Get the free pdffiller

Show details

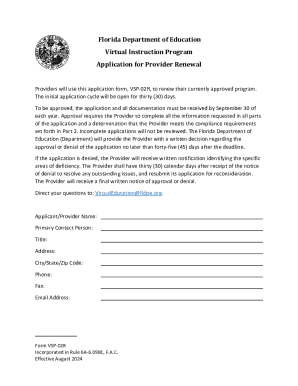

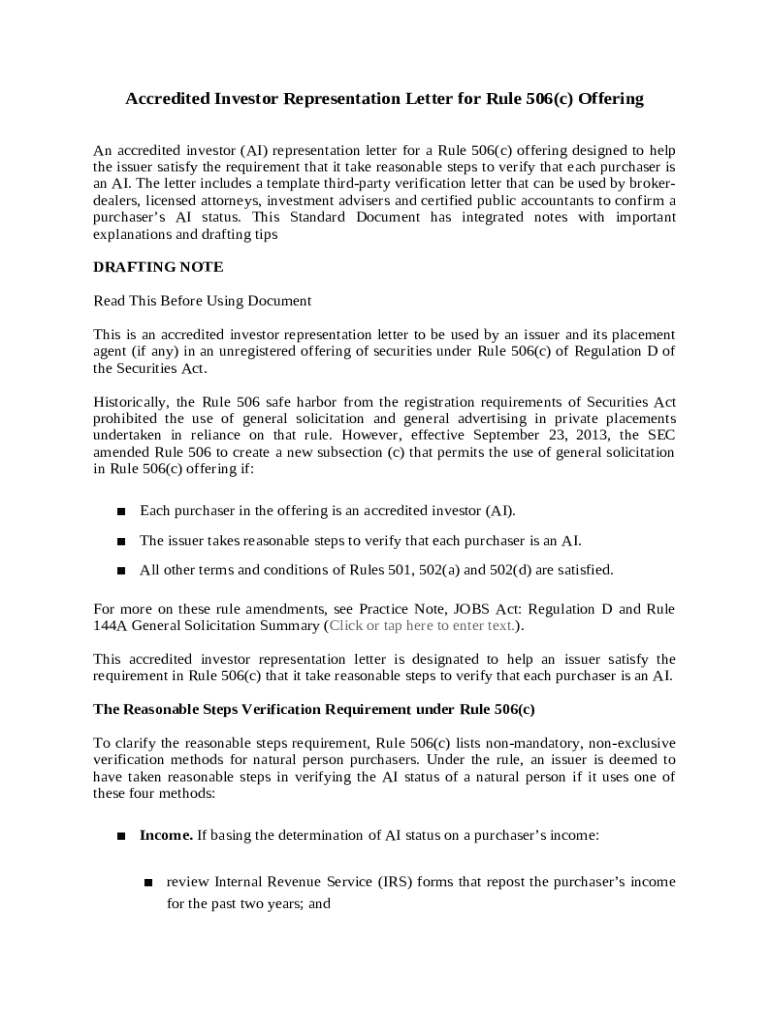

An accredited investor (AI) representation letter intended to assist issuers in verifying that each purchaser is an accredited investor in compliance with Rule 506(c) of the Securities Act. This document

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is accredited investor representation letter

An accredited investor representation letter is a document that certifies an individual's or entity's status as an accredited investor for securities transactions.

pdfFiller scores top ratings on review platforms

comes in very handy when outgoing officers haven't filed reports correctly!!!!

Really good..haven't quite worked everything out yet..but so far so good

Sometimes hard to find the doc template you are looking for but otherwise, it is great!

this is the best operation for the entreprenue

GREAT! Please be more clear about5.99 monthly rate, not actually monthly charge, all one charged lumped into 1 yearly charge,

Very excellent products and user friendly.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

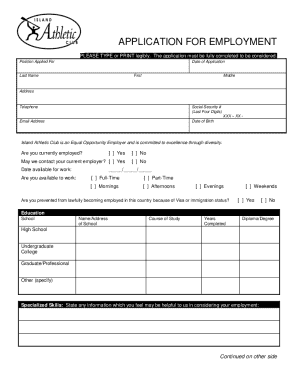

How to Complete the Accredited Investor Representation Letter Form

How do fill out an accredited investor representation letter form?

Filling out an accredited investor representation letter form requires careful attention to detail to ensure compliance. This form is essential for verifying your status as an accredited investor, which is crucial under Rule 506(c) of Regulation D. By following the right steps and utilizing tools like pdfFiller, you can streamline the process.

The form includes specific sections that must be populated, including your personal details and the issuer’s obligations. It’s recommended that you gather relevant documentation beforehand. Lastly, using online tools can simplify the completion and submission processes.

What is an accredited investor representation letter?

An accredited investor representation letter serves as a declaration made by a prospective investor, affirming that they meet the criteria set by the SEC. This document is critical for issuers who use the general solicitation provisions outlined in Rule 506(c).

-

Definition and purpose of the letter: It confirms the investor's accredited status, allowing them to participate in private placements.

-

Importance for issuers: Helps issuers avoid potential legal liability by ensuring they only allow qualified investors.

-

SEC amendments: Recent changes have expanded the definition and increased focus on transparency with general solicitations.

What are the key components of the form?

The accredited investor representation letter includes several critical components that ensure comprehensive verification of the investor's status. Understanding these components is essential for both the purchaser and the issuer to protect their interests.

-

Details required from the purchaser: This includes personal information, financial status, and verification of their accredited investor status.

-

Issuer's obligations: The issuer must undertake reasonable steps to verify the purchaser's information, demonstrating compliance with SEC regulations.

-

Third-party verification: Including a template for third-party verification adds a layer of validation to the claims being made.

-

Drafting notes: Important explanations and notes help clarify complex terms and obligations.

What is the step-by-step guide for filling out the form?

Completing the accredited investor representation letter form can be simplified into a few actionable steps. Following this guide will ensure that you provide all necessary information accurately and efficiently.

-

Gather necessary documentation: Collect proof of your income, net worth, or other relevant financial information to support your claim.

-

Populate the purchaser's information: Input your personal details, including your full name, address, and financial status.

-

Complete issuer's verification declaration: Provide the necessary information that confirms your accredited investor status as per the issuer's requirements.

-

Integrate pdfFiller tools for easy edits: Use pdfFiller to make necessary adjustments and ensure your form is complete before submission.

What are the best practices for compliance?

Compliance with regulations is crucial when submitting the accredited investor representation letter. By adhering to best practices, investors can safeguard their interests and maintain transparency.

-

Understanding the verification requirement: Familiarize yourself with what constitutes reasonable verification steps to ensure compliance.

-

Explore non-mandatory verification methods: Be aware of other verification techniques that may mitigate compliance risks.

-

Maintain proper documentation: Keep all records of submitted forms and supporting documents in case of future audits.

-

Collaborate through pdfFiller’s platform: Utilize shared tools for secure collaboration with your team.

What common mistakes should avoid?

Filling out the accredited investor representation letter can lead to pitfalls if not properly executed. Being aware of these common mistakes can help ensure a smooth submission process.

-

Incomplete purchaser information: Failing to provide all required personal and financial details can lead to rejection.

-

Neglecting verification methods: Ignoring the appropriate verification processes can impact your investor status.

-

Misunderstanding issuer's responsibilities: Both parties must be clear about their roles to maintain compliance.

-

Inadequate documentation: Not maintaining the necessary paperwork can complicate compliance checks by regulators.

How can use pdfFiller to manage my document?

Using pdfFiller enhances your experience in managing the accredited investor representation letter form. This cloud-based platform provides various features that streamline the document process.

-

Benefits of cloud-based management: Easily access, edit, and store your documents from anywhere, ensuring flexibility and convenience.

-

Sharing and collaborating: Utilize pdfFiller to share documents with your team securely, allowing simultaneous edits.

-

Editing and eSigning: Integrate tools into your workflow to edit and electronically sign your accredited investor representation letter seamlessly.

-

Security measures: pdfFiller implements robust security protocols to safeguard your sensitive information.

What steps should take to finalize and submit the form?

Prior to submitting the accredited investor representation letter form, it's crucial to perform a final review. This helps ensure all information is accurate and complete.

-

Review steps: Double-check all entries on the form to verify that all sections are properly completed.

-

Submission process: Follow the prescribed channel for submitting your letter based on the issuer’s instructions.

-

Follow-up actions: After submission, confirm receipt and retention of the document for future reference.

-

Utilize pdfFiller for ongoing management: Keep track of the letter and any related documents within pdfFiller’s platform for easy access.

How to fill out the pdffiller template

-

1.Open the accredited investor representation letter on pdfFiller.

-

2.Begin by filling in your name and contact information in the designated fields.

-

3.Specify your status as an accredited investor by selecting the appropriate option, such as individual or entity.

-

4.If applicable, provide additional details about your net worth or income to support your accredited status.

-

5.Review the document to ensure all information is accurate and complete.

-

6.Add your signature and date at the bottom of the letter where indicated.

-

7.Save the completed document in your preferred format, and submit it as required for your investment process.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.