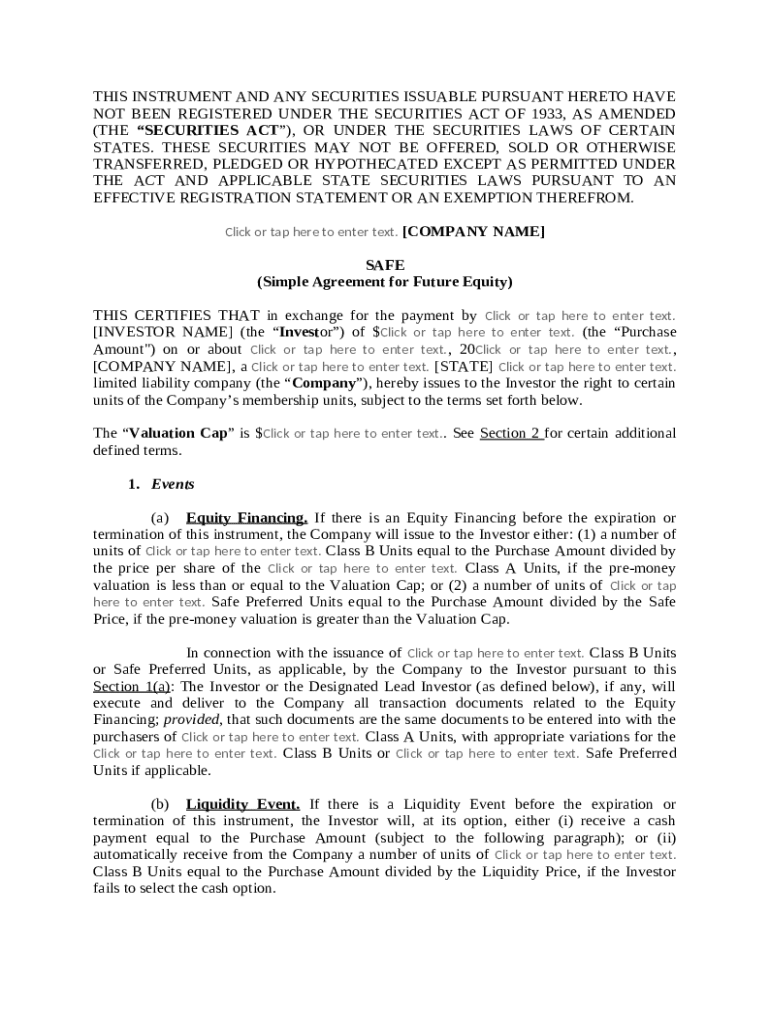

This term sheet summarizes the principal terms of the proposed Simple Agreement for Future Equity ("SAFE") financing of a Company, by certain Investors. This term sheet is for discussion purposes,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is simple agreement for future

A Simple Agreement for Future Equity (SAFE) is a financing contract that allows investors to convert their investment into equity at a later date, typically during a subsequent financing round.

pdfFiller scores top ratings on review platforms

As a small business owner, I use this tool daily. Couldn't live without it.

Brilliant. Easy to use.Gets the job done.

thank you for the live support. great product

What I thought was not possible is now possible with PDFfiller. Wow!!!

I have used several webs to fill out pdf but this, without any doubt, is the best one.

It keeps mixing up my two accounts - - one subscription with an aol email address and one free account with my fire dept. address. I believe it's due to my MSOffice password settings.

Who needs simple agreement for future?

Explore how professionals across industries use pdfFiller.

How to fill out a simple agreement for future form form

Understanding the Simple Agreement for Future Equity (SAFE)

The Simple Agreement for Future Equity (SAFE) is a financing contract that provides a startup with capital in exchange for future equity. Its primary purpose is to streamline fundraising by simplifying the stock issuance process for both startups and investors. Startups can benefit from a more straightforward fundraising approach, while investors gain the potential for equity in a company they believe in without the complexities of immediate stock negotiation.

-

Startups enjoy less paperwork and a faster timeline to secure funding, allowing them to focus on growth.

-

Investors can invest early in promising companies, obtaining shares at a lower price without immediate repayment obligations.

-

Unlike traditional equity agreements, which require negotiation on valuation at the time of investment, SAFEs enable deferred valuation until a later financing round.

What are the key components of a SAFE agreement?

A SAFE agreement outlines various critical components that clarify the roles and responsibilities of both parties involved. The main parties are the Company and the Investor, each with clearly defined roles in the agreement. The key components provide clarity regarding the transaction terms and responsibilities.

-

The agreement specifies the Company seeking funding and the Investor providing the capital.

-

Essential information includes the Company Name, Investor Name, and Purchase Amount, ensuring both parties are accurately represented.

-

Key terms include the Valuation Cap, which sets a ceiling on the company valuation for conversion, and conditions surrounding Equity Financing.

How to fill out a SAFE agreement?

Filling out a SAFE agreement requires careful attention to detail. Each section must be completed accurately to ensure legal validity. The following steps provide a comprehensive guide to filling out each section of your SAFE.

-

Follow the prompts provided on each section of the form to input information accurately.

-

Every input field, such as Company Name and Investor Name, requires precise entries to avoid future disputes.

-

Be wary of overlooking required fields and misinterpreting terms, which could jeopardize the agreement.

What legal compliance considerations should you keep in mind?

When dealing with SAFE agreements, it is crucial to understand the legal landscape that governs them. Compliance with state and federal regulations is vital to ensure the agreement's enforceability. This entails being aware of specific laws that may impact the agreement’s terms.

-

The Securities Act governs the issuance of securities, including SAFEs, making compliance essential to prevent legal repercussions.

-

Different states may have unique regulations affecting how SAFEs are used, which can impact their execution.

-

Recognizing effective registration statements and exemptions can facilitate compliance while minimizing costs.

How to manage your SAFE agreement with pdfFiller?

Managing a SAFE agreement is simplified with pdfFiller’s robust tools. Users can easily edit PDF forms, eSign agreements securely, and collaborate with stakeholders in real time. This cloud-based platform provides a seamless experience for all document-related tasks.

-

Utilize pdfFiller’s tools to modify agreements quickly without the need for complex software.

-

Sign your SAFE Agreement electronically, ensuring both security and legality.

-

Engage with team members or investors directly within the platform to finalize the agreement.

What should you consider post-SAFE agreement?

Following the signing of a SAFE, both parties must manage their expectations and responsibilities. It is essential to understand what comes next, including investor rights and company obligations.

-

Parties should familiarize themselves with their ongoing rights and responsibilities under the terms of the SAFE.

-

Investors obtain rights regarding their future equity, contingent upon subsequent financing events.

-

Subsequent funding rounds may impact the terms and execution of the SAFE, necessitating careful attention from all involved.

How to fill out the simple agreement for future

-

1.Start by downloading the Simple Agreement for Future Equity (SAFE) template from pdfFiller.

-

2.Open the saved template in pdfFiller to access editing options.

-

3.Fill in the company name and address in the designated sections to identify the entity involved.

-

4.Insert the investor's name and information as the party contributing the funds.

-

5.Specify the amount of investment agreed upon in the appropriate field.

-

6.Determine the valuation cap or discount rate, if applicable, and fill them in. This defines the terms under which the investor's funds will convert to equity.

-

7.Review the agreement for accuracy, ensuring all required information is complete and correct.

-

8.Save your changes and utilize the e-signature feature in pdfFiller for both parties to sign electronically.

-

9.Once signed, download or share the completed agreement with the involved parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.