Get the free Loan Assumption Addendum template

Show details

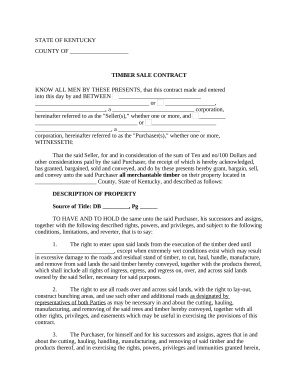

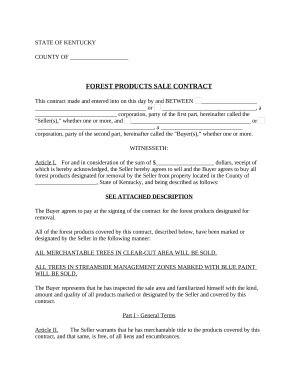

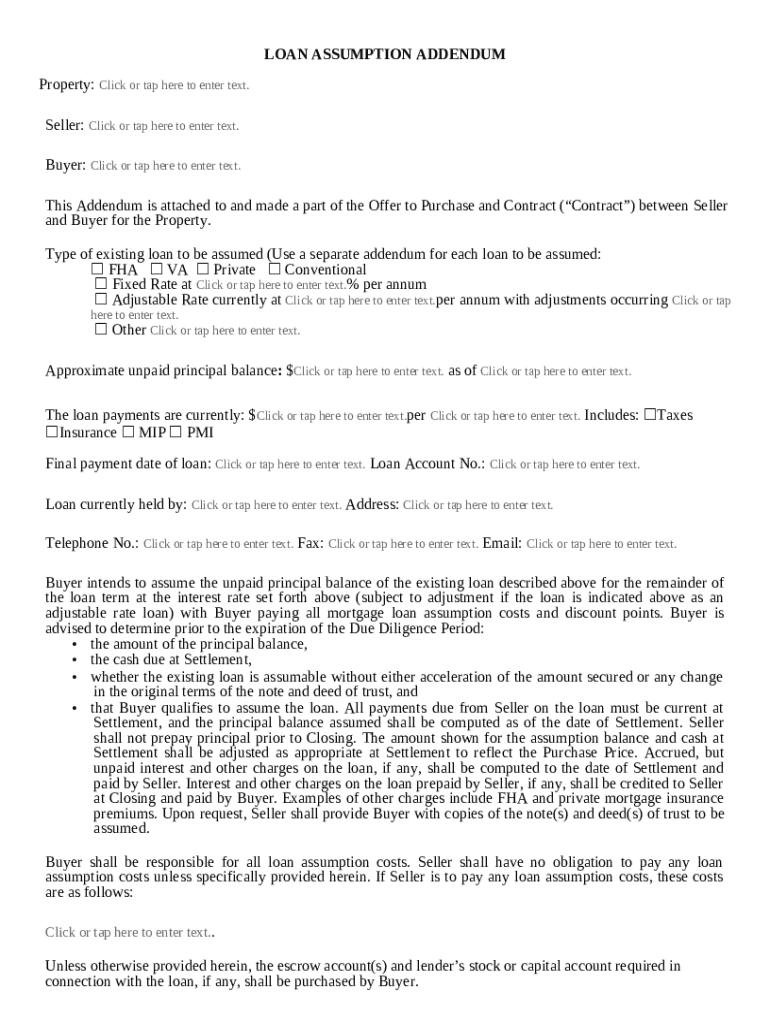

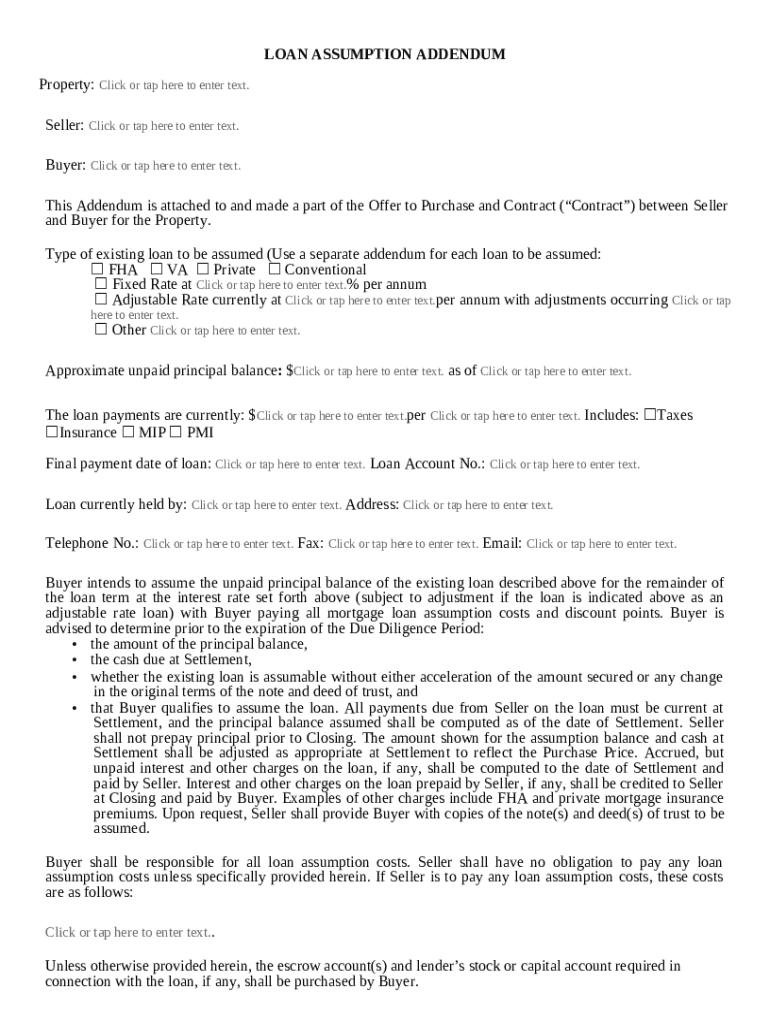

This is a sample Loan Assumption Addendum. This Addendum is attached to and made a part of the Offer to Purchase and Contract (“Contract”) between Seller and Buyer for the. Property. The form

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan assumption addendum

A loan assumption addendum is a legal document that allows a buyer to take over the seller's mortgage under its existing terms.

pdfFiller scores top ratings on review platforms

Its very helpful most especially in undertaking my documentary works in pdf form.

What do you like best?

Any pdf is editable

Integrates well with Google

Easy to use

A great platform for document signing

What do you dislike?

More font options should be available

Pricing can be high

Docusign still signs documents better

What problems are you solving with the product? What benefits have you realized?

Easy to have multiple people sign forms

Manages workflows flawlessly

Great app love how easy it is to use i…

Great app love how easy it is to use i love it

Saving A File After Editing It As Another File

The assistant was very attentive to what my needs were and helped me resolve the problem very easily.

i love it!!

i love it!!! its a great thing

great

Great program for PDF

Who needs loan assumption addendum template?

Explore how professionals across industries use pdfFiller.

How to fill out a loan assumption addendum form

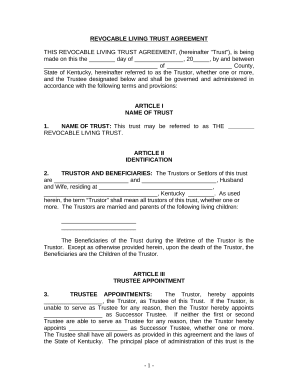

Understanding the Loan Assumption Addendum

A loan assumption addendum is a legal document that allows a buyer to take over the existing mortgage obligation from the seller. This form is typically used in real estate transactions where the buyer wishes to assume the current financing terms, rather than securing a new loan. This can benefit both parties, particularly in situations where interest rates have risen since the original loan was secured.

-

The addendum clarifies the terms under which the buyer assumes the mortgage, ensuring all parties understand their responsibilities.

-

Buyers may benefit from favorable terms, while sellers can sell your property quicker; this form can streamline the transaction.

-

Such an addendum is often required when the original loan allows assumption, making it essential for the transaction.

Essential components of the loan assumption addendum

A thoroughly filled-out loan assumption addendum covers critical information that delineates the responsibilities of the involved parties. Accurate details are vital for ensuring compliance with lender requirements.

-

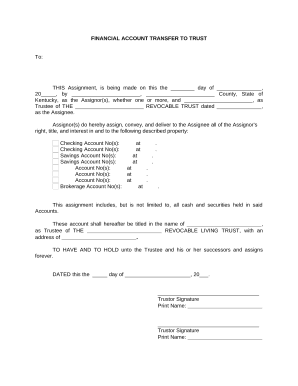

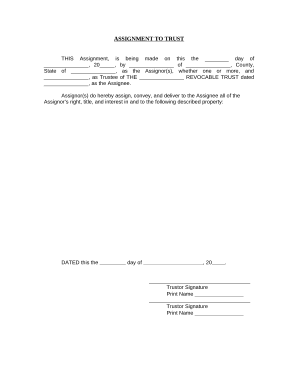

Clear identification of the property and the seller's details helps verify ownership and real estate specifics.

-

Buyers must be informed of their obligations, including maintaining payments and handling taxes.

-

The addendum should state the loan type, interest rate, and payment terms, which are essential for the buyer’s financial planning.

-

Listing the unpaid balance provides transparency and helps manage buyer expectations.

-

Buyers should assess the mortgage terms thoroughly, ensuring they understand their financial commitments.

How to fill out the loan assumption addendum on pdfFiller

Completing this form on pdfFiller makes the process easier with its user-friendly interface and interactive features. By following the step-by-step instructions provided, you can ensure the document meets legal requirements.

-

Follow detailed prompts to input the necessary data without overlooking key details.

-

Use pdfFiller’s tools to edit and fill the form conveniently, saving time and effort.

-

Always double-check your entries to ensure accuracy and compliance before submission.

Common scenarios for using the loan assumption addendum

Loan assumptions can be especially beneficial in various scenarios, allowing buyers to take advantage of lower interest rates or favorable loan terms.

-

In high-interest environments, assuming a loan can be far more affordable for buyers than securing new financing.

-

If multiple mortgages are involved, separate addendums may be necessary for clarity and management.

-

Different states have varying regulations regarding loan assumptions that must be understood and adhered to.

Completing the loan assumption process

Navigating the loan assumption involves coordinated efforts with lenders and a clear understanding of the submission process. Knowing what to expect next minimizes confusion.

-

Lenders play a crucial role in approving loan assumption requests and ensuring compliance with original loan terms.

-

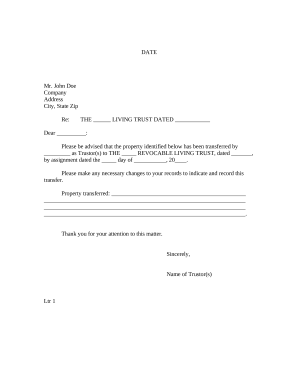

Ensure that all completed forms are correctly submitted to the lender for review.

-

After receiving approval, stay in contact with your lender for any final documentations required.

Tools and resources on pdfFiller for loan assumption addendums

pdfFiller offers valuable resources that simplify the management of loan assumption documents. Users can easily eSign and share forms, fostering collaboration.

-

Securely eSign documents directly on the platform while also enabling easy sharing with other parties.

-

Facilitate team efforts by managing documents collectively in a single secure space.

-

Access various relevant templates that help streamline your document preparation.

Understanding the risks and considerations

While assuming a loan can provide benefits, it’s crucial to understand the associated risks. Due diligence will protect your interests.

-

Buyers should be cautious of hidden costs or contingencies that can affect their financial situation.

-

Conduct thorough research to avoid unexpected complications during and after the assumption process.

-

Familiarize yourself with state regulations to ensure adherence to all legal requirements when assuming a loan.

How to fill out the loan assumption addendum template

-

1.Open the loan assumption addendum form on pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the full name and address of the seller who is transferring the loan.

-

4.Provide the buyer’s details, including full name and address, who will be assuming the loan.

-

5.Input the loan account number and current balance of the mortgage being assumed.

-

6.Clarify any additional terms or conditions of the loan assumption, if applicable.

-

7.Ensure both parties sign and date the document in the required areas.

-

8.Review the completed document for accuracy and completeness.

-

9.Save and download the finalized loan assumption addendum.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.