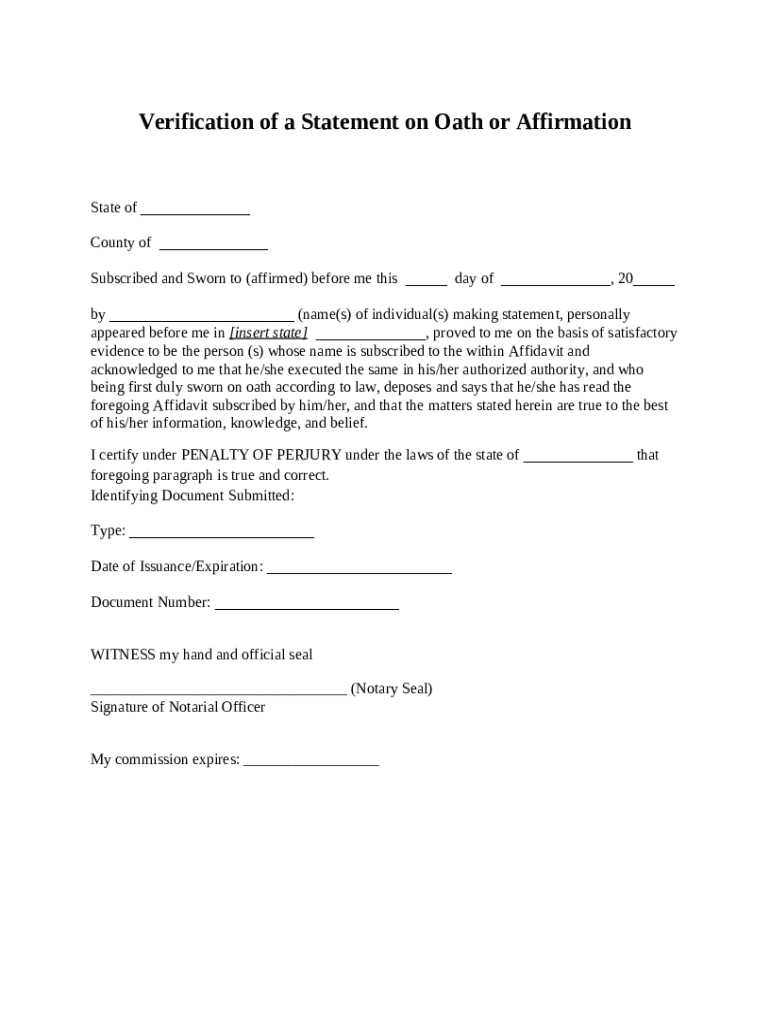

Get the free Verification of a Statement on Oath or Affirmation template

Show details

A customer whose document is being notarized must take an oath or affirmation and sign the document in front of you. A verification on oath or affirmation (previously known as an affidavit) is a

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is verification of a statement

A verification of a statement is a document that confirms the accuracy and truthfulness of a particular assertion or claim.

pdfFiller scores top ratings on review platforms

This service is a lifesaver. If, like me you don't have original adobe software and only occasionally have to fill in PDf's, PDFfiller has made life easier. So simple to use - brilliant!

THIS IS A GREAT PROGRAM THANK YOU SAVE ME TIME AND MONEY.

Too cumbersome. Need to streamline it more.

I am new to this process. seems easy enough

The entry level package has everything my small business needs

STILL LEARNING THE TRICKS FOR FILLING, PRINTING AND SAVING.

Who needs verification of a statement?

Explore how professionals across industries use pdfFiller.

Verification of a Statement Form: A Step-by-Step Guide

To fill out a verification of a statement form, start by understanding the required details, including state and county information. Then, accurately provide the necessary identifiers and include signatures where required. Utilizing tools like pdfFiller can streamline this process.

Understanding the verification of a statement

The verification of a statement form is crucial in legal and formal documentation. Its primary purpose is to confirm the accuracy of the information provided, especially in legal contexts. Completing this form accurately is essential to maintain integrity and compliance.

-

The verification of a statement form attests to the truth of the assertions it contains.

-

Any inaccuracies can lead to legal disputes and implications.

-

It is typically used in legal proceedings, property transactions, and during audits.

What are the key components of the verification of a statement form?

Several key components make up the verification of a statement form. Essential details must be included to ensure the document is valid.

-

This information serves as the primary identifiers required on the form.

-

Full names and signatures are vital for validating the form.

-

A notary public must complete the form to fulfill legal requirements and verify its authenticity.

How to fill out the verification of a statement form?

Filling out this form requires meticulous attention to detail. Each step is fundamental to ensure that the documentation is proper and legally binding.

-

Choose accurately to reflect the legal jurisdiction applicable.

-

Include full names and any required identifying information.

-

Ensure that notary details and seals are filled out as prescribed.

What common mistakes to avoid when completing the form?

Errors in the verification of a statement form can have significant repercussions. Understanding common pitfalls can help in avoiding costly mistakes.

-

Ensure that all required personal information and identifiers are included.

-

Both signatures are crucial for the form's validity.

-

Verify all dates and references to avoid misunderstandings or disputes.

How to use pdfFiller for your verification form needs?

pdfFiller offers an array of features that simplify the process of managing the verification of a statement form. With its interactive tools, actively engaged users can efficiently create, edit, and validate documents.

-

Utilize pdfFiller's user-friendly interface for interactive editing.

-

Ensure compliance with legal requirements through electronic signatures.

-

Teams can work together in real-time, enhancing efficiency during the document verification process.

What are the legal considerations and compliance requirements?

Compliance requirements vary by state, and understanding the nuances is essential to avoid potential penalties. It is imperative to acknowledge and observe any legal stipulations pertinent to the verification process.

-

Research regulations governing the use of verification forms in your state.

-

Fraudulent submissions can lead to severe legal repercussions.

-

Understand the weight your signature carries in legal contexts.

What additional features does pdfFiller offer for verification forms?

As a cloud-based platform, pdfFiller provides versatile functionalities that extend beyond just filling forms. Users can benefit from advanced document management capabilities.

-

Cloud technology allows users to access forms from any device.

-

Utilize features for organizing and storing documents efficiently.

-

pdfFiller distinguishes itself with comprehensive functionalities, offering a one-stop solution for document management.

How to fill out the verification of a statement

-

1.Access the pdfFiller website and log in to your account or create a new one.

-

2.Search for the 'verification of a statement' template in the template gallery.

-

3.Select the appropriate template to open it in the editor.

-

4.Fill in the required information fields, including details about the statement needing verification and the parties involved.

-

5.Review the entries for accuracy, ensuring all claims and details are correctly stated.

-

6.Use the options available to add any necessary signatures or date fields to the document.

-

7.Once complete, save the document to your pdfFiller account or download it directly to your device.

-

8.If needed, share the document via email or generate a link for easy access.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.