Get the free Checklist - Certificate of Status as an Accredited Investor template

Show details

Under SEC law, a company that offers its own securities must register these investments with the SEC before it can sell them unless it meets an exception. One of those exceptions is selling unregistered

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is checklist - certificate of

A checklist - certificate of is a document used to verify completion of necessary requirements or tasks for certification.

pdfFiller scores top ratings on review platforms

fill box to big needs to adjust to be smaller for printing

Very user friendly, would highly recommend.

IT IS VERY EASY TO USE AND FILL, SAVE, SEND AND CHANGE PDF DOCUMENTS

Sometimes it is hard to figure things out

I needed a commercial invoice and found this in a search. I hope it continues to be helpful to use for many other forms.

this feature is awesome but a little to pricey for me

Who needs checklist - certificate of?

Explore how professionals across industries use pdfFiller.

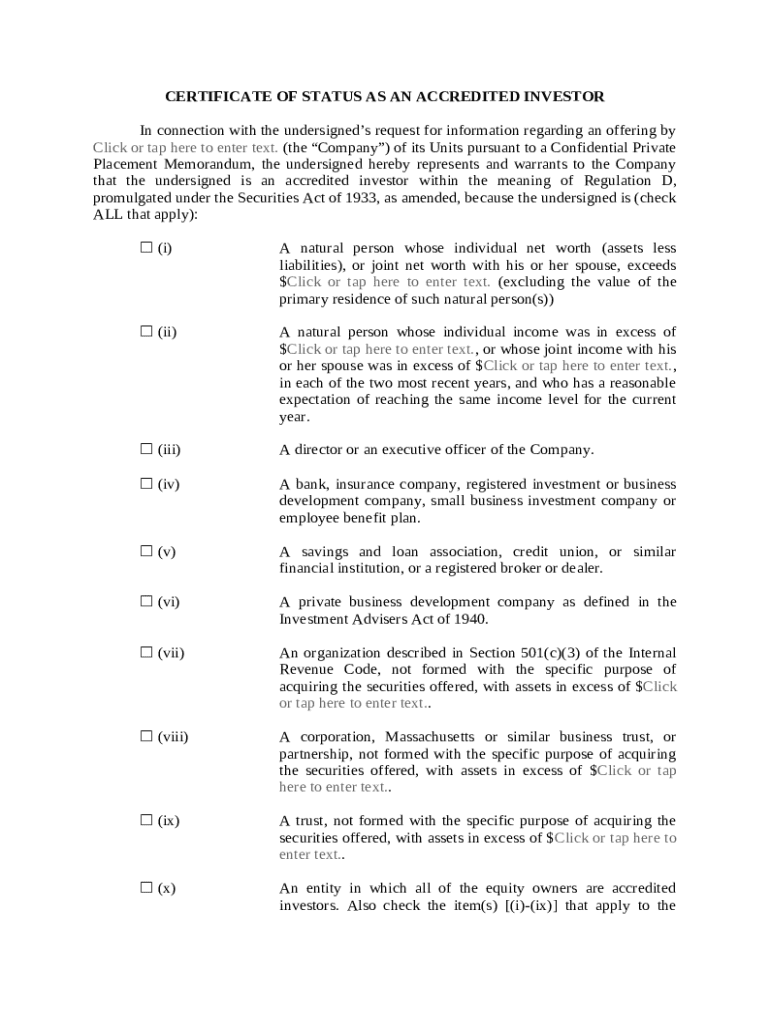

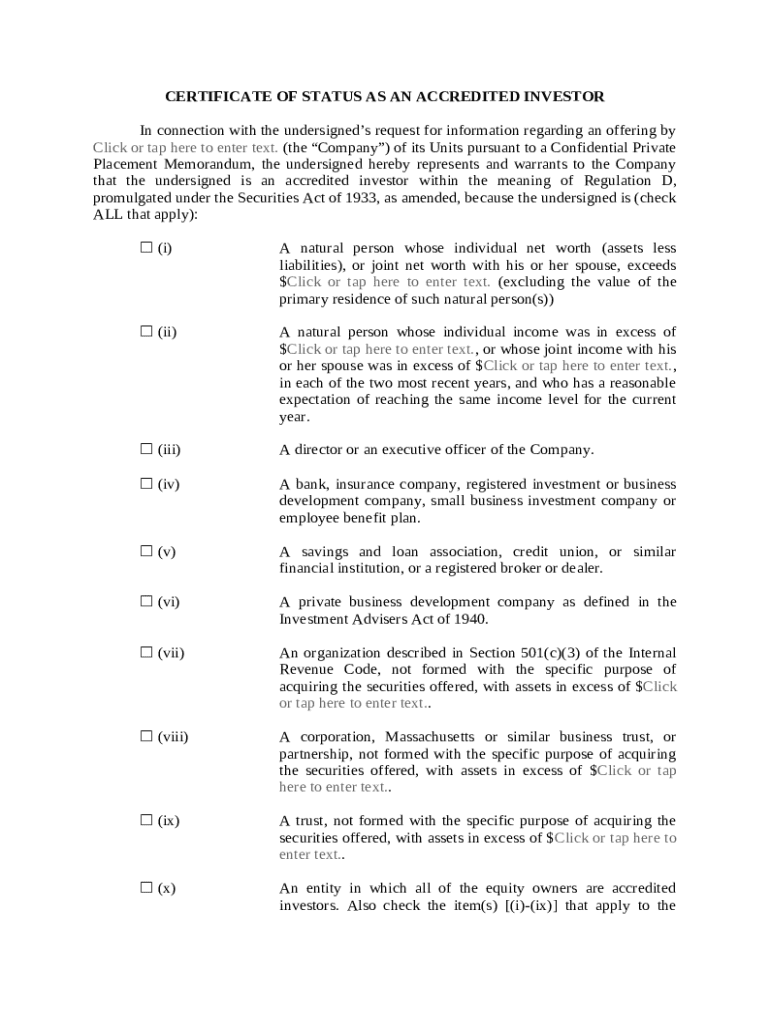

Comprehensive Guide to the Certificate of Status as an Accredited Investor

This guide focuses on the checklist for the certificate of form form, specifically the Certificate of Status as an Accredited Investor, crucial for those looking to participate in private placements.

What is the certificate of status?

The Certificate of Status serves to validate an individual's status as an accredited investor, mainly to comply with legal requirements in private investment opportunities. This document plays a significant role in establishing credibility for investors seeking to enter restricted investment markets.

-

This certificate confirms one’s status as an accredited investor, which is essential for accessing private investment opportunities.

-

Being recognized as an accredited investor opens doors to a wider range of investment options, including private equity and venture capital.

-

Regulation D of the Securities Act outlines the requirements and safeguards associated with private placements.

How can you determine your status as an accredited investor?

To be classified as an accredited investor, one must meet specific criteria related to net worth, income, or professional certifications. Understanding these requirements helps in self-assessment and preparation for investment opportunities.

-

The criteria for accredited investors include having a net worth of over $1 million excluding primary residence, consistent income above $200,000 for individuals or $300,000 for couples, or possessing certain professional designations.

-

For instance, an investor with a combined income of $300,000 over the previous two years qualifies as accredited, or a person holding a Series 7, 65, or 82 license can also qualify.

-

Create a checklist with your income details, asset lists, and professional credentials to determine your status effectively.

How do you fill out the certificate of status form?

Filling out the Certificate of Status form can seem daunting but following a systematic approach makes it manageable. Each section of the form is crucial and requires accurate completion to avoid delays in processing.

-

Begin by filling in personal information, then move to financial details—ensure you accurately calculate your net worth and verify your income.

-

Pay close attention to the net worth calculation; it needs to reflect your assets minus your debts to be accurate.

-

Avoid omitting required fields or providing outdated financial information, as these errors can lead to rejection or delays.

How do you modify and manage your form on pdfFiller?

pdfFiller provides a streamlined platform to edit and manage your Certificate of Status form efficiently. Users can leverage various tools for completing and submitting documents securely and conveniently.

-

Utilize pdfFiller’s editing features to fill out or correct any inaccuracies in your form quickly.

-

The eSignature feature adds authenticity to your submission, making your documentation valid and legally binding.

-

You can also share forms with your team members, allowing for collaborative editing and submission.

What resources might also be of interest?

In addition to the Certificate of Status, accessing related forms and templates can enhance the investment experience for accredited investors. Supplementary resources can provide vital insights and assist in maintaining compliance.

-

Explore other essential forms necessary for investors seeking compliance, like the Investor Qualification Questionnaire.

-

Look for guides on regulations affecting accredited investors, ensuring you remain up-to-date with compliance matters.

-

Read insights into how to maintain your accredited investor status over time, which can change with financial circumstances.

How to fill out the checklist - certificate of

-

1.Open the checklist - certificate of document in pdfFiller.

-

2.Review the certification requirements outlined in the checklist.

-

3.Begin filling in your personal information such as name, date, and any relevant identification numbers.

-

4.Go through each item on the checklist, marking completed tasks with a check or cross as appropriate.

-

5.Add any supplementary documentation or notes required for specific items.

-

6.Review the entire checklist for completeness, ensuring all sections are filled correctly.

-

7.Save the filled document to your device or cloud storage within pdfFiller.

-

8.If necessary, print the document or send it electronically to the relevant authority for certification.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.