Get the free Term Sheet - Series Seed Preferred Share for Company template

Show details

Seed funding typically refers to the first money invested in the company from a source other than the founders. It can also be helpful to think of seed funding as the money invested in the company

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is term sheet - series

A term sheet - series is a document that outlines the terms and conditions of a proposed investment in a startup or company, typically related to a specific funding round.

pdfFiller scores top ratings on review platforms

It's a great tool

super

super,quick and tip top

Excellent service

Excellent service, easy to navigate and had all the functions required

SO FAR...I AM ENJOYING THIS PRODUCT.

I FOUND IT TO BE VERY EASY AND FAST TO…

I FOUND IT TO BE VERY EASY AND FAST TO WORK WITH. I VERY SATISFIED.

Great program!

Who needs term sheet - series?

Explore how professionals across industries use pdfFiller.

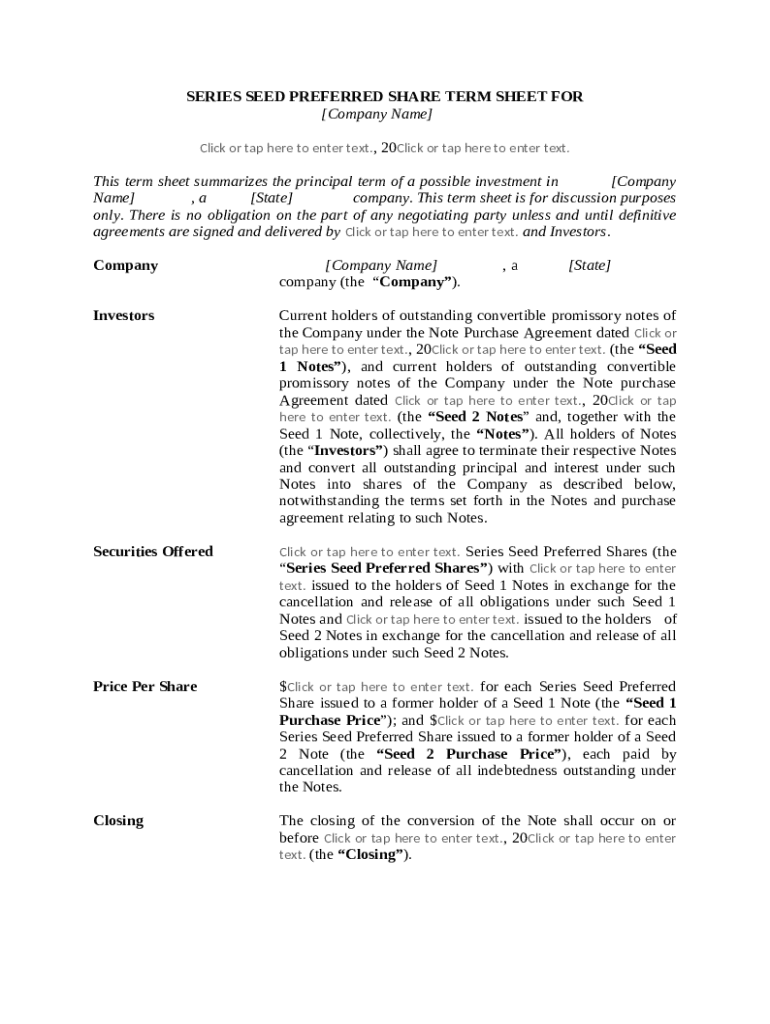

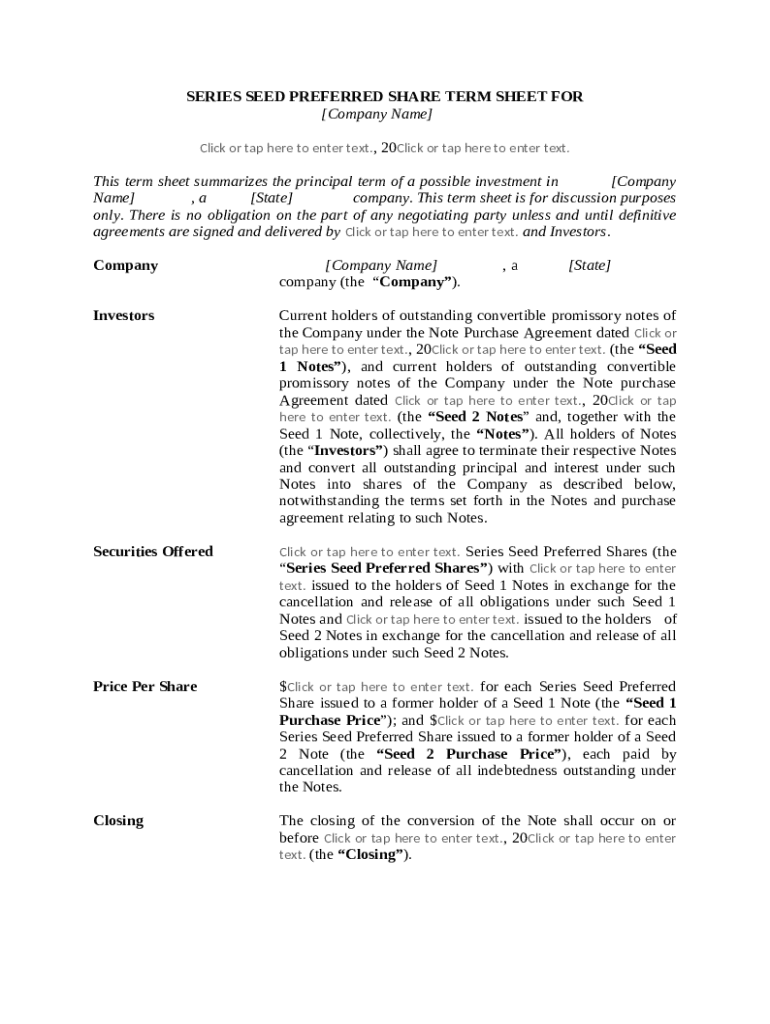

Understanding the Series Seed Preferred Share Term Sheet

To effectively create a term sheet for a Series Seed funding round, it's imperative to understand its components and implications. This guide will walk you through the intricacies of a Series Seed preferred share term sheet, detailing each essential aspect.

What is the purpose and importance of a term sheet?

A term sheet serves as a foundational document outlining the critical aspects of a potential investment agreement. It provides a framework for negotiation, ensuring that all parties understand key terms before diving deeper into contract specifics.

-

It outlines essential terms and conditions that guide the investment process.

-

As a non-binding document, it encourages open discussions and helps clarify expectations.

What are the key components of a Series Seed term sheet?

Every Series Seed term sheet contains specific components vital for both investors and founders. Understanding these elements is crucial for navigating the investment landscape.

-

Essential terms leading to investment, including valuation and funding amounts.

-

Clear statements identifying the company, investors involved, and the status of existing convertible promissory note holders.

-

A critical clarification that the term sheet is for discussion purposes only, paving the way for formal agreements.

Who are the investment parties involved?

Understanding the roles and responsibilities of the different investment parties is essential. This includes identifying the company and stakeholders involved in the financing process.

-

The company seeking investment must always be clearly defined to ensure transparency.

-

Identifying current stakeholders, including convertible note holders who may convert to shares.

-

Both parties—companies and investors—must have distinct responsibilities outlined in the term sheet.

What securities are offered in the investment?

Investors need to understand what securities they are being offered. This will typically include detailed descriptions of Series Seed preferred shares.

-

These are the shares offered in exchange for investment, often with specific rights and terms.

-

The term sheet should clearly state the cancellation and release of obligations related to Seed Notes.

-

Defining clear stakes in investment agreements ensures mutual understanding of interests.

How is the price per share determined in a Series Seed term sheet?

The price per share is a pivotal component impacting both valuation and investor interest. Various factors influence this pricing mechanism.

-

Understanding current market conditions is crucial for establishing an appropriate price.

-

Factors such as company valuation, projected growth, and investment risks are critical in pricing.

-

Ensuring transparency in pricing avoids confusion and builds trust among investors.

What are the best practices for negotiating a Series Seed term sheet?

Negotiating a term sheet requires strategic planning and awareness of potential pitfalls. Here are some best practices to consider.

-

Be clear about your objectives and ensure all terms align with your business goals.

-

Avoid vague language; ensure all parties are on the same page regarding expectations.

-

Successful negotiations result from all parties agreeing on key terms before execution.

What is the investor perspective on a term sheet?

Investors have unique insights into what they seek from a term sheet. Understanding their perspective can enhance negotiations.

-

Investors consider risk versus reward, evaluating potential return on investment thoroughly.

-

Clearly present the opportunity, highlighting favorable terms to create an attractive proposition.

How long does it take to negotiate a term sheet?

The timeline for negotiating a term sheet can vary widely based on several factors. It's important to set realistic expectations.

-

Complexity of the deal, parties involved, and due diligence processes can all affect negotiation time.

-

Expect negotiations to take anywhere from a few days to several weeks, depending on the context.

-

Establish major deadlines to ensure all parties keep the process moving smoothly.

How to fill out the term sheet - series

-

1.Open pdfFiller and upload the term sheet - series template.

-

2.Begin with Section 1, where you will enter the company's name and legal structure.

-

3.In Section 2, provide details about the funding amount and valuation proposed for this round.

-

4.Section 3 requires you to specify the type of securities being offered, such as preferred or common stock.

-

5.Next, in Section 4, outline the rights and preferences associated with the securities, including dividend rights and liquidation preferences.

-

6.Proceed to Section 5 and detail any conditions for closing the deal, like legal compliance and satisfactory due diligence.

-

7.In Section 6, fill in the timelines for the funding round and key milestones expected.

-

8.Finally, review all entries for accuracy and completeness, then save the document and share it with all relevant parties for review.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.