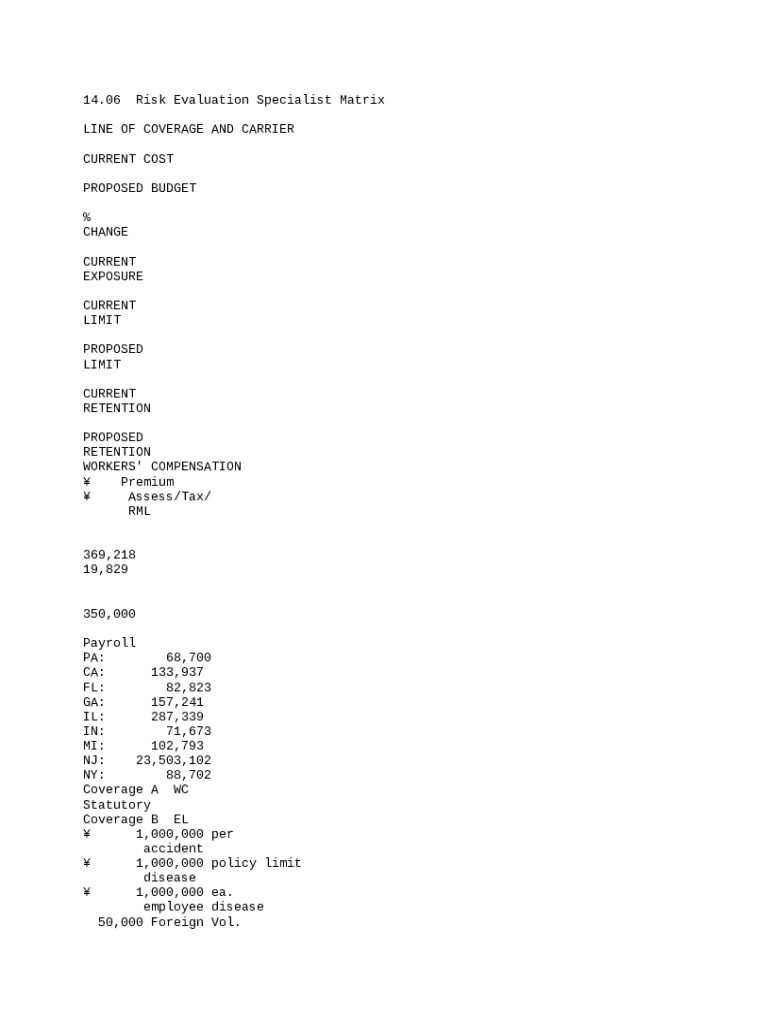

Get the free Risk Evaluation Specialist Matrix template

Show details

This due diligence form contains information documented from a risk evaluation within a company regarding business transactions.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is risk evaluation specialist matrix

The risk evaluation specialist matrix is a structured tool used to assess and prioritize potential risks within a project or organization.

pdfFiller scores top ratings on review platforms

Efficient

It's been great and it gets the job done!

good

takes some time to get it...but it's worth it

I am just learning it. But so far it's ok.

I'm new to this, but so far this has been very easy to use!

Who needs risk evaluation specialist matrix?

Explore how professionals across industries use pdfFiller.

Risk evaluation specialist matrix: Comprehensive guide

How does a risk assessment matrix work?

A risk assessment matrix is a vital tool for evaluating potential risks in business operations. It simplifies complex risk factors by providing a visual representation that helps decision-makers categorize and prioritize risks based on their likelihood and impact. Understanding how to fill out a risk evaluation specialist matrix form can enhance your organization's ability to manage risks effectively and make informed decisions.

-

A risk assessment matrix is a structured tool that quantifies risk based on two primary factors: the likelihood of an event occurring and its potential impact. This dual-axis approach enables businesses to effectively categorize risks, helping prioritize resources and mitigation strategies.

-

Effective risk evaluation allows organizations to identify potential threats and prepare for them, ensuring strategic decision-making that safeguards assets and enhances productivity. It is particularly crucial during uncertain times when the magnitude of risks can vary significantly.

-

Utilizing a risk assessment matrix streamlines the risk management process. It promotes clarity in understanding risks, enhances communication among stakeholders, and provides a systematic approach to addressing vulnerabilities, thus leading to better outcomes.

What are the components of the risk evaluation specialist matrix?

The components of a risk evaluation specialist matrix lay the groundwork for accurate risk assessment. Each element plays a critical role in understanding the scope of risks and guiding businesses in their risk management strategies.

-

Understanding various coverage options and the specific insurance carriers involved is essential for tracking risk exposure. This breakdown allows businesses to identify gaps in coverage and whether their current policies are sufficient.

-

Evaluating current costs in relation to potential adjustments in the budget helps organizations make informed financial decisions. This insight enables leaders to allocate resources efficiently, implementing changes that are sustainable in the long term.

-

Recognizing the extent of current exposure allows organizations to inform stakeholders about potential liabilities. By assessing limits, businesses can prevent overexertion of their resources when dealing with risks.

How should you fill out the risk evaluation specialist matrix?

Filling out the risk evaluation specialist matrix requires a systematic approach to ensure accurate assessment and actionable insights. Following a structured process can streamline the completion of this vital document.

-

Begin by identifying potential risks and categorizing them based on likelihood and impact. This method ensures a holistic view of risks within the organization.

-

Use pdfFiller to easily edit and customize your risk assessment matrix. The platform allows users to create personalized fields, ensuring all necessary information is captured efficiently.

-

Engage team members in filling out the matrix to gain diverse insights. pdfFiller facilitates collaboration through shared access, allowing real-time updates and communication.

What critical fields are included in the risk evaluation matrix?

Critical fields in the risk evaluation matrix are essential for identifying where risk lies within the organization. By analyzing these elements, organizations can more effectively mitigate risks.

-

Clearly defining risk categories such as Workers' Compensation and General Products Liability allows teams to categorize risks efficiently. This clarity enables focused risk management strategies.

-

Understanding how to balance insurance premiums against potential retained losses can lead to smarter investment in risk management. This balance can prevent financial strain while appropriately covering potential risks.

-

Familiarizing yourself with policy limits ensures that businesses know their coverage boundaries. This understanding is crucial for making informed decisions about risk exposure.

How can you analyze risk outcomes?

Analyzing risk outcomes is integral to effective risk management. By evaluating potential risks and their financial implications, organizations can strategize on how to minimize threats.

-

Identifying potential risks involves a thorough review of historical data and forecasts. This data enables businesses to calculate the potential financial impact of specific risks.

-

Visual tools available in pdfFiller can transform data into clear reports. These reports promote better stakeholder engagement and understanding during discussions around risk management.

-

Regularly re-evaluating risks ensures that operations adapt to changing circumstances. Scheduling assessments at consistent intervals is a best practice to maintain an updated risk profile.

What compliance considerations should you be aware of?

Compliance considerations in risk assessment are vital for maintaining organizational integrity and avoiding legal repercussions. Understanding regional regulations is essential for aligning risk management practices.

-

Awareness of compliance standards helps organizations align their risk assessment strategies with industry regulations. Non-compliance can lead to substantial penalties and reputational damage.

-

Different regions may have specific regulations that must be addressed. Organizations should keep abreast of these to ensure their risk assessment matrix is compliant.

-

pdfFiller provides features for document management that can help support compliance tracking. This support can simplify maintaining records required by regulatory authorities.

How do you implement the matrix into business practices?

Integrating the risk evaluation specialist matrix into daily business practices is essential for effective risk management. This approach ensures that risk considerations are part of the overall business strategy.

-

Incorporating risk evaluation directly into business strategy enhances alignment between operations and risk management objectives.

-

Using technology to set up alerts for any changes in risk status can help keep teams informed and proactive.

-

Creating collaborative strategies involving multiple teams facilitates a more robust approach to risk management, promoting a culture of safety and awareness.

How can you maximize your use of pdfFiller for risk management?

Maximizing your use of pdfFiller can streamline your risk management processes significantly. Understanding its features allows teams to execute tasks efficiently and effectively.

-

Features like seamless editing, eSigning, and document sharing enable users to manage their risk assessment documents in an intuitive, user-friendly interface.

-

Leveraging cloud-based solutions from pdfFiller brings the advantages of accessibility and security, ensuring documents are available anywhere, anytime.

-

The platform allows for secure sharing options, which helps maintain confidentiality while promoting transparency among stakeholders involved in risk management discussions.

How to fill out the risk evaluation specialist matrix

-

1.Open the risk evaluation specialist matrix template in pdfFiller.

-

2.Begin by entering the title of your project or assessment in the designated field.

-

3.Identify and list out all potential risks associated with the project. Categorize them according to their sources, such as operational, financial, legal, or environmental.

-

4.Next, for each identified risk, provide a brief description highlighting its potential impact.

-

5.Assign a likelihood rating to each risk, generally on a scale from low to high, based on historical data or expert opinion.

-

6.After assessing likelihood, determine the severity of the potential impact, using a similar rating scale.

-

7.Combine the likelihood and impact ratings to calculate a risk score, which will help in prioritizing the risks.

-

8.Enter the calculated risk scores into the matrix and visually arrange them in a way that clearly indicates which risks require immediate attention.

-

9.Finally, review the matrix for accuracy and completeness before submitting or saving the document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.