Get the free Term Sheet - Series A Preferred Stock Financing of a Company template

Show details

The Term Sheet summarizes the principal terms of the Series A Preferred Stock Financing of a Company, in consideration of the time and expense devoted, and to be devoted, by the Investors with respect

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is term sheet - series

A term sheet - series is a non-binding agreement outlining the terms and conditions of investment financing, typically used in venture capital rounds.

pdfFiller scores top ratings on review platforms

not enough experience yet

Great Way To Fill Out And File Forms. Wish there was more form's availible.

Great software

I am so happy with PdfFiller. It is so user frendly.

Was very easy to edit and sign

Was very easy to edit and sign. Thank you

Ratings

Very simple to use

Who needs term sheet - series?

Explore how professionals across industries use pdfFiller.

Understanding Term Sheets: A Comprehensive Guide

To effectively navigate a term sheet for a Series A funding round, it's essential to understand its structure and components. This guide provides valuable insights into creating and managing a term sheet, which is vital for startup founders and investors.

What is the significance of term sheets?

Term sheets serve a crucial role in the funding process, outlining the initial terms agreed upon by startups and investors. They act as a blueprint for the final investment agreement and highlight key advantages such as clarity in negotiations and alignment on key terms.

-

A term sheet provides a summary of the investment’s key components, such as valuation and funding amount, ensuring all parties understand the agreement before legal documentation.

-

For startups, term sheets clarify expectations and standards for funding. Investors use these sheets to assess risks and understand the investment's structure upfront.

How do you navigate the Series A term sheet structure?

Understanding the structure of a Series A term sheet is critical for founders entering the venture capital world. This section will break down its components and emphasize the significance of aligning these with the NVCA Model Documents, which set industry standards.

-

Components include the amount of investment, valuation, and rights granted to investors, which are vital for a well-rounded agreement.

-

Many venture capitalists use NVCA Model Documents as a baseline. Understanding how your term sheet aligns with these documents can facilitate smoother negotiations.

-

Ensuring that the terms in the sheet match those in the legally binding documents reduces confusion and potential disputes later in the process.

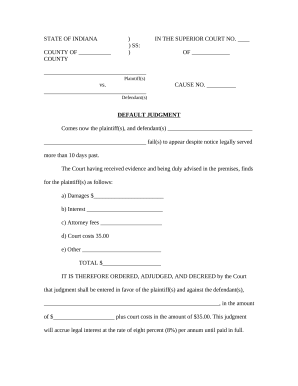

What are the essential components of a Series A term sheet?

A well-crafted term sheet contains key details that every startup and investor must understand. Essential components include company and investor information, financing terms, and specific provisions to protect both parties.

-

These details usually include names of the parties involved, their roles, and any pertinent background information that influences the terms.

-

This includes the amount being raised and the type of securities being offered, which directly affect shareholder equity.

-

Confidentiality provisions ensure sensitive information remains protected, while no-shop clauses prevent startups from seeking other offers during the negotiation period.

What key provisions should you explore in depth?

Delving into specific provisions of the term sheet is essential, especially regarding valuation models and anti-dilution clauses that can significantly impact ownership.

-

These models determine how much equity an investor receives and are influenced by the company’s perceived market value.

-

These clauses protect investors from the dilution of their ownership percentage in subsequent funding rounds.

-

This stipulates the order in which investors recover their investment in case of a liquidation event, essential for assessing risk.

How do you negotiate a term sheet effectively?

Negotiation is a critical part of the term sheet process that requires skill and strategy. Founders must understand both sides' interests and establish a balanced approach during discussions.

-

Founders should focus on building a rapport, understanding investors’ motivations, and clearly articulating their business’s value to align interests.

-

Investors are primarily concerned with securing favorable terms that protect their investment while ensuring the startup’s potential for success.

-

These include underestimating the importance of clear communication, overlooking critical legal provisions, and failing to anticipate investor concerns.

How can pdfFiller assist with Series A term sheet management?

pdfFiller is an ideal platform for managing your term sheets, offering tailored tools to simplify the document handling process.

-

With intuitive editing tools, users can easily modify term sheets and other investment documents directly within the platform.

-

Collaboration features and electronic signature capabilities streamline communication between parties, making negotiation more efficient.

-

As a cloud-based solution, pdfFiller ensures accessibility, helping users manage their documents effectively from anywhere.

What examples can illustrate key concepts?

Practical examples can clarify how to structure and negotiate term sheets effectively. Reviewing sample layouts highlights standard practices and negotiation outcomes.

-

A standardized layout serves as a guideline for budding startups, illustrating common sections and necessary details.

-

Reviewing a hypothetical scenario can provide insights into favorable terms achieved through effective negotiation tactics, helping inform real-world applications.

How can you tailor your term sheet approach for specific needs?

Tailoring your term sheet strategy to account for regional and industry-specific differences is paramount. Such adaptability can lead to more successful funding rounds.

-

Understanding regional regulatory environments can help startups align their approaches and enhance trust with potential investors.

-

Different industries may have unique requirements or norms in their term sheets, necessitating adjustments to meet those standards.

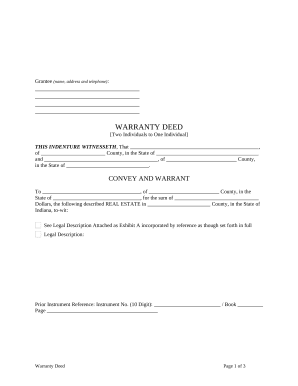

How to fill out the term sheet - series

-

1.Open the term sheet template on pdfFiller.

-

2.Begin by entering the date at the top of the sheet.

-

3.Fill out the company name and address in the designated fields.

-

4.Specify the round of financing, such as Series A, B, etc.

-

5.Clearly state the amount of investment being made.

-

6.Detail the valuation of the company and the percentage of equity offered.

-

7.Include information about any preferred stock terms if applicable.

-

8.Define conversion rights and any liquidation preferences.

-

9.Specify the rights and obligations of both investors and the startup.

-

10.Once all fields are filled accurately, review the document for any errors.

-

11.Save the completed term sheet and download it in your preferred format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.