Last updated on Feb 17, 2026

Get the free Statement to Add to Credit Report template

Show details

Statement to Add to Credit Report

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is statement to add to

A statement to add to is a formal document used to provide additional information or context regarding a particular issue or claim.

pdfFiller scores top ratings on review platforms

organization

I wish the updates had an option to keep the title and not make duplicates. I like to keep "my documents" organized and not all the downloads unless I want to save it as multiple copies. I love that it combines pdfs w other docs. I love the highlight and annotate features.

One of the best PDF editors I ever used, I am encouraging others to use it.

Easy and afordable price

Useful for filling out applications.

Its been so useful for applications that I'd otherwise have to write by hand. I have arthritis and writing information in tiny spaces is painful and there's never enough room for the answer. This has solved this problem.

so far so good

Very easy ,and fast , recomend . Im will to buynow

Who needs statement to add to?

Explore how professionals across industries use pdfFiller.

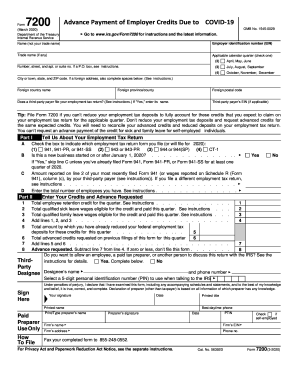

How to Add a Statement to Your Credit Report

When you need to add a statement to your credit report, it's essential to understand your rights and the process involved. This guide will walk you through the steps necessary to submit a statement effectively, ensuring your voice is heard.

Understanding your rights under the Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law that safeguards consumer information and ensures fair reporting practices. Under the FCRA, you have the right to dispute inaccuracies in your credit report. Knowing which sections of the FCRA apply to your situation will help you navigate the process of adding a statement effectively.

-

The FCRA was enacted to promote accuracy, fairness, and privacy of consumer information held by credit reporting agencies.

-

Notify creditors of discrepancies; they are obligated to investigate your claims.

-

Section 609 allows you to request a statement to be included to provide additional context to your credit history.

Preparing to write your statement

Preparation is key when crafting your statement. Gathering the necessary documentation and information regarding the disputed items will give you a solid foundation. Consider which creditor and account details are crucial to include, as well as how to condense your message into a clear and concise statement.

-

Compile any relevant correspondence or evidence regarding disputed items to support your position.

-

Clearly identify the creditor, account number, and specific reporting details you are addressing.

-

Your statement should be direct, limited to 100 words to maintain clarity and focus.

Step-by-step guide to creating your statement

Writing your statement involves several structured steps. It’s important to draft your statement methodically to ensure it meets all necessary guidelines, enhancing the chances of successful inclusion in your credit report.

-

Always include the current date at the top of your statement.

-

Include the recipient's details, including the organization name and address for completeness.

-

Start your letter with an appropriate salutation, like 'To Whom It May Concern' or a specific name if known.

-

Clearly label your communication with 'ADD STATEMENT TO CREDIT REPORT'.

-

Draft a concise paragraph explaining your dispute—focus on clarity and brevity.

-

Conclude with a request for an updated credit report within 30 days to ensure follow-up.

Navigating the submission process

After drafting your statement, the next step involves submitting it to the relevant credit reporting agencies. Understanding the submission options and ensuring you include all necessary documentation will simplify this process.

-

You can submit your statement via mail or through online options provided by the credit reporting agencies.

-

Ensure your submission contains the signed statement, along with your identification to verify your identity.

-

Keep a record of your submission method in order to follow up on the status of your request.

Ensuring compliance and follow-up

Following your submission, it's essential to know what to expect in terms of response times and follow-up actions. Understanding your options if your statement isn't added will help you stay proactive.

-

Credit reporting agencies are required to respond to updates within 30 days.

-

If your statement is not added, follow up with the agency or consult a consumer protection attorney.

-

Request clarification and possibly file a complaint with the Consumer Financial Protection Bureau.

Interactive tools for managing your credit

Utilizing tools such as pdfFiller can simplify the process of editing and formatting your statement. This platform allows you to create, collaborate, and manage documents securely, enhancing your submission experience.

-

pdfFiller offers intuitive PDF editing features that streamline the crafting of your statement.

-

This ensures secure submissions by allowing you to easily sign and share documents with others.

-

Track the status of submissions and manage any revisions, making the entire process efficient.

How to fill out the statement to add to

-

1.Open the PDFfiller website and log into your account or create a new one if you haven't already.

-

2.Once logged in, upload the document for which you need to add a statement by clicking on the 'Upload' button.

-

3.Navigate to the area of the document where you need to insert the statement by scrolling or using the search function.

-

4.Select the 'Text' tool from the toolbar, usually located on the left side of the screen.

-

5.Click on the location in the document where you want to place the statement and start typing your additional information.

-

6.Format the text as needed using available formatting options, which may include font size, style, and alignment.

-

7.Once you're satisfied with your statement, review the document for accuracy and clarity.

-

8.Save your changes by clicking on the 'Save' button, and then download the edited document or send it directly from PDFfiller if required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.