Get the free Deed of Trust template

Show details

This is a sample Deed of Trust that can be altered as needed. A deed of trust is a type of secured real-estate transaction that some states use instead of mortgages. Generally, it is an agreement

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed of trust

A deed of trust is a legal document that secures a loan by transferring the title of a property to a third party until the loan is paid off.

pdfFiller scores top ratings on review platforms

I really like it. Easy to use, a great program.

It does what it is supposed to do! So many services don't live up to their own description. Thank you!!!

PDF Filler is easy to use and practical.

once purchased, this was very easy to use, friendly, and efficient.

I like it. I'm a Realtor and it comes in handy when having to write multiple offers for the same client. Thanks!

Good experience. Just wish I could figure out OCR.

Who needs deed of trust template?

Explore how professionals across industries use pdfFiller.

Guide to Deed of Trust Form on pdfFiller

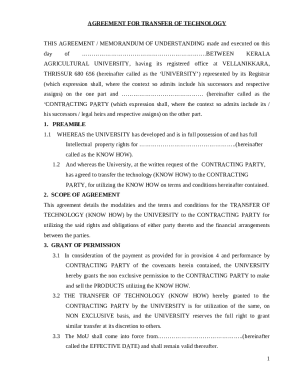

What is a deed of trust?

A deed of trust is a legal document used in real estate transactions that secures a loan by transferring the title of property to a trustee. This instrument contains three parties: the trustor (borrower), the beneficiary (lender), and the trustee (third party). Understanding this document is crucial as it serves to protect the interests of the lender while also outlining the borrower's obligations.

What are the key components of a deed of trust?

-

The individual or entity that borrows the money and offers the property as security.

-

The lender or financial institution that loans the money; they hold the benefit of the repayment.

-

A neutral third-party who holds the title until the loan is repaid.

Why is the deed of trust important?

The deed of trust is vital in real estate transactions as it protects the lender's investment in the property. It outlines the terms and conditions of the loan, ensuring clarity for all parties involved. Additionally, it enables lenders to initiate a foreclosure process if the borrower defaults on the loan.

What are the key elements of the deed of trust form?

-

Each term outlined helps all parties understand their rights and obligations.

-

Includes the borrower's personal information and the obligations that they must fulfill regarding the loan.

-

Lenders must identify themselves and outline their responsibilities to the borrower.

-

Defines the trustee's responsibilities under the agreement.

-

Accurate information about the property being used as collateral is critical for legal purposes.

-

Summarizes the terms of the loan, including interest rates and repayment plans.

How do you fill out a deed of trust form?

-

Clearly state the names and roles of the trustor, beneficiary, and trustee.

-

Fill in the borrower's details, ensuring accuracy in personal information.

-

Provide the lender's name, address, and contact information.

-

Specify the name and address of the trustee.

-

Include a complete description of the property securing the loan.

-

Clearly define all financial obligations and terms associated with the loan.

What sections are in the deed of trust form?

-

This section provides clear definitions of key terms used in the document.

-

Outlines obligations and rights specific to the borrower.

-

Details the lender's rights and responsibilities under the deed.

-

Specifies the actions and duties expected from the trustee.

-

Clarifies what financial obligations the borrower is agreeing to.

-

Allows customization of the deed according to specific needs or agreements.

What are the notarization and recording processes for a deed of trust?

-

Notarization adds a layer of legality and validity, confirming the identities of the parties involved.

-

This step must be completed at your regional county recorder's office to ensure enforceability.

-

Post-recording, parties should receive confirmation of recording, along with any associated documents.

What follows after recording the deed of trust?

Once recorded, the borrower has ongoing obligations that must be understood and managed. This includes community association dues, fees, and assessments related to the property. Failure to respond to these obligations can lead to penalties, impacting both credit scores and the overall financial health of the borrower.

How to ensure compliance with regional laws?

-

Understanding the overarching legal framework can prevent issues before they arise.

-

Be aware of complexities in local laws for real estate transactions, especially in your specific region.

-

Proper adherence to laws protects against legal complications and financial loss.

What interactive tools for deed of trust management are available on pdfFiller?

-

Edit and eSign your deed of trust seamlessly, taking advantage of user-friendly digital tools.

-

Utilize pdfFiller to work collaboratively with all parties involved, ensuring transparency and efficiency.

-

Keep your documents organized and accessible in the cloud, enabling remote access and management.

How to fill out the deed of trust template

-

1.Open the PDFfiller website and log into your account or create a new one.

-

2.Upload the deed of trust template or select it from your document library.

-

3.Begin filling out the borrower information, including name and address in the designated fields.

-

4.Input the lender’s details, including name and contact information, accurately in the provided sections.

-

5.Enter the property description, ensuring to include the correct legal description as specified.

-

6.Fill in the loan amount that the deed of trust will secure in the corresponding area.

-

7.Indicate the interest rate and any other loan terms required by the lender.

-

8.Review all entered information for accuracy before moving forward.

-

9.Save the completed deed of trust document.

-

10.Share, download, or print the document as needed for signing and recording.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.