Get the free Accredited Investor Status Certificate template

Show details

Under SEC law, a company that offers its own securities must register these investments with the SEC before it can sell them unless it meets an exception. One of those exceptions is selling unregistered

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is accredited investor status certificate

An accredited investor status certificate is a document confirming that an individual or entity meets the financial criteria set by regulatory authorities to qualify as an accredited investor.

pdfFiller scores top ratings on review platforms

It has worked great thus far. I am really satisfied with my user experience.

Its pretty busy. needs to have less things going on.

Very time consuming creating the custom form I needed and it still isn't right, but I'm making due with it. Other than that, it works perfect.

It was fast and easy to use thankyou so much

Great, Especially for do it yourself. Love it

Seems like a great program but not user friendly when trying to self-teach

Who needs accredited investor status certificate?

Explore how professionals across industries use pdfFiller.

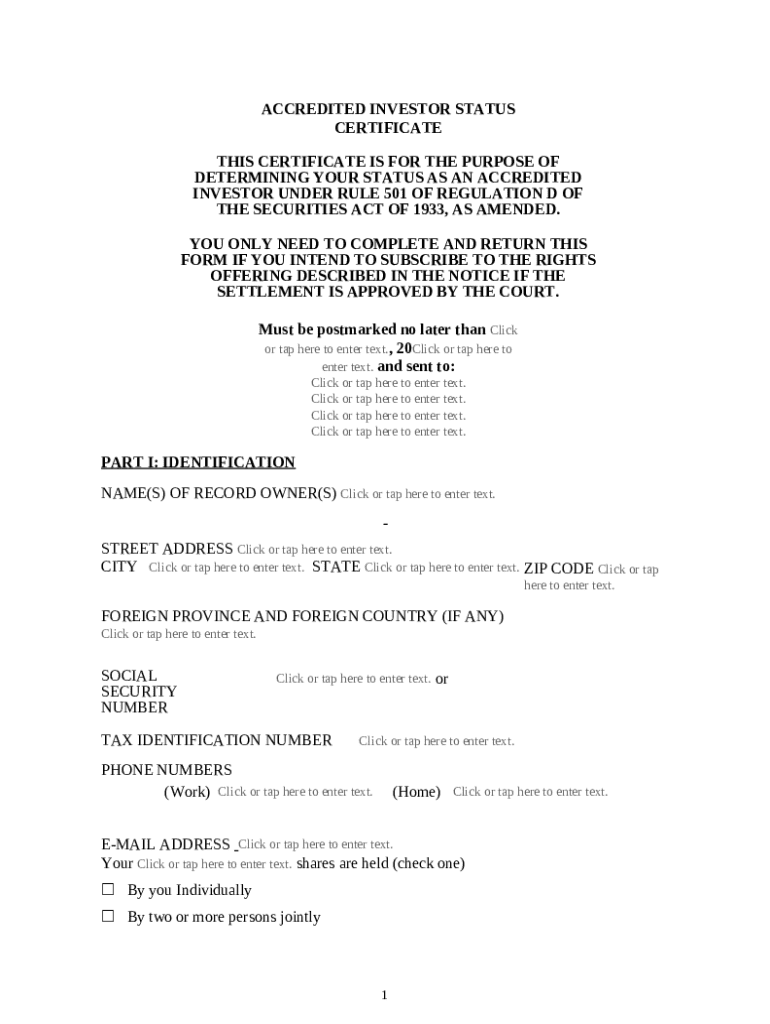

How to Fill Out the Accredited Investor Status Certificate Form

TL;DR: How to fill out a form for accredited investor status

To complete the accredited investor status certificate form, carefully gather required information such as your identification and ownership details. Follow the provided instructions to fill in accurate details regarding your investment status and submit the form to the appropriate financial institution.

What is an accredited investor?

An accredited investor is defined by the Securities Exchange Commission (SEC) as an individual or entity that meets certain financial criteria, allowing them access to investment opportunities that are not available to the average investor. This designation is crucial for participating in private placements, hedge funds, and venture capital, which often yield higher returns but also come with heightened risks.

-

An individual with a net worth over $1 million, excluding their primary residence, or an income exceeding $200,000 in each of the last two years.

-

Being accredited opens doors to exclusive investment options that are typically less regulated and potentially more lucrative.

-

Regulation D allows companies to raise capital through private placements, providing accredited investors with opportunities to invest in high-potential ventures.

What is the accredited investor status certificate form?

The Accredited Investor Status Certificate Form is a crucial document for individuals who wish to confirm their status as accredited investors. This form is typically required when you are looking to invest in private securities offerings.

-

To formally declare and verify your accredited investor status to financial institutions or companies offering private investment opportunities.

-

Individuals and entities wanting to partake in private investments, including high-net-worth individuals, family offices, and many types of trusts.

-

This form is generally required whenever you apply to invest in a private placement offering.

-

Ensure that you pay attention to specific deadlines set by the offering company for form submission, as this can affect your eligibility for investment.

How do fill out the accredited investor status certificate form?

Filling out the accredited investor status certificate requires attention to detail, especially in the identification and ownership sections. Below are the parts of the form you will encounter.

-

Provide full identification details, including your name, address, and Social Security Number or Tax Identification Number to ensure you are accurately recognized.

-

Indicate how your investment shares are held—whether individually, jointly, or through entities like trusts or corporations. This section is vital for determining how your financial credentials will be interpreted.

What information is needed to complete the Identification Information section?

-

Full legal names of all record owners.

-

Complete street address must include city, state, and ZIP code; foreign entities must add province and country.

-

This is essential for verifying your identity and accredited status.

-

Include phone numbers and email addresses for effective communication and record-keeping.

What details are necessary for Ownership Information?

-

Clarify the nature of ownership: individual, joint, trust, or corporate.

-

If shares are owned jointly, provide detailed information for all parties involved.

Where do submit my accredited investor verification?

Once the form is accurately completed, submission is the next critical step. Ensuring that it's sent to the right person or department is essential for a smooth verification process.

-

Review the requirements to submit via email or through a postal service.

-

Check the investment offering documentation or website for correct submission addresses.

-

Keep a record of your submission method and date, and consider following up to confirm receipt.

What happens after submission?

After you submit your accredited investor verification form, there will be a review process to determine your eligibility. Understanding the next steps can ease any anxiety about your application.

-

The review process may take anywhere from a few days to a few weeks depending on the institution and its workload.

-

You will receive a confirmation of your accredited status or a request for additional information.

-

Your submission may either be approved, requiring no further information, or it might necessitate additional documentation to validate your accredited status.

What are the best practices for investors?

It's essential to approach the accredited investor status certificate form with care. Adopting best practices can prevent delays and issues in your investment journey.

-

Verifying your entries can help avoid common errors that lead to delays.

-

Having a personal copy aids in tracking your submission and is useful for future reference.

-

Regulations regarding accredited investors can shift, impacting the criteria for investment; staying updated will benefit your investment decisions.

How to fill out the accredited investor status certificate

-

1.Visit pdfFiller and log in to your account.

-

2.Search for 'accredited investor status certificate' in the template library.

-

3.Select the appropriate template and click 'Fill' to edit the document.

-

4.Enter your personal information, including your name, address, and contact details.

-

5.Provide financial information, such as income, net worth, and investment experience, as required on the form.

-

6.Review the completed sections for accuracy and completeness.

-

7.If applicable, attach supporting documents that verify your accredited status, like bank statements or tax returns.

-

8.Sign the document electronically using pdfFiller's e-signature option.

-

9.Save your completed certificate and download a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.