Get the free Gift Deed of Mineral Interest with No Warranty template

Show details

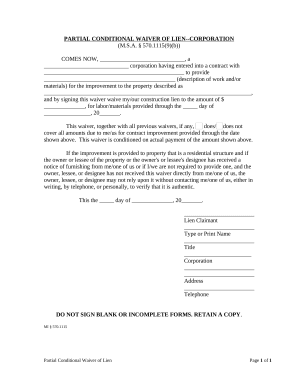

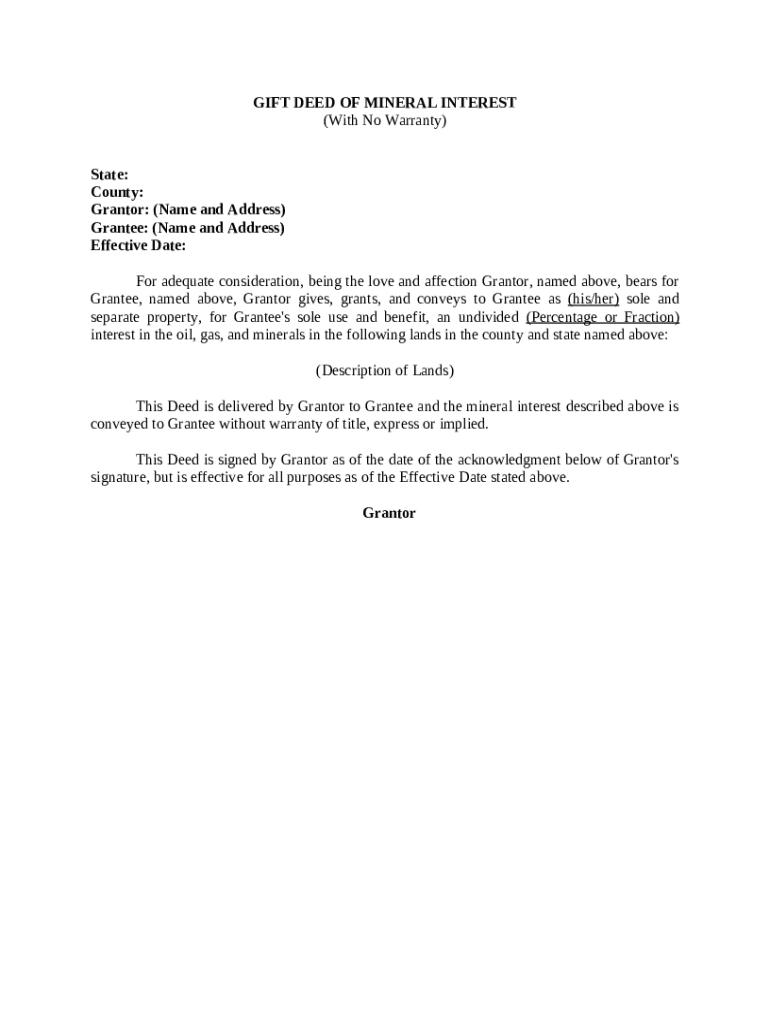

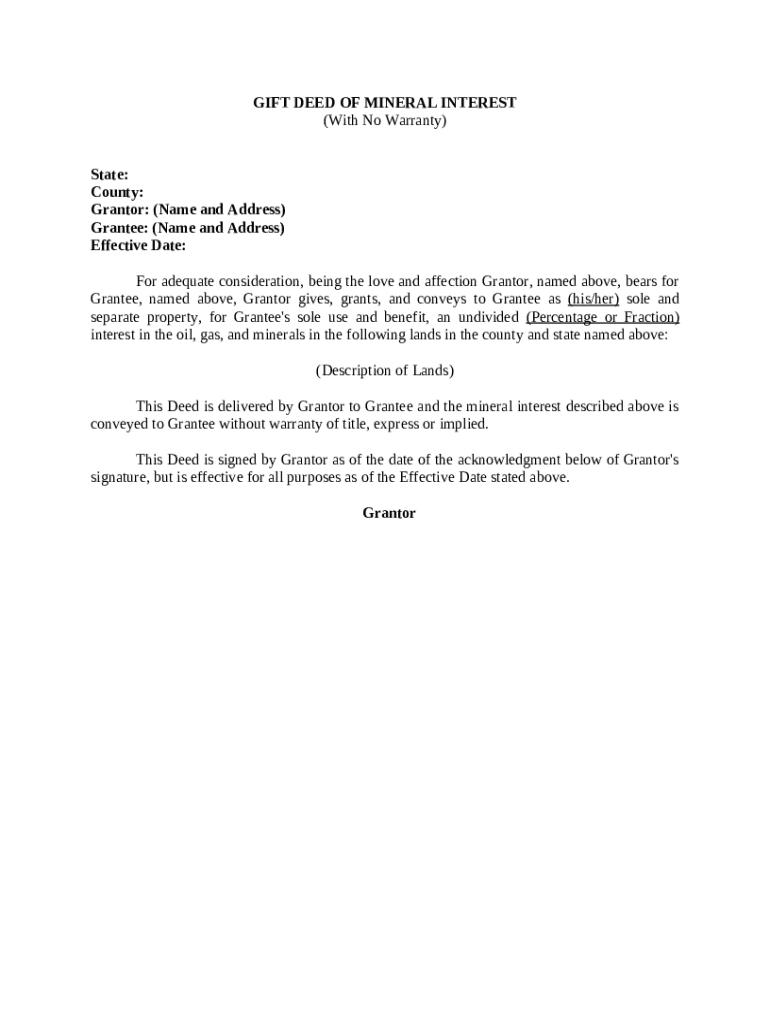

This form of deed conveys an interest in minerals, as a gift. In States, such as Texas, recognizing community property, a gift deed creates separate property in the grantee.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is gift deed of mineral

A gift deed of mineral is a legal document that transfers ownership of mineral rights from one party to another as a gift without any exchange of money.

pdfFiller scores top ratings on review platforms

wish I'd known how to do this earlier, It was so easy and this was my first time

this worked well for what I needed to accomplish.

Love the editing. But saving is PIA at times when using the watermarks. A lot of extra steps. Also would be nice to have a compression function.

I love this and it really helps me in every aspect. Customer service is above and beyond there services

It seems like a long process but maybe it won't after I've had time to play!!!

this apps is just great, is an real good tool

Who needs gift deed of mineral?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Gift Deed of Mineral Interest

What is a gift deed of mineral interest?

A gift deed of mineral interest is a legal document that allows an individual to transfer ownership of mineral rights without compensation. Mineral rights refer to the rights to extract and manage the minerals beneath the surface of a property. Understanding these rights is essential for property ownership and involves various legal implications, especially when a 'No Warranty' clause is involved.

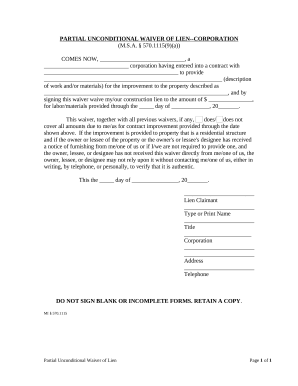

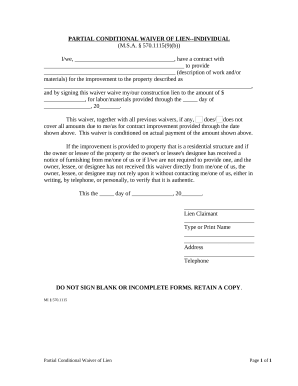

What are the key components of a gift deed?

-

Every jurisdiction has specific regulations regarding the creation and filing of gift deeds.

-

Full names and addresses of both the person giving and receiving the gift must be included.

-

The effective date is critical as it marks when the ownership transition occurs. This helps avoid disputes regarding when the gifts take effect.

-

It's necessary to precisely define the lands where the mineral rights apply to avoid any ambiguity.

How do complete my gift deed?

-

Gather all personal details of both parties, including names, addresses, and the specific mineral rights you intend to gift.

-

Accurately complete all required fields in the form, ensuring clarity and correctness to avoid future complications.

-

Both parties must examine the document for any mistakes and then sign it, preferably in the presence of a notary.

-

Depending on local laws, you might need to file the deed to officially record the transfer. Check with your county office for specific requirements.

What are the legal considerations and next steps after executing a gift deed?

After executing a gift deed, it's vital to understand its legal effects, which include potential changes in property tax obligations. Additionally, there may be tax implications for the Grantor, including discussing any taxes that could arise from such transfers, which can vary by jurisdiction. Keep thorough records of the transaction, as these documents serve important purposes for future reference.

How can get support for further assistance?

-

pdfFiller offers user-friendly access to customer support for any queries regarding the gift deed process.

-

There are numerous resources available on pdfFiller aimed at assisting with legal document preparation and understanding your rights of mineral interests.

-

For complex issues related to mineral rights, engaging with experts can ensure you navigate the legal landscape effectively.

How to fill out the gift deed of mineral

-

1.Open your PDF filler and upload the gift deed of mineral template.

-

2.Begin by entering the date of the deed at the top of the document.

-

3.Provide the full legal names and addresses of both the donor (the person giving the gift) and the donee (the person receiving the gift).

-

4.Clearly describe the mineral rights being transferred, including the specific location of the property and the types of minerals involved.

-

5.Add any specific terms or conditions regarding the transfer, if applicable.

-

6.Ensure the legal description of the property meets local requirements by verifying with local property records or legal advice.

-

7.Sign and date the document where indicated, ensuring signatures are gathered from both parties in the appropriate places.

-

8.Consider having the deed notarized to add an extra layer of authenticity and legality.

-

9.Save the completed document on your device and consider providing copies to all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.