Get the free Close Account Letter by Consumer template

Show details

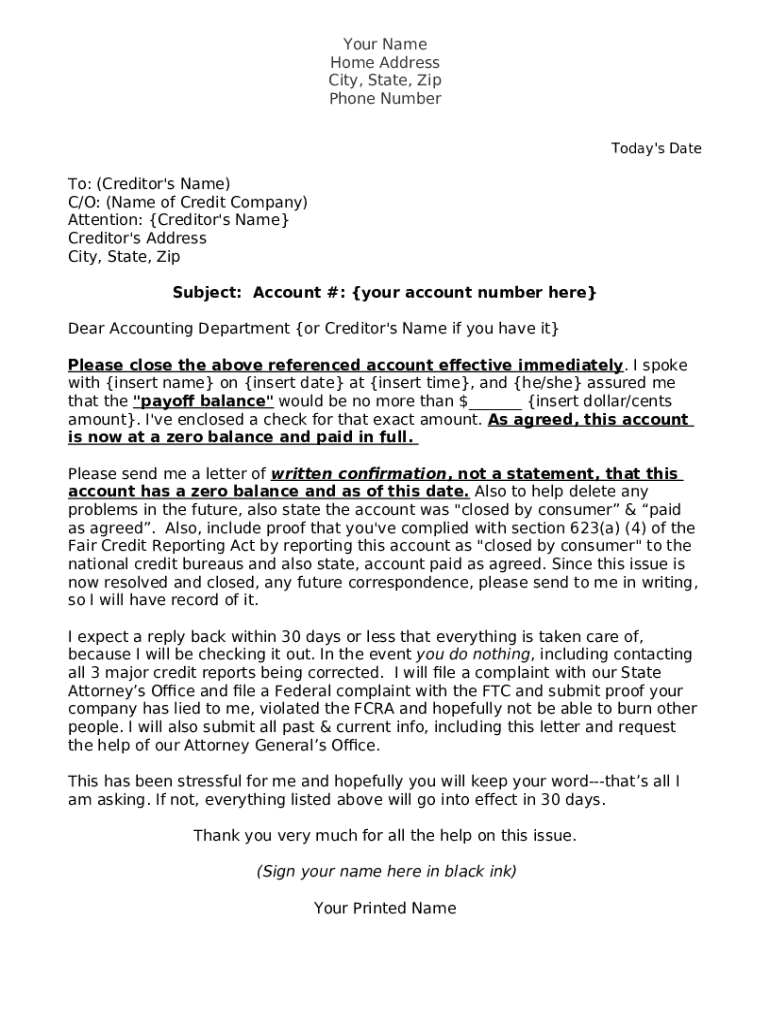

Close Account Letter by Consumer

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is close account letter by

A close account letter by is a formal request to a financial institution or service provider to terminate an account.

pdfFiller scores top ratings on review platforms

The program very intelligently interprets PDF images, creating fields in just the right spot for us to type our responses in, while avoiding the print-write-scan-save cycle.

Needed this in a pinch and it worked so well I subscribed.

i love this platform it is user friendly. Ideal for editing, signing and amending pdf docs. This service has been so useful and i would definitely recommend it

Excellent for filling forms for credetialing and licensing as a physician

Quick, Fast, a little confusing for where to find icons

I ove pdf filler ,easy to use, send or save options,there's even sending option by usps haven't tried it yet but overall very good application.

Who needs close account letter by?

Explore how professionals across industries use pdfFiller.

How to Close an Account Letter by Form

How do you understand the need for a closure letter?

Closing an account with a bank or credit provider can seem daunting, but it's essential to understand why a formal closure letter is necessary. Reasons may include wanting to avoid fees, dissatisfaction with services, or simply no longer needing the account. Failing to send a closure letter can lead to ongoing fees or negative impacts on your credit report. Documenting the closure helps ensure that both you and the institution have a clear understanding of the transaction.

-

Identify if the closure is due to bank fees, poor service, or closure of financial needs.

-

Not sending a closure letter can lead to continued billing or impacts on credit history.

-

A formal letter serves as proof of your request should issues arise later.

What are the key elements of a closure letter?

A well-structured closure letter contains essential information that facilitates a smooth account termination. Each element plays a vital role in verifying your identity and intent to close the account. It's important to provide accurate details to avoid any confusion that could prolong the process or lead to miscommunication.

-

Ensure the letter is dated and addressed to the correct department.

-

Provide your account number and any required forms of ID for verification.

-

Include a clear and polite request to close the account.

-

Mention any remaining balance and any enclosed checks if applicable.

-

Ask for written confirmation of the closure for your records.

What is the step-by-step guide to writing your account closure letter?

Drafting an effective account closure letter involves several key steps, each crucial for successful communication with your financial institution. Begin with the essentials, such as date and addressee, before clearly stating your intention to close the account. Including past communications with representatives reinforces your position and adds context to your request.

-

Start with the date and the addressee for clarity.

-

Clearly specify the desired closure date of your account.

-

Mention relevant conversations with bank representatives that pertain to the closure.

-

List any amounts enclosed along with the request and state the current account balance.

-

Ask the bank to confirm receipt of your request and ensure compliance with credit reporting laws.

-

Outline your plan for follow-ups and response timelines.

Can you provide a closure letter template and example?

Having a template or example at hand can simplify the process of closing your account. Such tools not only save you time but also guide you through the necessary format and language required. Consider personalizing these templates to reflect your situation accurately.

-

Utilize an editable PDF template to streamline your customization process.

-

Provide a completed sample for easy reference and understanding of structure.

-

Mark areas in the template that need your specific information.

How should you submit your closure letter?

The method you choose to submit your closure letter can significantly impact its receipt and processing time. Options include email or physical mail, each with its own advantages. Tracking delivery is essential, as you may need proof of submission.

-

Evaluate whether email or hard copy is more suitable based on bank preferences.

-

Employ registered mail or email receipt notifications to track document delivery.

-

Maintain a documented history of your communications with the bank for reference.

What to do if your closure request is ignored?

In cases where your closure request goes unanswered, it's crucial to take further action. First, set a reasonable timeframe for a follow-up. If you still receive no response, you may wish to escalate the situation by filing complaints with appropriate regulatory bodies.

-

Determine an appropriate duration to await confirmation before taking action.

-

Reach out to consumer protection agencies such as the FTC if problems persist.

-

Ensure you protect your consumer rights if the bank fails to comply.

How can pdfFiller assist in managing your closure letter?

pdfFiller provides a robust solution for managing all aspects of your closure letter process. Its suite of tools allows you to edit, eSign, and store documents securely in one easy-to-access platform. This provides both ease of use and legitimacy to your correspondence.

-

Utilize pdfFiller to customize your closure letter rapidly and effectively.

-

Incorporate eSignatures to add a professional touch to your documents.

-

Store all related files on a cloud platform for convenient access.

What tips can enhance your account closure process?

Successful account closure goes beyond merely submitting a letter; it involves ongoing monitoring and record-keeping. Stay attentive to any changes in your credit report and maintain organized records for future reference. Being aware of their timelines also helps preempt potential delays.

-

Keep an eye on your credit report after the account is closed to catch any unexpected effects.

-

Store all documentation related to the closure for easy future retrieval.

-

Be informed about potential delays in processing to avoid unnecessary concerns.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.