Get the free Insurance and Liability Coverage Due Diligence Request List template

Show details

This due diligence form lists certain documents, items and information which are required in order to complete the due diligence investigation with respect to the company's risk management procedures

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

I love it. It is very easy to use

I think the features are really great for the price

A lot easier to use than Adobe and a lot cheaper. I love that it allows me to do so much editing and saves as it goes

Beginner

very helpful , to people who struggle with forms.

perfect, easy to use, so convenient, appealing to the eyes. love it

How to fill out an insurance and liability coverage form

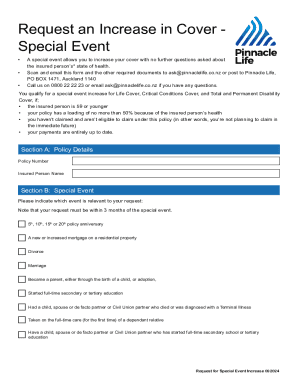

Understanding Insurance and Liability Coverage Forms

Insurance and liability coverage forms are essential documents that provide critical information for both insurers and policyholders. They outline the coverage available, the terms, and other important details. Without these forms, navigating the complexities of liability coverage can be challenging.

-

These forms help you understand what is covered under your policy and protect you against various risks.

-

There are numerous types of coverage, including general liability, professional liability, and property insurance.

-

Familiarizing yourself with terms like 'deductible', 'premium', and 'exclusions' can help you make informed decisions.

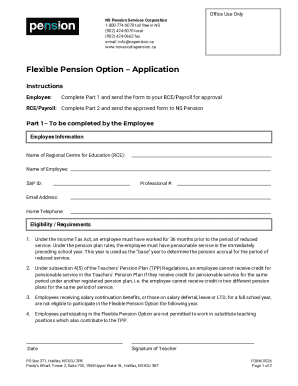

What are the basic insurance documentation requirements?

To create a comprehensive insurance profile, specific information is essential. This ensures that your coverage is accurate and meets your needs.

-

Details like your business type, number of employees, and prior claims information help tailor your policy.

-

A complete list includes past insurance policies, property records, and loss history.

-

Using digital tools like pdfFiller can streamline the organization and retrieval processes.

What is the detailed breakdown of required documents?

-

This includes a schedule of insurance, loss triangulation, and historical program information.

-

Document properties by listing their details, including construction types and historical loss information.

-

Compiling claims information along with classification codes is vital for comprehensive coverage.

-

Provide a vehicle schedule with ownership details and past vehicle data to strengthen your application.

-

Organizing payroll information and key statistics is crucial for this aspect.

How to submit insurance and liability coverage documents?

Proper submission of insurance documentation can expedite the review process and enhance communication with your insurer.

-

Accurate and timely submissions will reduce delays in processing and approvals.

-

Typically, you can expect a review process that might take anywhere from a few days to a few weeks.

-

pdfFiller allows users to manage, edit, and submit documents in a cloud-based environment, enhancing accessibility.

What to know about navigating legal considerations?

Understanding the legal requirements surrounding insurance liability can help mitigate risks and enhance compliance.

-

It is crucial to familiarize oneself with rules and regulations that govern insurance practices.

-

Ensure that all necessary disclosures are part of your documentation to avoid potential legal issues.

-

Regular audits and consultations with legal experts can help maintain compliance.

How can interactive tools assist in managing your insurance forms?

Interactive tools make it easier to manage and collaborate on insurance forms effectively.

-

These features enhance the functionality of dealing with documentation, ensuring it is quick and straightforward.

-

Team members can work on documents simultaneously, streamlining communication and approval processes.

-

Cloud solutions like pdfFiller ensure your documents are accessible anywhere, anytime.

What are best practices for risk management?

Implementing effective risk management practices is crucial for protecting your assets and ensuring compliance.

-

Conduct thorough assessments and audits to mitigate risks effectively.

-

Reviewing historical claims can guide better decision-making and risk reduction.

-

Staying informed about best practices and regulations helps maintain effective risk management.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.