Get the free This Series Seed Preferred Stock Purchase Agreement (this "Agreement") is made as of...

Show details

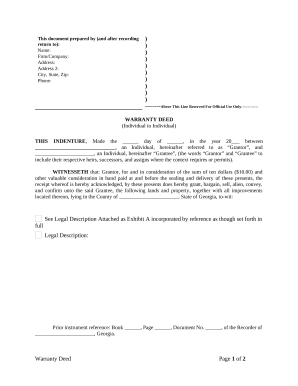

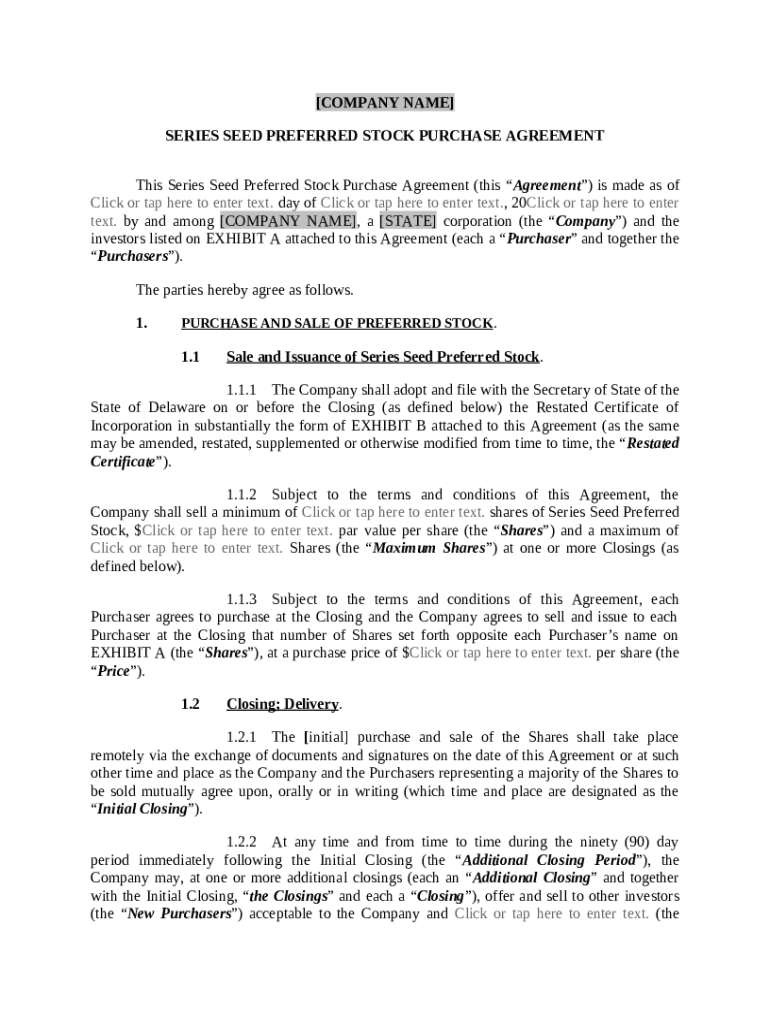

[COMPANY NAME] SERIES SEED PREFERRED STOCK PURCHASE AGREEMENT This Series Seed Preferred Stock Purchase Agreement (this \"Agreement\") is made as of Click or tap here to enter text. day of Click or

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is this series seed preferred

The document 'this series seed preferred' outlines the terms and details related to preferred series seed investments.

pdfFiller scores top ratings on review platforms

THIS IS GREAT & VERY EASYTO UNDERSTAND

Just started but satisfied

I've only used this program for a few documents but so far i am highly satisfied with the ease of use.

A few connection issues...otherwise…

A few connection issues...otherwise helpful and easy to use.

I am still learning more about it

I am still learning more about it, However, I have been very pleased with it so far.

excellent product

excellent product, saved me hours of filling in cn22 forms, lifesaver

AWESOME AND GREAT TOOL

Who needs this series seed preferred?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Series Seed Preferred Stock Purchase Agreement

How does one understand Series Seed preferred stock?

Series Seed preferred stock is a form of equity financing that offers startups a way to raise funds by attracting investors. The main advantage of preferred stock is its priority over common stock in terms of payments, especially in liquidation scenarios. This makes it an attractive option for investors looking to mitigate risk while supporting startup growth.

-

Series Seed preferred stock represents an ownership interest in a startup, typically with special rights granted to shareholders.

-

It empowers startups to tap into investment with fewer immediate obligations compared to other financing methods.

-

Preferred stockholders generally have a better claim on assets and earnings compared to common stockholders, providing them with a financial cushion.

What are the key components of the stock purchase agreement?

A stock purchase agreement outlines the terms of the sale of shares. Understanding its key components can help ensure that both parties commit to a clear and binding agreement.

-

Clearly state the names and roles of all parties in the agreement to avoid confusion.

-

Detail the price per share, total number of shares, and any payment terms such as upfront or installment payments.

-

Include specifications like the type of shares and any attached rights or preferences.

How to fill out the agreement?

Filling out the agreement accurately is crucial for legal compliance and mutual understanding between parties. Each section of the agreement demands attention to detail to avoid future disputes.

-

Begin by entering the date of the agreement and introductory details to establish context.

-

Provide the legal name of the company, its address, and other identifying information for accuracy.

-

Include all pertinent details regarding the buyer(s), including the offered price and the number of shares being purchased.

What is the filing and delivery process?

Completing the filing and delivery process ensures the stock purchase agreement is legally recognized and binding. It's crucial to follow proper procedures to avoid delays and compliance issues.

-

Submit the necessary documents to the Secretary of State in the appropriate jurisdiction for the agreement to become effective.

-

Follow the required steps for executing the document, ensuring that all necessary parties sign and date the agreement.

-

Utilize pdfFiller's platform for electronic signatures and document delivery, streamlining the process.

What are the legal considerations and compliance requirements?

Adhering to local and state laws is critical in drafting a valid stock purchase agreement. Understanding these nuances can prevent legal disputes and enforceability challenges.

-

Most startups choose Delaware due to its business-friendly laws; ensure your agreement adheres to these regulations.

-

Familiarize yourself with this foundational document as it impacts the terms of preferred stock rights.

-

Incorporate disclaimers that clarify the extent of liability and obligations, safeguarding against misunderstandings.

How do modifications and amendments to the agreement work?

Document modifications and amendments accurately to reflect any changes in the agreement after initial execution. This helps maintain clarity and legal validity.

-

Amendments may alter or add terms, requiring all parties to review and agree upon the changes.

-

Changes can significantly affect shareholders and their rights; it is crucial to communicate these adjustments.

-

Always keep a record of amendments to track changes and preserve the historical context of agreements.

What common mistakes should be avoided?

Being aware of common pitfalls in the stock purchase agreement process can save time and resources. Ensuring thoroughness can prevent legal issues down the line.

-

Missing signatures invalidate the agreement; double-check that all required parties have signed.

-

An incorrect purchase price can lead to disputes and dissatisfaction among stakeholders.

-

Non-compliance with legal standards could lead to penalties; stay informed of regulatory changes.

How does pdfFiller facilitate document management?

Using pdfFiller streamlines the process of document management, especially in managing a Series Seed preferred stock purchase agreement. The platform offers tools that enhance the user experience by simplifying edits, signings, and collaborations.

-

The platform provides easy-to-use features for making edits and applying electronic signatures, making document management efficient.

-

Cloud storage allows for seamless access and collaboration among team members, regardless of their location.

-

The software enables users to track changes over time, facilitating clearer communication and version control.

How to fill out the this series seed preferred

-

1.Open the pdfFiller platform and log in to your account.

-

2.Locate the 'this series seed preferred' template in the document library or upload your own version of the document.

-

3.Select the 'Fill in' option to begin editing the document.

-

4.Input your company’s name and relevant details in the designated fields.

-

5.Provide information about the preferred shares, including the number, value, and rights associated with them.

-

6.Complete any additional sections that specify terms such as dividend rates, conversion options, or liquidation preferences.

-

7.Review the filled details carefully for accuracy and completeness.

-

8.Utilize the 'Save' function to store your completed document, and if needed, proceed to 'Send' or 'Download' it for distribution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.