Get the free pdffiller

Show details

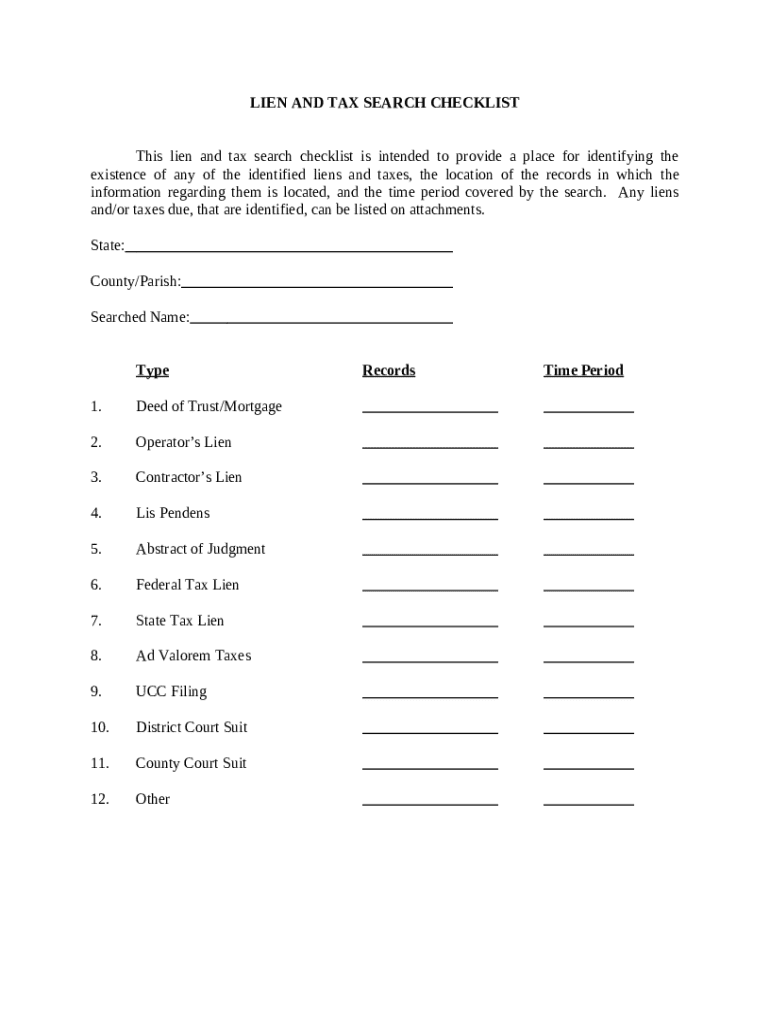

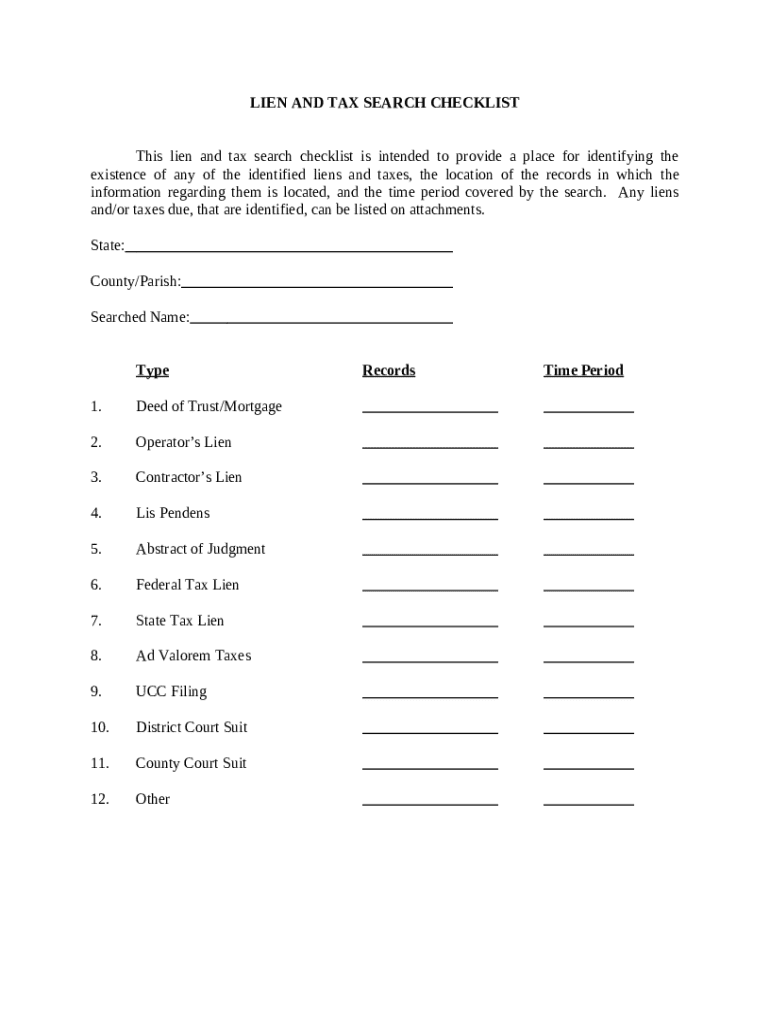

Lien and Tax Search Checklist, this form is to provide a checklist for a lien and tax search.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is lien and tax search

A lien and tax search is a process to check for any outstanding liens or taxes associated with a property.

pdfFiller scores top ratings on review platforms

This program has saved me a lot of time and easy to use.

THe program is very easy to use. Basically copy and paste.

easy to use. problem with printing complete doc on pages

Very easy to use along with all of the features I need.

Has been very simple to use. Meets my needs for filling in pdf files and faxing them.

Application is very user friendly and makes completing documents a breeze. The e-signature feature seems to be accepted by most vendors.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Guide to lien and tax search form

How does understanding liens and taxes benefit me?

Understanding liens and taxes is crucial for informed property ownership and management. A lien is a legal claim against a property due to unpaid debt, while taxes, such as property taxes and income tax, have direct financial implications. Conducting a lien and tax search helps uncover any existing obligations that may impact your financial standing or your ability to buy or sell property.

-

Liens grant creditors a right to take possession of property until a debt is settled, which can affect your property ownership.

-

A thorough search helps prevent future disputes and ensures you understand any financial obligations prior to transactions.

-

Common liens include the Deed of Trust, which secures a loan; Mortgages, which involve financing; and Contractor's Liens for unpaid work.

What do need to prepare for my lien and tax search?

Preparation is key to a successful lien and tax search. Knowing the right state and county to research is essential as regulations can vary by region. Additionally, identifying the searched name accurately helps streamline the process and minimizes potential delays.

-

Start by knowing where the property or title search is focused; each location may have different search requirements.

-

Accurate name identification ensures you search the correct records associated with the individual or entity.

-

Prepare any relevant documents such as previous tax returns, property deeds, and identification to support your search.

How do use the lien and tax search checklist?

A checklist simplifies the lien and tax search process by providing a clear structure. This helps you gather the necessary information systematically and ensures no crucial steps are overlooked.

-

The checklist typically details sections such as State, County/Parish, and Searched Name for an organized approach.

-

Each item denotes what documentation or information is required, helping you prepare thoroughly.

-

Accurate filling in of these fields ensures your search results are current and pertinent to your needs.

What types of liens and taxes should search for?

Different types of liens and taxes can exist on a property, each requiring scrutiny. Understanding these can help you gauge potential risks when assessing property transactions.

-

These are security interests attached to property that help lenders ensure repayment of loans.

-

Unpaid taxes can lead to liens that might complicate property transactions and ownership.

-

A claim for payment made by contractors for work done on a property, typically arising from unpaid bills.

-

Uniform Commercial Code filings may also impact property ownership if there are secured interests.

What happens after the lien and tax search?

After completing a lien and tax search, understanding your findings is vital. Any identified liens can pose significant implications for ownership and transactions, and it’s important to know your next steps.

-

Liens can restrict your ownership rights and may require addressing before proceeding with a sale.

-

Engaging with a legal professional might be necessary to navigate the process of addressing the lien.

-

Depending on the situation, you may need to negotiate, pay off the debts, or dispute a lien you believe is inaccurate.

How can pdfFiller assist with document management?

pdfFiller enhances the efficiency of filling out lien and tax forms, making document management seamless. Its functionalities allow users to edit, eSign, and collaborate on documents from any device, ensuring accessibility and organization.

-

Users can quickly edit PDF forms to include necessary information without hassle.

-

pdfFiller enables real-time collaboration and eSigning capabilities to streamline the document workflow.

-

Store all your documents securely in the cloud, making access easy and organized, ensuring you’re always prepared.

How do navigate local regulations and compliance?

Local regulations and compliance rules play a significant role in lien and tax searches. Being aware of state-specific variations in lien laws can significantly influence the search process and outcomes.

-

Different states have varying rules that may affect how liens are filed or searched.

-

Utilize local legal resources or online platforms to increase understanding of compliance language and terms.

-

Each state has nuanced laws governing liens; familiarity with these can be critical for successful navigation.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.