Get the free pdffiller

Show details

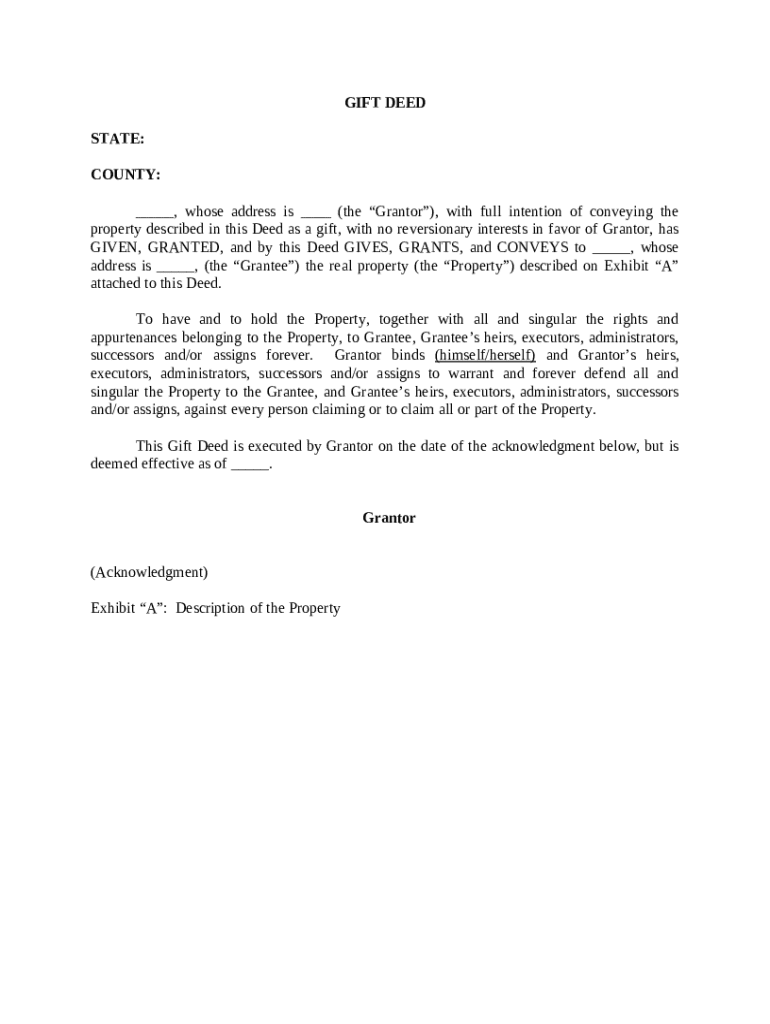

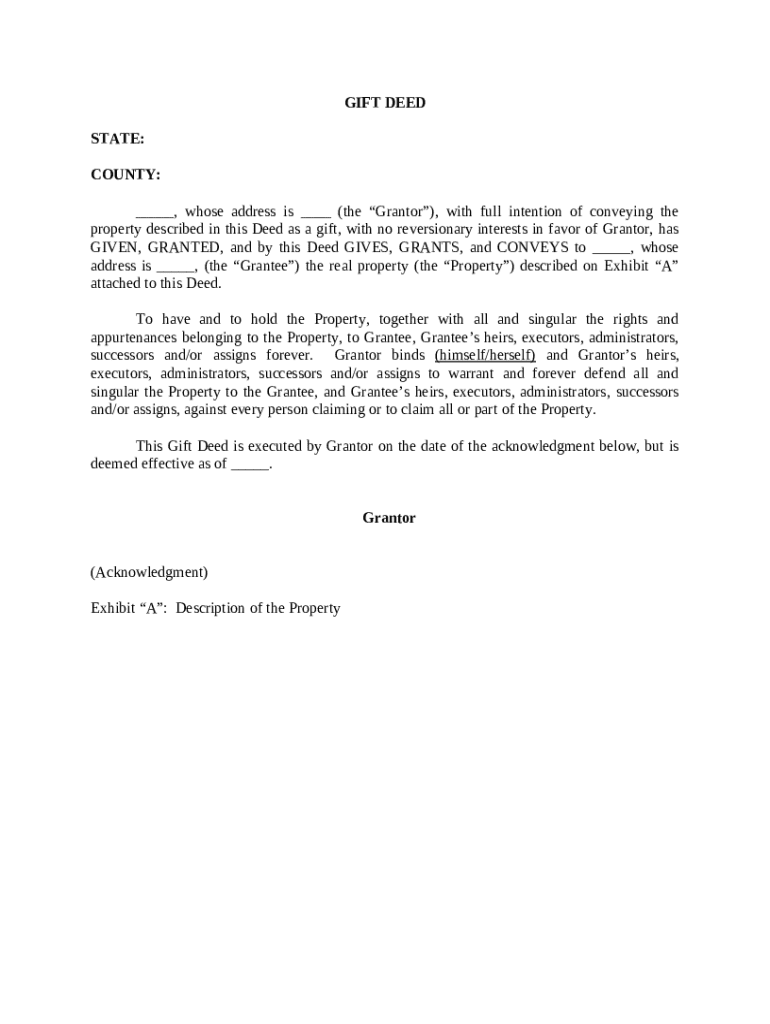

This Gift Deed conveys to the Grantee all of the Grantor_x0019_s interest in lands (including all surface, mineral, and royalty interests).

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is gift deed

A gift deed is a legal document that allows one person to transfer ownership of property or assets to another person without any exchange of money or consideration.

pdfFiller scores top ratings on review platforms

PDF Filler is great. I can save my documents and come back to them anywhere. Love it.

Really useful tool. Will save me a fortune on printer ink and time standing by a scanner!

I may be an idiot but it isn't the most intuitive experience I've had. I have been under pressure to produce so that may have something to do with it.

Had PDFfiller for a couple of months now and has been very helpful. A Great Service

I'm just getting used to it! I'll let you know how it goes.........Thank you

Just made my form and contract Distribution much easier. Thank you

Dennis Campbell, President,COO

My Landscaper LLC. Denver, CO

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Gift Deed Form

What is a gift deed?

A gift deed is a legal document that allows a person, the grantor, to convey property or assets to another person, the grantee, without compensation. This type of transfer is noteworthy because it establishes the intention to give without expecting payment, which differentiates it from other property transfer methods, such as a sale deed. The intent behind utilizing a gift deed can vary, but it often signifies a personal or familial relationship.

How does a gift deed differ from other transfer forms?

Understanding the differences between a gift deed and other forms of transfer is crucial. Unlike a sale deed, which requires payment and conveys a clear transactional nature, a gift deed emphasizes the element of gratuity and intent to donate. Furthermore, the legal implications diverge, as gift deeds may have distinct tax considerations and could require different execution protocols.

What is the importance of intent in a gift deed?

Intent plays a significant role in gift deeds. The grantor must clearly demonstrate their intention to make a gift, as this intention can impact the deed's legality. It ensures the transfer is voluntary and not made under duress or coercion, maintaining the ethical and legal integrity of the transaction.

What are the key components of a gift deed?

Every gift deed must contain essential components to be legally valid. Common fields include the details of the grantor and grantee, a precise description of the property being gifted, and the acknowledgment of the gift.

-

Names, addresses, and identification of the parties involved.

-

A detailed representation of the property, including its location and boundaries.

-

Standard clauses that clarify the gift and protect against disputes.

How do witnesses and notarization impact a gift deed?

Witnesses and notarization add credibility to the gift deed. In many jurisdictions, having witnesses sign the document enhances its validity and can protect against future disputes regarding the transfer. Notarization further assists in confirming identities and the voluntary nature of the transaction.

How do you fill out the gift deed form?

Filling out a gift deed form requires attention to detail and a methodical approach. Follow these step-by-step instructions to ensure accuracy.

-

Begin with the grantor's information, clearly stating their legal name and address.

-

Next, fill in the grantee's details, ensuring they match legal identification.

-

Provide a thorough description of the property, including any boundaries and specific identifiers.

-

Include legal language and clauses to protect both parties.

-

Ensure all required signatures are gathered, including those of witnesses or a notary if required.

What common mistakes should be avoided?

Errors in filling out a gift deed can lead to significant legal setbacks. Common mistakes include missing information, such as addresses or property descriptions, and failing to secure necessary signatures or notarization. Ensuring that the completed deed adheres to state-specific regulations is crucial for its enforceability.

How can interactive tools assist in managing gift deeds?

Utilizing platforms like pdfFiller for gift deed management streamlines the process. You can fill, edit, and sign your documents directly in the cloud, ensuring easy access from anywhere.

-

You can invite others to review and edit your gift deed in real time.

-

Stay informed about changes in your gift deed with comprehensive version control.

-

Ensure accountability by reviewing who made changes to the document and when.

What legal considerations should be kept in mind for gift deeds?

Executing a gift deed involves adhering to specific legal requirements that can vary by state. It's essential to understand the nuances of local regulations regarding gift deeds, especially in terms of compliance and potential tax liabilities.

-

Different states may have unique protocols that dictate how a gift deed must be executed.

-

Consider potential gift taxes which may be applicable depending on the value of the property being gifted.

-

Ensure that the gift deed is recognized in the local jurisdiction to avoid future disputes.

What are common mistakes to avoid when executing a gift deed?

Common pitfalls include failing to properly complete the document or neglecting to comply with local legal standards. Such oversights can lead to disputes and diminish the original intent of the gift. Effective planning and awareness of best practices are essential.

-

Missing critical details like property ownership can render a deed unenforceable.

-

Ensure all parties involved have signed the document, as incomplete signatures can lead to challenges.

-

In some jurisdictions, failing to have necessary witnesses or notarization can invalidate a gift deed.

How to follow best practices when drafting a gift deed?

To mitigate risks, adhere to best practices such as confirming all parties fully understand the terms of the deed. It’s also advisable to consult legal professionals when in doubt about requirements or implications, especially when transferring high-value properties.

What are the final steps in the gift deed process?

Before finalizing and submitting the gift deed, ensure that all necessary checks are complete. Verify that the document is filled out correctly, all signatures are present, and any required notarization has been performed.

-

Conduct a final review of the deed to confirm accuracy and completeness before submission.

-

Make use of platforms like pdfFiller for assistance and guidance on completing your gift deed.

-

We recommend users take advantage of pdfFiller for a seamless gift deed preparation experience.

How to fill out the pdffiller template

-

1.Open the gift deed template in pdfFiller.

-

2.Enter the names and addresses of the donor (giver) and the donee (receiver).

-

3.Specify the property or assets being gifted in clear terms, including detailed descriptions.

-

4.Include the date of the gift.

-

5.If applicable, outline any conditions or terms related to the gift.

-

6.Both the donor and donee should sign the document in the designated areas.

-

7.Optionally, have the deed notarized to add legal validity, if required in your jurisdiction.

-

8.Save the completed document and distribute copies to all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.