Get the free Real Estate Loan Assumption Addendum template

Show details

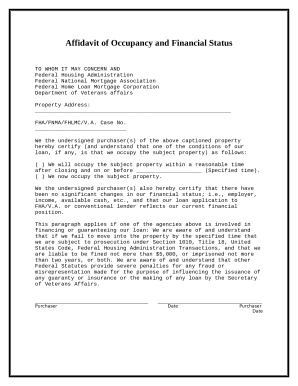

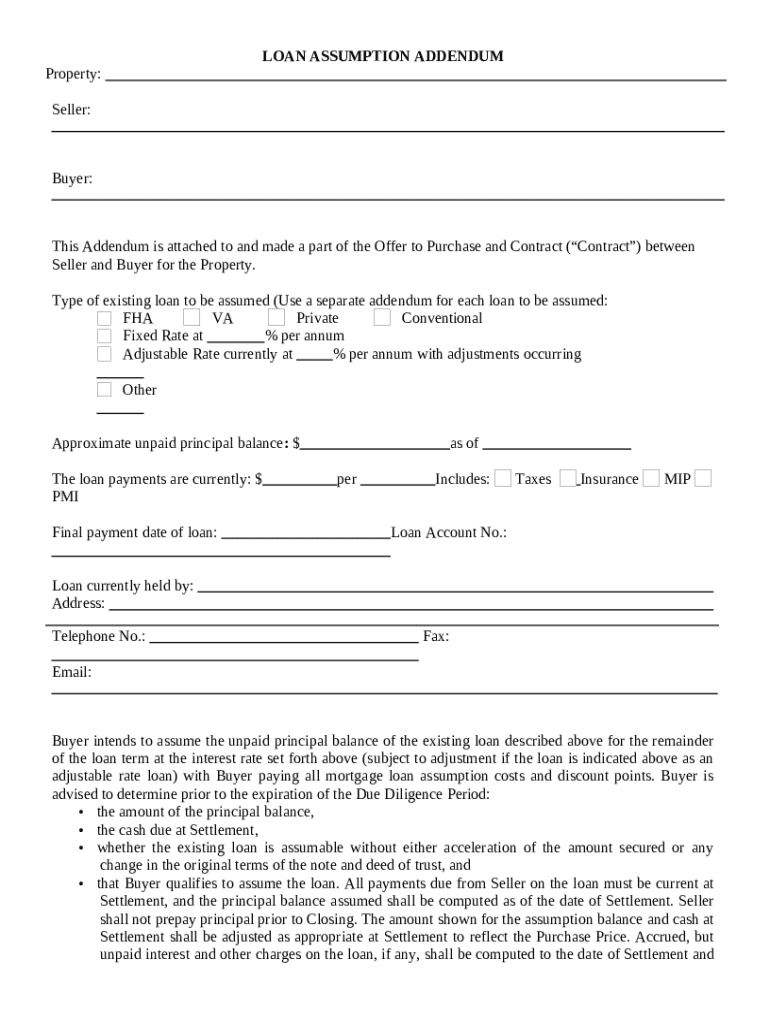

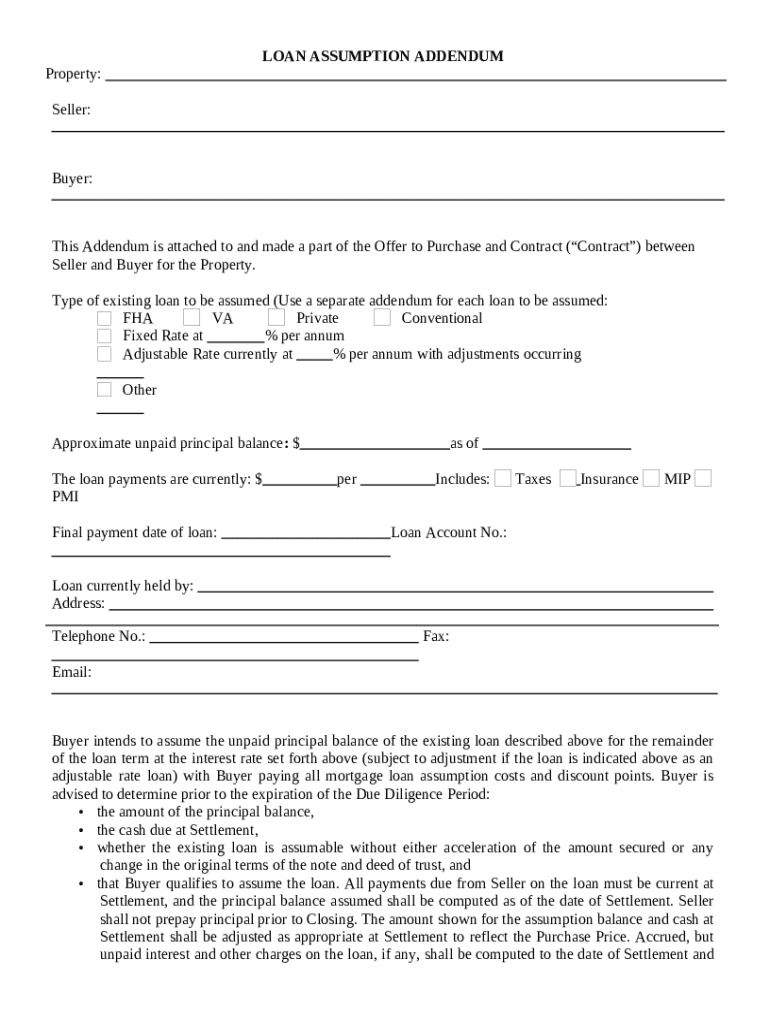

This is a sample Loan Assumption Addendum. This Addendum is attached to and made a part of the Offer to Purchase and Contract (“Contract”) between Seller and Buyer for the. Property. The form

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is real estate loan assumption

A real estate loan assumption is a financial arrangement where a buyer takes over the remaining mortgage obligations of the seller on a property purchase.

pdfFiller scores top ratings on review platforms

pdf is the best i've paid for in so long

I love the features! Thanks PDF Filler!

It was easy to use and worked very well.

very easy great program user friendly

Very easy to use

able to send medical release forms…

able to send medical release forms right away

Who needs real estate loan assumption?

Explore how professionals across industries use pdfFiller.

How to fill out a real estate loan assumption form

Filling out a real estate loan assumption form is essential when a buyer intends to take over a seller's existing mortgage. This guide delves into the key aspects of loan assumptions, including processes, components of the necessary forms, and considerations during the due diligence period.

What is loan assumption?

A loan assumption in real estate refers to the process whereby a buyer takes over the seller's existing mortgage obligations. This approach can be beneficial for buyers, as it may result in lower interest rates and favorable loan terms compared to applying for a new mortgage.

-

Benefits of assuming a loan include potentially lower interest rates and reduced closing costs.

-

Common loan types that can be assumed are FHA, VA, and Conventional loans.

-

Assuming a loan usually simplifies the buying process for both parties.

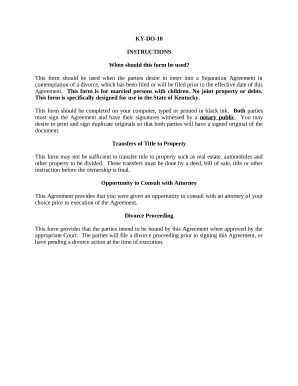

What are the key components of the loan assumption addendum?

The loan assumption addendum is a vital document representing the agreement between the buyer and seller regarding the loan transfer. It outlines both parties' responsibilities and clarifies the loan type.

-

Details of the seller and buyer, including names and property descriptions.

-

Specifications of the loan type, distinguishing between fixed-rate and adjustable-rate mortgages.

-

Full disclosure of the unpaid principal balance, loan account details, and responsibilities at the time of settlement.

How do you fill out the loan assumption addendum?

Completing the loan assumption addendum requires careful attention to detail to ensure all necessary information is accurately provided. Begin by gathering all pertinent property and loan details.

-

Identify the property details that pertain to both the seller and buyer.

-

Select the applicable loan type (e.g., FHA or VA) and carefully complete each relevant section.

-

Clearly specify the current loan balance, payment terms, and outline any obligations for the seller at settlement.

What to consider during the due diligence period?

The due diligence period is crucial for ensuring that both parties understand the terms and conditions associated with the loan assumption. By adhering to the original loan terms, buyers can confirm their eligibility.

-

Define the specific terms and timelines associated with the due diligence.

-

Ensure that the buyer is eligible to assume the loan without any changes to the original terms.

-

Consider critical factors such as the total principal balance, cash at settlement, and the buyer's qualifications for loan assumption.

What costs are associated with loan assumption?

When assuming a loan, buyers should be aware of the potential costs involved. This includes various fees that can be part of the assumption process.

-

Common costs for buyers can include closing costs, loan assumption fees, and possible inspection costs.

-

Discount points and other financial obligations should be anticipated as part of the overall costs.

-

It's essential to discuss the implications of unpaid interest and any adjustments that may need to be made at the time of settlement.

How to manage your PDF loan assumption form with pdfFiller?

Managing your loan assumption addendum can be made easier with pdfFiller, a cloud-based platform that streamlines the editing and signing process of your real estate loan assumption form.

-

Use pdfFiller to create, edit, and customize your loan assumption addendum with ease.

-

Utilize e-signature features for a simplified agreement process between buyers and sellers.

-

Leverage the collaboration tools on pdfFiller for efficient communication between all parties involved.

In conclusion, understanding how to fill out a real estate loan assumption form is critical for both buyers and sellers in a transaction. Utilizing tools like pdfFiller can greatly facilitate the management of these documents, ensuring a smooth transition of loan obligations.

How to fill out the real estate loan assumption

-

1.Obtain the original loan documents and check if the mortgage is assumable.

-

2.Gather personal and financial information necessary for the lender's review.

-

3.Contact the current lender to discuss the assumption process and request a loan assumption application form.

-

4.Fill out the loan assumption application with accurate personal and financial details.

-

5.Attach any required supporting documents such as proof of income, credit information, and identification.

-

6.Submit the completed application and documents to the lender for approval.

-

7.Wait for the lender to assess your application and notify you of approval or additional requirements.

-

8.If approved, review the terms of the loan assumption agreement carefully before signing.

-

9.Complete and return the signed loan assumption agreement to the lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.