Get the free - Stock Purchase Agreement for Strategic Investment Made at Time of Initial Public O...

Show details

This form is a model adaptable for use in partnership matters. Adapt the form to your specific needs and fill in the information. Don't reinvent the wheel, save time and money.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

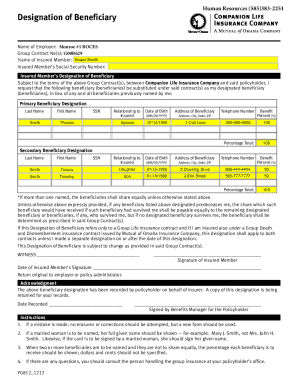

What is form - stock purchase

A stock purchase form is a legal document used to facilitate the buying of shares from a company by an investor.

pdfFiller scores top ratings on review platforms

I've tried several pdf editors and…

I've tried several pdf editors and pdfFiller is by far the most user friendly

Thanks

Thanks , work great

Good pdf editor

Good pdf editor, has been very helpful for important documents

Excellent

Excellent and awesome

IT IS VERY USEFUL TOOL

Got what i needed it worked great and…

Got what i needed it worked great and edited great no issues at all.

Who needs stock purchase agreement?

Explore how professionals across industries use pdfFiller.

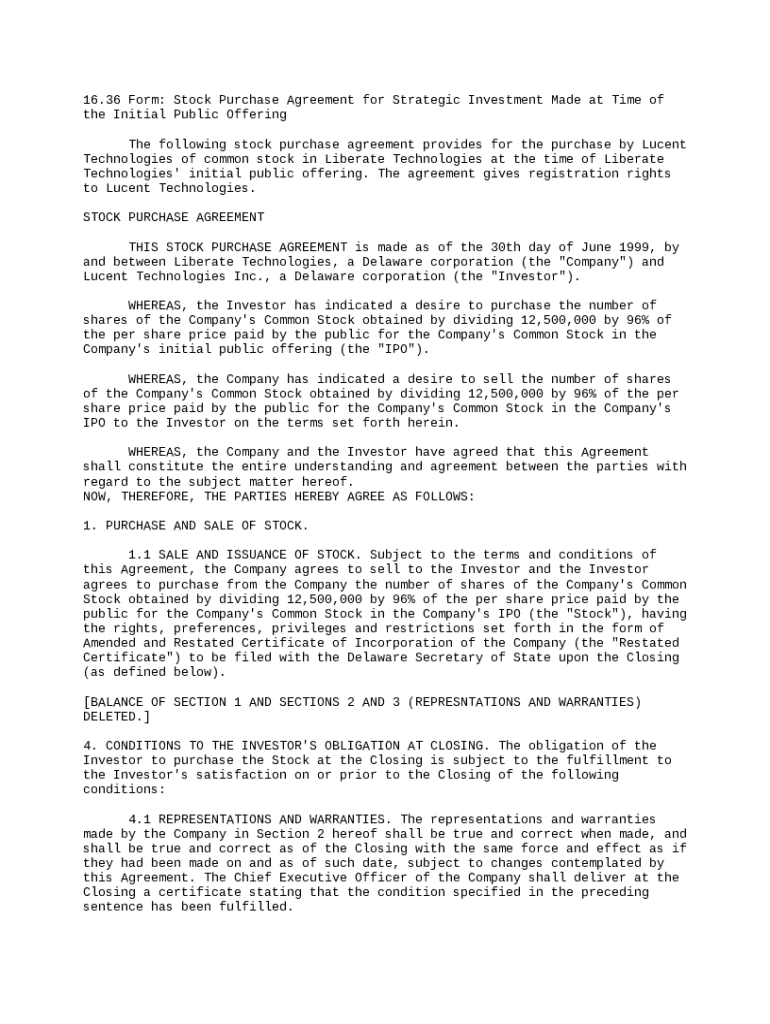

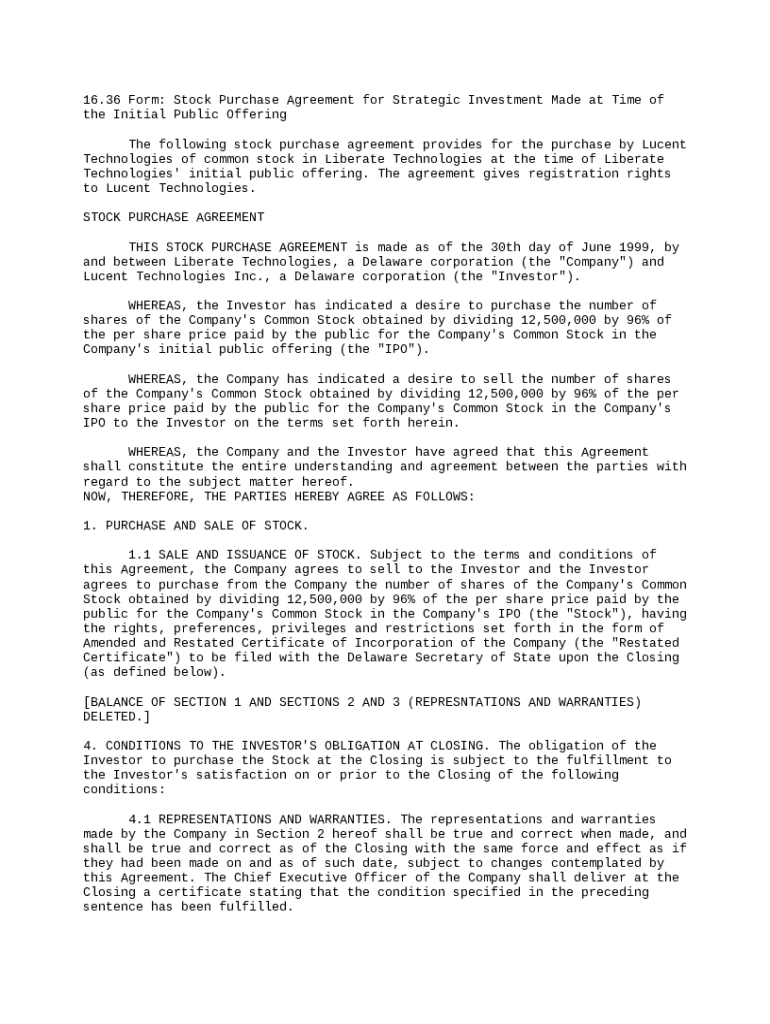

Comprehensive Guide to the Stock Purchase Form on pdfFiller

Filling out a stock purchase form is essential for legalizing a transaction between buyers and sellers of stocks. Taking the time to understand the process ensures compliance and protects your investments.

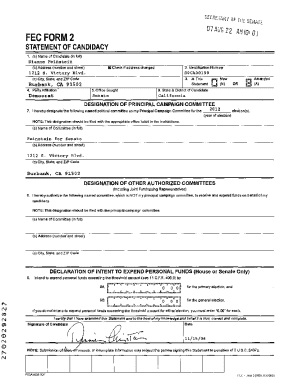

What is a stock purchase agreement?

A Stock Purchase Agreement (SPA) is a legal contract that outlines the terms and conditions under which an investor agrees to purchase shares of a company. This vital document plays a crucial role in the investment process, ensuring clarity and legal protection for both parties involved. SPAs can differ significantly between public and private stock purchases, affecting compliance, taxes, and investor rights.

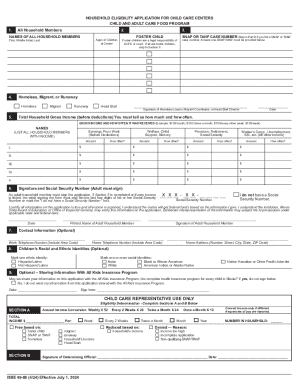

What key components are included in a stock purchase agreement?

-

The agreement defines 'The Company' selling the shares and 'The Investor' buying them, clarifying roles and responsibilities.

-

These are the specific details regarding the purchase price, payment method, and other significant clauses that govern the transaction.

-

Each party's rights will be explicitly stated, including what happens in the event of a dispute or breach of contract.

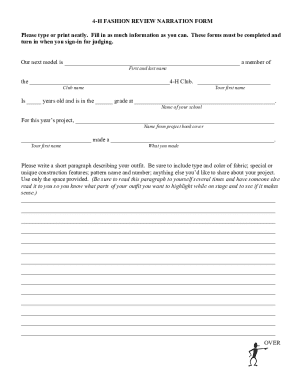

How do you complete the stock purchase form?

Filling out the stock purchase form can be done efficiently using pdfFiller, which offers a user-friendly platform. Follow these step-by-step instructions to complete the form accurately. Include essential fields such as your name, contact information, and share pricing. Make sure to sign the document digitally to expedite processing.

Why is the stock purchase agreement legally binding?

-

An agreement becomes legally binding when it meets certain criteria, including mutual consent and consideration.

-

Each region may have specific regulations impacting your agreement. Compliance with these laws is essential to avoid enforcement issues.

-

Avoid ambiguity in the contract. Clearly outlining the terms helps prevent disputes and misunderstandings.

What does a sample stock purchase agreement look like?

A typical Stock Purchase Agreement template will include various sections such as representations and warranties, define the implications of closing, and include any conditions that must be met. By using pdfFiller, you can customize your template to suit your specific deal, ensuring all terms are relevant to your situation.

How to fill out the stock purchase agreement

-

1.Access the form - stock purchase on pdfFiller.

-

2.Enter the buyer's full name and contact information at the top of the form.

-

3.Provide the seller's name and contact data in the designated section.

-

4.Specify the number of shares being purchased and the price per share.

-

5.Indicate the total amount being paid for the shares purchased.

-

6.Include the date of the transaction in the appropriate field.

-

7.Both the buyer and seller must sign the form to validate the transaction.

-

8.If necessary, include any additional terms or conditions of the sale in the comments section.

-

9.Review all entered information for accuracy before submission.

-

10.Save and submit the completed form as instructed by pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.