Get the free Third Party Financing Agreement Work template

Show details

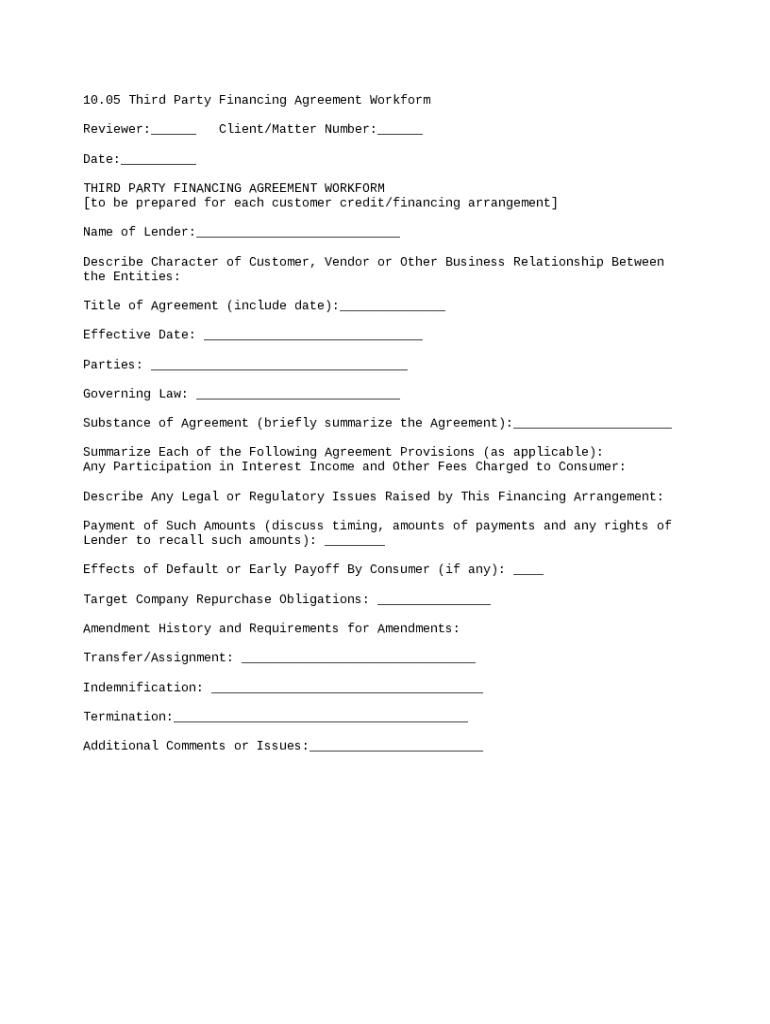

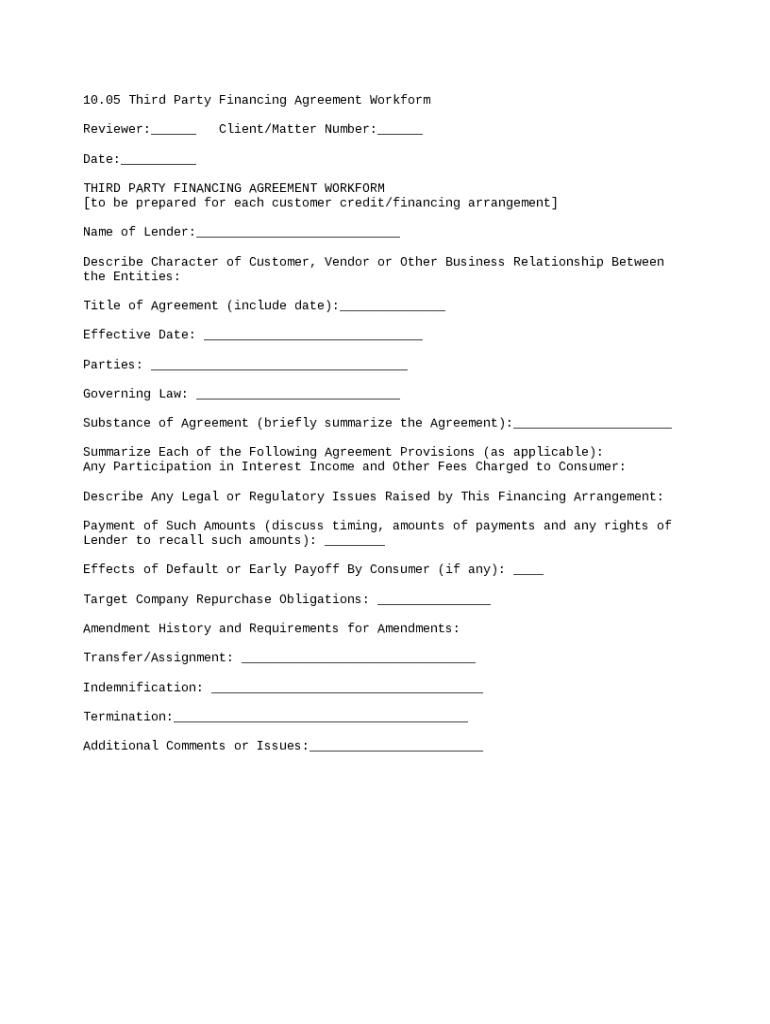

Third Party Financing Agreement Workform

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is third party financing agreement

A third party financing agreement is a contractual arrangement in which a third party provides funding to facilitate a transaction or project, ensuring the parties involved can proceed without upfront costs.

pdfFiller scores top ratings on review platforms

It works for what its for and has some…

It works for what its for and has some nice features like saved signatures. If you're commonly using this its probably worth getting.

Save Time and Money

No need to look any further, just google the form number and voila! You can fill it out, download it, email it in a few minutes.

Excellent tool for editing pdfs

Excellent tool for editing pdfs. Standard templates are also very helpful

I'm such a tech phobic-i was easy able to navigate your website and send documents! Very happy!

N/A

Easy to use and can perform multiple tasks.

Who needs third party financing agreement?

Explore how professionals across industries use pdfFiller.

Third party financing agreement workform guide

How do fill out a third party financing agreement form?

Filling out a third party financing agreement form involves several key steps to ensure compliance and clarity. Start by clearly stating the names of all parties involved, including the lender and the customer. Next, specify the terms of the financing, including payment schedules and interest rates, and follow with signatures from all relevant parties to finalize the agreement.

Understanding third party financing agreements

A third party financing agreement is a legal contract that involves a lender, a customer, and often a vendor. These agreements are essential in various industries, enabling businesses and consumers to secure necessary funds for purchases or projects without immediate payment. Common scenarios for these agreements include purchasing equipment, homes, or engaging in large-scale projects that require upfront investment.

-

These are contracts involving three parties where the lender provides financing to the customer for use in a transaction that often includes a vendor.

-

They facilitate transactions that would otherwise be unattainable for individuals or businesses, promoting economic activity.

-

These can include real estate transactions, equipment leasing, and consumer loans for big-ticket items.

What are the key elements of a third party financing agreement?

Understanding the key elements of a third party financing agreement is critical for ensuring its effectiveness and legality. Key components include the identification of all parties involved, the effective date of the contract, and specific rights and responsibilities outlined in the agreement.

-

The lender provides the financing and must ensure transparency regarding interest and repayment terms.

-

Clarity on the relationship between customer and vendor can affect financing terms and obligations.

-

These details provide structure to the agreement and prevent potential disputes.

What provisions should be included in a financing agreement?

Provisions in a third party financing agreement define the obligations of all parties. The clarity in these provisions minimizes risks and ensures compliance with laws and regulations. It’s important to also anticipate adjustments that may arise as agreements are amended.

-

Concise summaries help in understanding the basic contractual obligations of parties.

-

Customers should be aware of how fees affect the overall cost of financing.

-

Each region may have specific laws impacting financing agreements which should be strictly followed.

How are payment structures defined in financing agreements?

Payment structures in financing agreements dictate how and when the customer will repay the finances. Precise definitions regarding timing and amounts alleviate any potential misunderstandings between the lender and the customer. It's crucial these specifications are thoroughly reviewed before finalization.

-

Clear schedules for payments help both parties manage expectations and prevent defaults.

-

Know when and how a lender can enforce repayment rights.

-

Clear clauses regarding consequences of default and conditions for early payoff can save both parties trouble.

What obligations and responsibilities exist in the agreement?

The obligations of all parties in a third party financing agreement are crucial for the agreement’s validity. These responsibilities can encompass financial commitments as well as other responsibilities that may arise from the vendor or customer sides.

-

Know when the target company may need to repurchase the financed item and its implications.

-

Maintaining a thorough amendment history can protect all parties in case of disputes.

-

Understanding the transfer rights for obligations can shape the value and liquidity of an agreement.

How can risk management and termination clauses protect parties?

Risk management is crucial in third party financing agreements as it delineates how to protect the interests of all parties. Establishing clear termination clauses informs parties of conditions under which the agreement may be dissolved.

-

Indemnification clauses can provide security against loss due to third-party claims.

-

Understanding the conditions for termination helps mitigate risks associated with prolonged obligations.

-

Clear sections for addressing additional concerns can avoid misunderstandings later.

How to use pdfFiller for financing agreements

pdfFiller is a comprehensive tool that simplifies the management of financing agreements. With features for editing, signing, and collaborating, it enriches the process of handling documents in a cloud-based environment.

-

Easily input information into the form and make modifications intuitively.

-

eSigning allows for quick, secure approvals and storage.

-

Team collaboration features allow multiple users to interact with the document, enhancing transparency.

What legal and compliance issues should be navigated?

Navigating legal and compliance matters is vital for ensuring your third party financing agreements adhere to local laws and regulation. Best practice guidelines can enhance compliance and minimize risks of penalties.

-

Regulations can differ widely based on jurisdiction and should be carefully studied.

-

Employing industry standards can help in drafting compliant agreements.

-

pdfFiller provides templates and guidelines to help users navigate legal landscapes effortlessly.

What are the next steps for finalizing your third party financing agreement?

Finalizing a third party financing agreement requires thorough verification of every aspect outlined. Ensuring all fields are completed is critical, as is following up appropriately after signing.

-

Review each section to confirm all terms are agreed upon and documented.

-

Keep communication open regarding repayment and any future adjustments.

-

Use pdfFiller’s cloud storage for safe, easy access and retrieval.

How to fill out the third party financing agreement

-

1.Open the third party financing agreement template on pdfFiller.

-

2.Review the introductory section to understand the key components of the agreement.

-

3.Fill in the parties' names and contact information in the designated fields.

-

4.Specify the amount of financing needed and any related terms.

-

5.Detail the purpose of the financing and how the funds will be utilized.

-

6.Include any necessary legal disclosures or conditions outlined in the template.

-

7.Review the financing terms, including interest rates or repayment schedules, and fill in as required.

-

8.Add a section for signatures and date lines for all parties involved to complete the agreement.

-

9.Once all fields are filled, review the document for completeness.

-

10.Download or print the finalized agreement for execution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.