Get the free Community Property Trust template

Show details

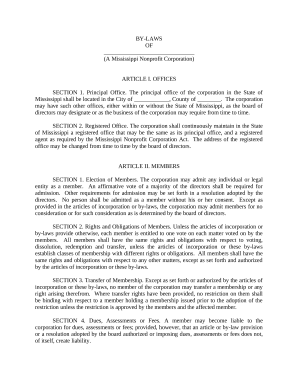

This is a sample Community Trust. Community trusts are joint trusts that are set up by married couples. They allow spouses in non-community property states to enjoy the same benefits as spouses

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is community property trust

A community property trust is a legal arrangement where spouses can manage and control their community property in a manner similar to a trust.

pdfFiller scores top ratings on review platforms

So far my experience has been good and self taught myself without using how to guide so easy to learn and do

In my line of work (payroll) it's a lot easier to be able to fill out some of the paperwork that I need to send to employees/managers and attach it via email instead of handwriting it and scan it to them.

i would like there to be more options to fill in and draw

So far it has been great, and it works on MAC too!

Very consistent and reliable program. Best on line program I have used.

I've been using a short time, but this has improved my productivity 3 fold!

Who needs community property trust template?

Explore how professionals across industries use pdfFiller.

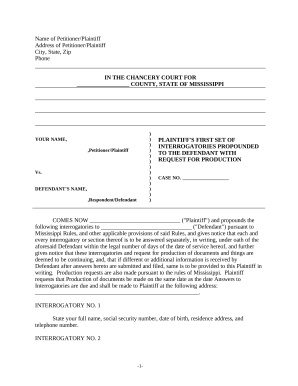

Comprehensive Guide to Community Property Trust Form

If you're looking to understand how to fill out a community property trust form, you've come to the right place. This guide provides step-by-step instructions to ensure you can easily create a legally binding document tailored to your needs.

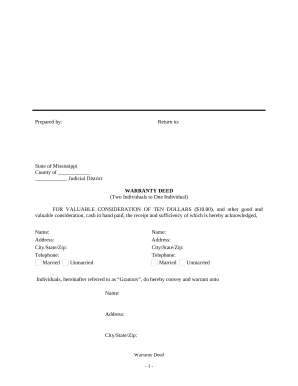

What are community property trusts?

A community property trust is a specialized estate planning tool allowing married couples to manage and maintain their joint assets. This type of trust plays a crucial role in ensuring that both spouses retain control over their community assets, distinguishing it from other trust structures such as revocable trusts that might not offer the same protections.

-

Community property trusts offer unique benefits, particularly in states that recognize community property, unlike traditional revocable trusts.

-

A community property trust can serve to simplify asset distribution upon death, ensuring both spouses are protected and benefits are maximized.

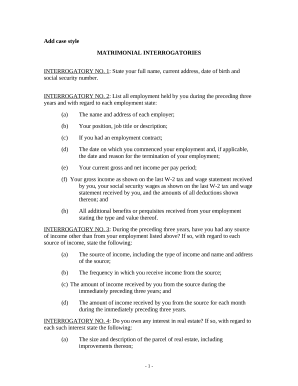

What are the components of a community property trust form?

Understanding the essential parts of a community property trust form is crucial for effective estate planning. The form typically includes specific sections that guide the setup and management of the trust.

-

Choosing an appropriate name for your trust is vital as it reflects the trust's purpose and differentiates it from others.

-

This section defines both the original trust property and future assets that may be added, providing clarity on the total assets entrusted to the management.

-

Details how trust property will be managed and distributed, emphasizing responsibilities and rights of the trustees.

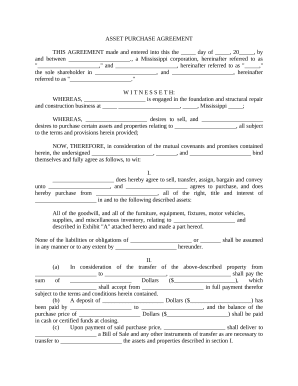

How to fill out the community property trust form?

Completing your community property trust form can feel daunting; however, it can be streamlined with the right approach. Follow these simple steps to ensure accuracy and completeness.

-

Collect necessary information about trust assets, grantors, and beneficiaries before starting the process.

-

Leverage pdfFiller's user-friendly tools for seamless data entry and document management, making the process efficient and straightforward.

-

Ensure all entries are correct before submitting the form, preventing any potential errors.

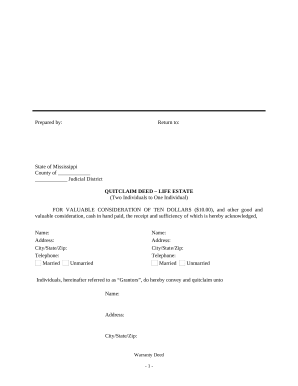

What are the rights and revocation options?

Understanding the rights to revoke or amend a community property trust is crucial for grantors. These rights allow for adjustments as circumstances change.

-

Grantors typically have the authority to amend the trust while they are alive, reflecting any new desires or changes.

-

Details on how the trust continues after the death of a grantor are essential, clarifying powers transferred to trustees.

How is property distributed upon the death of a grantor?

Distribution of assets becomes a crucial topic upon the death of a grantor. The community property trust design outlines how assets are to be handled after this event.

-

The trust must specify which assets will be retained or transitioned to the survivor, minimizing conflict and confusion.

-

Establishing guidelines for the survivor's trust is critical to ensure the remaining spouse's financial stability and access to necessary resources.

What provisions support the surviving spouse?

Ensuring that the surviving spouse is adequately supported is paramount when designing a community property trust. Specific provisions can be included to facilitate this.

-

The trust can grant the surviving spouse various options for accessing trust assets during their lifetime.

-

Qualified terminable interest property (QTIP) allows the surviving spouse to receive income from the trust while ensuring the trust’s principal passes to other beneficiaries upon death.

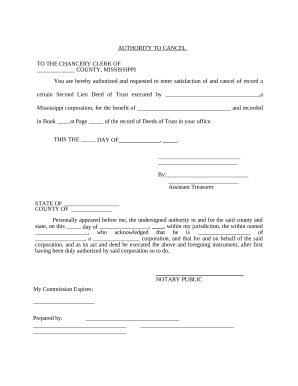

How should separate trusts for descendants be structured?

Establishing separate trusts for descendants fulfills specific family desires and needs. This approach can ensure that heirs receive their fair share without conflict.

-

The trust can outline the rights and obligations of the primary beneficiary concerning asset management.

-

Provisions regarding how assets transition after a beneficiary's death need to be clearly defined to alleviate confusion.

-

Setting up separate trusts for different heirs can provide tailored financial management, benefiting families with multiple needs.

When are alternative dispositive provisions necessary?

In some cases, standard trust terms may be insufficient for addressing unique family situations. Alternative provisions provide much-needed flexibility.

-

Trustees must assess when typical terms may fall short, modifying the asset distribution strategy accordingly.

-

Different conditions and asset types may require alternative strategies to effectively meet the family's needs.

What powers do trustees have in distributing principal?

Trustees play a vital role in managing how principal is distributed. Their powers and responsibilities ensure that the trust objectives are honored.

-

Trustees have the authority to distribute principal as intended by the trust, guided by fairness and fiduciary responsibility.

-

Trustees must act in the best interest of the beneficiaries and adhere to the terms outlined in the trust document.

How to fill out the community property trust template

-

1.Begin by obtaining the community property trust form from pdfFiller.

-

2.Open the form in pdfFiller and review all sections carefully.

-

3.Fill in the names and addresses of both spouses in the designated fields.

-

4.Specify the details of the community property involved in the trust, including descriptions and any relevant account numbers.

-

5.Indicate how the property should be managed and who will have the authority to make decisions regarding it.

-

6.Fill in any optional clauses regarding distribution upon death or divorce.

-

7.Review the completed document for accuracy and completeness.

-

8.Once confirmed, save the document and proceed to sign as required, ensuring both spouses’ signatures are included.

-

9.Download and/or print the final version for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.