Get the free pdffiller

Show details

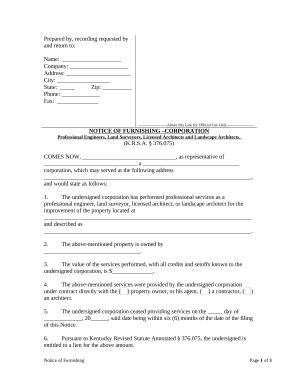

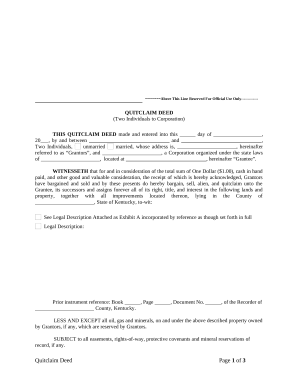

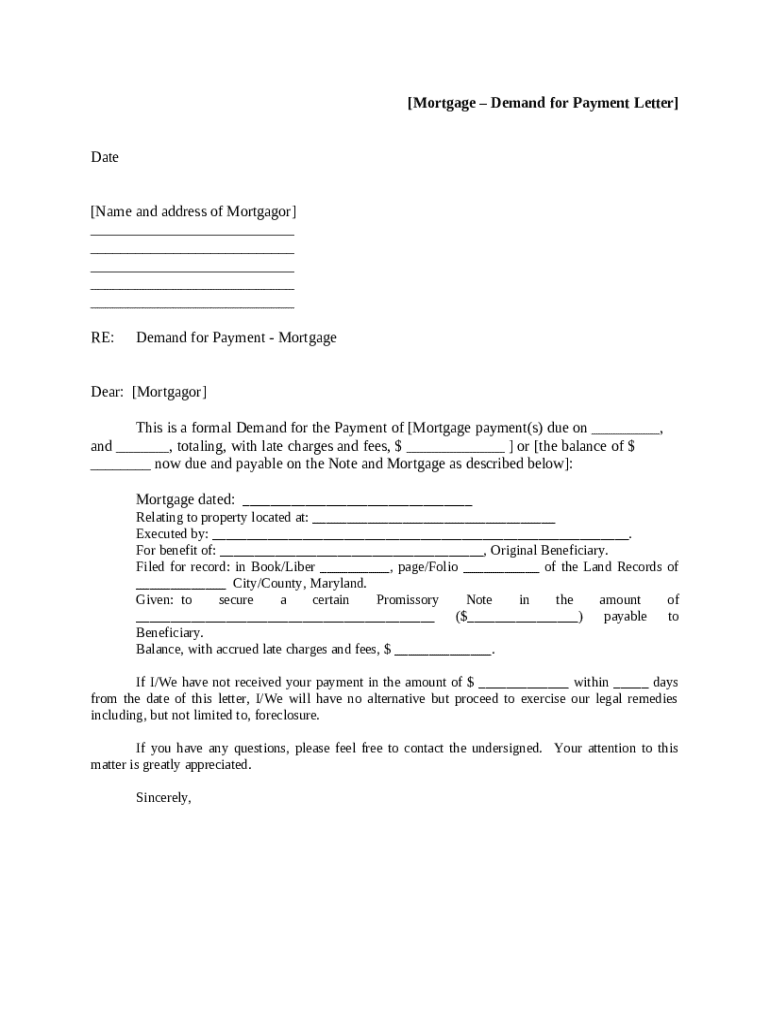

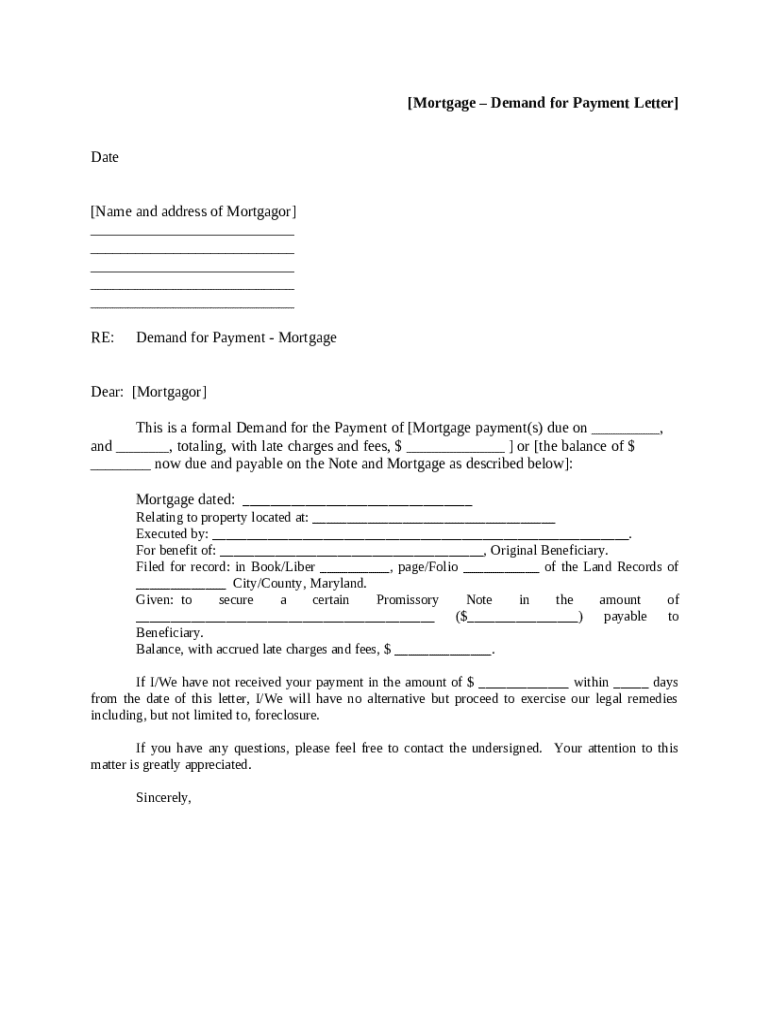

This is a sample mortgage demand letter. It is basically a letter demanding payment of the mortgage in full or all delinquent payments in full.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is mortgage demand letter

A mortgage demand letter is a formal request from a lender to a borrower, demanding the full repayment of a loan secured by real property due to default or specific terms of the mortgage agreement.

pdfFiller scores top ratings on review platforms

Simple, easy to use, easy to manipulate,

even for a novice.

It was my first time uploading forms. It was pretty easy. I think the more I use it the better.

I have tried many different PDF fillable forms... this one, BY FAR, is the easiest to use and I LOVE IT!

Very user friendly and looks like a very good lease form

Easy! But it's not free to use just to fill!

Really love the ease of filling out electronic forms with your website! What a difference it makes!

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Mortgage Demand Letter Form

How to fill out a mortgage demand letter form

Filling out a mortgage demand letter form is essential for homeowners needing to formally request outstanding payments. This structured document serves as a notification to the borrower about overdue payments. By understanding its components and the proper way to fill it out, you can ensure effective communication and compliance with legal requirements.

What is a mortgage demand letter?

A mortgage demand letter is a formal document that communicates to the borrower that their mortgage payment is overdue. It serves the purpose of requesting payment of the outstanding debt and outlines the necessary actions to be taken if payment is not forthcoming. These letters are crucial in maintaining transparency in financial agreements and providing clear expectations.

-

A mortgage demand letter communicates overdue payments and requests immediate action.

-

These letters are often required when payments are late or if there is a default situation.

-

Understanding the legal ramifications can help borrowers avoid financial penalties or foreclosure.

What are the key components of a mortgage demand letter?

A clear and effective mortgage demand letter should include essential details that help identify the borrower, the loan, and the amount overdue. Each section of the letter must adhere to a specific format to ensure clarity and legality.

-

Include the date, mortgagor's information, and specifics about the property in question.

-

The RE line should state the reason for the letter, while the payment demands clarify the exact balance owed.

-

It's important to use legally recognized terms to avoid misunderstandings.

How do you complete a mortgage demand letter?

Completing a mortgage demand letter involves several steps that can be easily managed through streamlined guidance. Following a clear step-by-step approach helps ensure that all necessary details are captured correctly.

-

Begin with the correct format, filling out each section methodically.

-

Use straightforward language while ensuring that the document maintains a formal tone.

-

Utilize pdfFiller for efficient editing, which allows customization and easy management of your document.

How can you edit your mortgage demand letter?

Editing a mortgage demand letter may be necessary to adjust payment amounts or to tailor the contents according to specific local regulations. With tools like pdfFiller, users can adapt their letters to meet these needs effectively.

-

Use pdfFiller to make modifications to existing documents easily.

-

If the payment terms change or if part of the debt has been cleared, update the letter as needed.

-

Ensure that the letter complies with local state laws and regulations to avoid any issues.

What are the steps to eSign and send your mortgage demand letter?

Modern technology offers various options for electronic signatures, which are becoming increasingly recognized as valid in legal contexts. Understanding how to eSign and send your letter can streamline the process.

-

pdfFiller provides secure eSigning capabilities to meet legal standards.

-

Follow up upon sending to ensure delivery and receipt are confirmed.

-

Recognize that eSigned documents are generally valid unless otherwise specified in the agreement.

How do you manage responses to your mortgage demand letter?

Responding effectively to replies received from your mortgage demand letter can make a significant difference in outcome. Knowing what to expect allows you to prepare for potential next steps.

-

Payment arrangements or discussions for resolution may follow the issuance of the letter.

-

Consider further legal action or alternative negotiation methods if responses are lacking.

-

Be prepared to explore options for foreclosure or additional avenues of recourse if necessary.

How to fill out the pdffiller template

-

1.Open your PDF filler application and start a new document creation.

-

2.Select the template for a mortgage demand letter from the provided options.

-

3.In the first section, enter the date when the letter is being sent.

-

4.Fill in the name and address of the borrower as the recipient of the letter.

-

5.In the subsequent section, clearly state the amount owed along with any relevant payment deadlines.

-

6.Include a detailed description of the loan agreement, referencing the mortgage number and property address.

-

7.State the consequences of failing to pay the amount due within the specified time frame.

-

8.Proofread the letter to ensure all information is correct and clear.

-

9.Save the completed document, and prepare to send it via regular mail or email to the borrower.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.