Get the free Letter Ining Debt Collector of False or Misleading Misrepresentations in Collection ...

Show details

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter informing debt collector

A letter informing a debt collector is a communication that notifies them of specific details regarding a debt issue, rights, or disputes.

pdfFiller scores top ratings on review platforms

undecided

worth every penny!

Lots of forms, very easy.

easy to use

IM SATISTFIED SO FAR

very convenient will definitely come in use.

Who needs letter ining debt collector?

Explore how professionals across industries use pdfFiller.

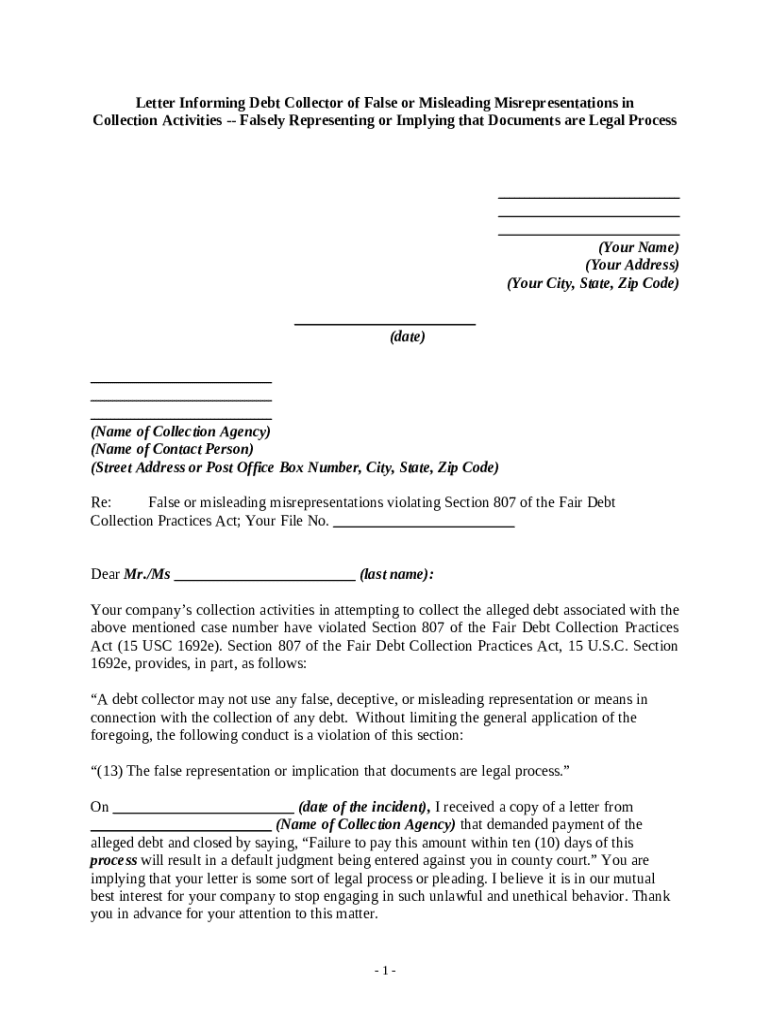

Comprehensive guide to the letter informing debt collector of false or misleading misrepresentations

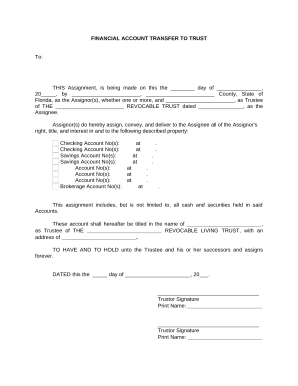

How to fill out a letter informing debt collector form

To fill out a letter informing debt collector form, begin by including your personal information and the collection agency's details. Clearly state the purpose in the subject line and summarize your case regarding the collector's violations. Finally, ensure that you add your signature before sending it to maintain a record of your correspondence.

Understanding your rights under the Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) provides crucial protection for consumers against abusive and misleading debt collection practices. It is critical to understand Section 807 of the FDCPA, which prohibits debt collectors from using false, deceptive, or misleading representations in connection with the collection of any debt. This knowledge empowers individuals to take action against harassment and misrepresentation by debt collectors.

When a debt collector contacts you: initial steps to take

-

The first step is to remain composed and collect all documentation related to the alleged debt, as this will be critical for verifying the validity of the claim.

-

Ensure the debt collector is legitimate by checking their credentials and ensuring they comply with FDCPA regulations.

-

Understand the timeline for addressing collection notices to avoid any adverse action by the collector.

Crafting your response: key elements of the letter informing debt collector

Writing an effective letter to a debt collector requires careful attention to detail. Your personal information should be written clearly, starting with your name and full address. The date of the letter is also crucial for reference.

Addressing the collection agency

It is essential to correctly identify the collection agency and the contact person in your letter. Ensure you include their address for proper delivery and reference any specific case or file number if available.

Subject line and salutation

Use a clear subject line that states the letter's purpose right away. Begin your letter with a professional salutation addressed directly to the contact person at the agency.

Stating your case: violations and misrepresentation

In your letter, you should outline specific violations relevant to your situation. Citing Section 807 reinforces your case and highlights its significance to your argument. Be sure to provide details about the deceptive letter you received, along with its implications.

Finalizing your letter: signature and submission

-

Make sure to leave space at the bottom of the letter for your printed name and signature.

-

It's recommended to send your letter via certified mail to confirm delivery. Email options through tools like pdfFiller are also available.

-

Keep a record of your sent correspondence for future reference, which is vital if further action becomes necessary.

Follow-up steps after sending your letter

-

Keep an eye on any responses from the debt collector, as they may provide clarity or escalate the situation.

-

Understanding what to do next if you receive no response, or if harassment continues, is essential to protect your rights.

-

Consider consulting with a legal professional if your issues persist or escalate to ensure that all your legal rights are safeguarded.

Using pdfFiller to create and manage your letter

pdfFiller offers a robust platform for editing and managing your letter through various functionalities. It allows users to utilize interactive tools which simplify the process of document management, ensuring you have the most efficient method at your disposal. The cloud-based accessibility means you can manage your documents from anywhere, making it easier to stay organized and responsive.

How to fill out the letter ining debt collector

-

1.Open pdfFiller and select 'Create Document' from the menu.

-

2.Choose a template for debt collection letters or start with a blank document.

-

3.In the header, include your name, address, and contact information.

-

4.Add the date of writing the letter, aligned to the left or right margin.

-

5.Next, address the letter to the debt collector's name and company, with their address below your details.

-

6.In the body, state your intention clearly—whether you’re informing them to cease communication, disputing the debt, or requesting validation.

-

7.Provide specific details about the debt including the original creditor's name, the amount, and any account numbers if applicable.

-

8.Include a statement of your rights referencing applicable laws, e.g., Fair Debt Collection Practices Act.

-

9.Close the letter with your signature, printed name, and any additional remarks you want to add.

-

10.Finally, save the document and download it or send it directly using pdfFiller's sharing options.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.