Get the free Interest Verification template

Show details

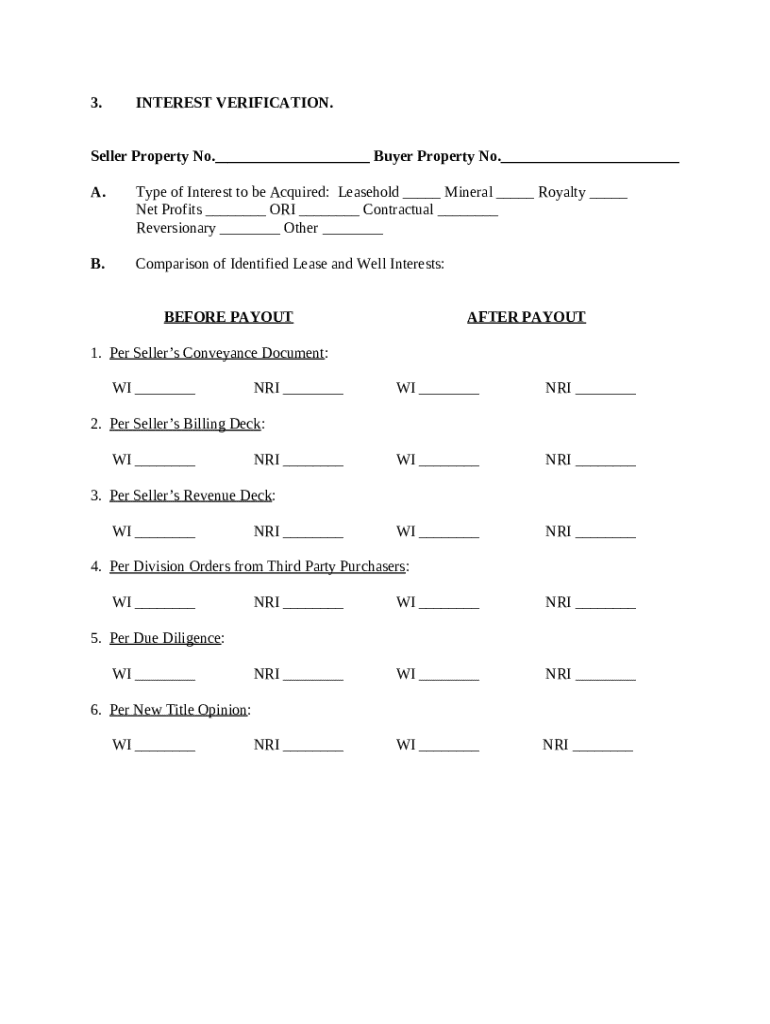

This form is used for interest verification.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

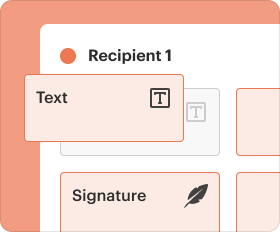

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is interest verification

Interest verification is a formal document used to confirm and validate the interest or ownership status of an asset or account.

pdfFiller scores top ratings on review platforms

awesome glad to have it and lots of…

awesome glad to have it and lots of resources and action keys

Great program to help fill in PDF's.

It made filling out documents so much…

It made filling out documents so much easier. Great service

K.I.S.S.

This is a lot easier than I thought it would be.:)

A good product

A good product. You'll have to sign up for the service if you want to save your doc, but they have a free thirty day trial, so it's not so bad. Allows you to edit documents in a relatively user-friendly and intuitive way. No real complaints, but it also didn't blow my socks off or anything, so 4/5.

excellent

excellent tool, fast, efficient and very convenient

Who needs interest verification template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the interest verification form

TL;DR: How to fill out an interest verification form

Filling out an interest verification form involves gathering accurate property and seller information, selecting the appropriate type of interest, and ensuring all sections of the form are completed according to guidelines. Review all entries, avoid common mistakes, and utilize tools like pdfFiller for edits and signatures to streamline the process.

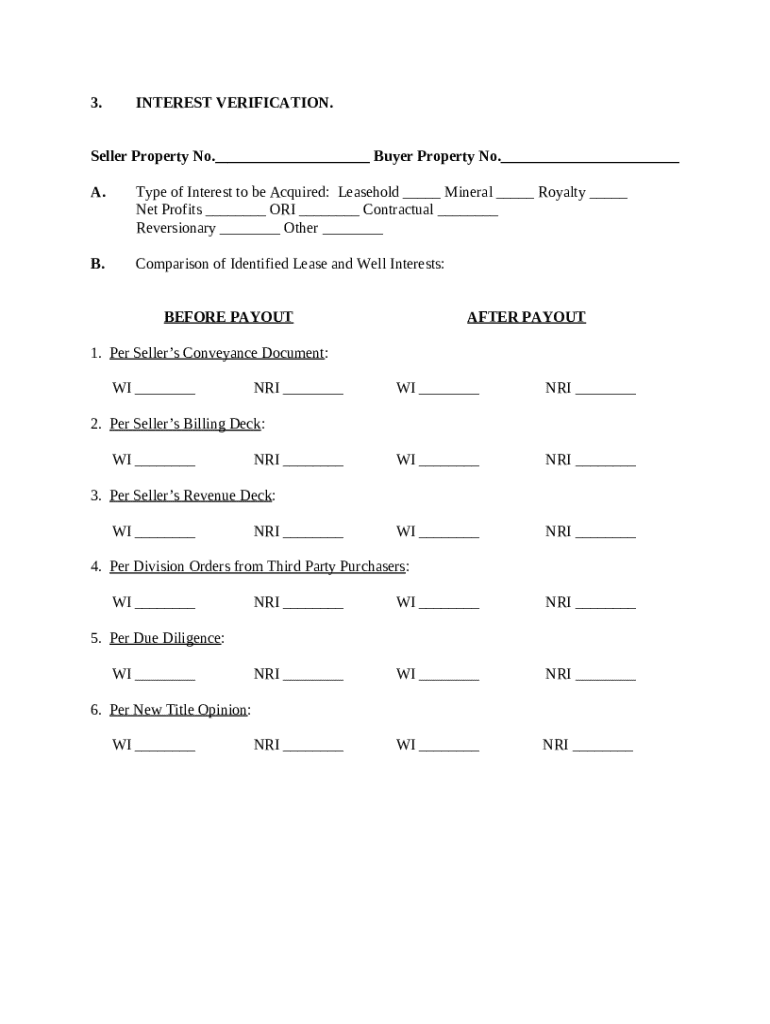

What is the interest verification form?

The interest verification form is a document used to establish and confirm the details of interests in properties, particularly in transactions involving leasehold, mineral rights, and royalties. Its primary purpose is to ensure transparency and accuracy between parties, making it essential in property transactions.

Why is the interest verification form important in property transactions?

This form plays a critical role in property transactions by documenting the specific interests of both sellers and buyers. Failing to accurately verify interests can result in disputes, financial losses, or legal challenges later on.

What scenarios typically require the interest verification form?

-

Whenever real estate is sold, both parties need to ascertain the interests involved.

-

When interests are being transferred between parties, confirming the details helps mitigate misunderstandings.

-

Lenders often require an interest verification form to evaluate collateral against loans.

How do you provide seller property information?

Providing accurate seller property information is crucial. This section includes the seller's property number and details about the property’s location, boundaries, and current use.

What is a seller property number?

The seller property number is a unique identifier assigned to a specific parcel of land or property, facilitating easier management and reference in transactions. It is essential for tracking property histories and ensuring accurate records.

How to properly fill out property details?

-

Gather documentation regarding the property to ensure accuracy, including legal descriptions and prior title deeds.

-

Avoid jargon; use simple terms that can be easily understood to avoid ambiguity.

-

Double-check each field for accuracy to prevent issues during processing.

Why is accurate seller information crucial?

Accurate seller information is vital as it ensures that the rightful owner is accounted for and protects against fraud. Moreover, it aids in the seamless transfer of ownership and prevents potential disputes in the future.

What types of interests can be acquired?

There are various types of interests such as leasehold interests, mineral rights, and royalty interests. Understanding these categories helps parties make informed decisions during the acquisition process.

How to choose the right interest type?

-

Determine if you need rights for residential, commercial, or recreational use.

-

Engage with legal or real estate experts to get tailored advice.

-

Each type of interest carries different rights and responsibilities.

What misunderstandings commonly arise about interest types?

There are common misconceptions related to property interests, such as assuming that leasehold interests provide the same rights as ownership or that all interests are permanent. Clarifying these differences is essential for successful transactions.

How to compare identified lease and well interests?

Understanding leasehold and well interests requires recognizing their classification as 'before payout' or 'after payout,' which impacts revenue distributions. This knowledge assists both parties in making informed decisions ahead of transactions.

What details are required for the seller's conveyance document?

-

Outlines the exact boundaries and location.

-

Includes personal data of the seller to confirm identity.

-

Clearly define whether it's a lease, mineral, or royalty interest.

What are key data points from billing and revenue decks?

Key data points include net revenue interest (NRI), working interest (WI), and any deductions that may apply, which all contribute to understanding the financial aspects of a property interest.

What are the steps for filling out the form?

Filling out the interest verification form requires following structured instructions through sections A to F, ensuring compliance along the way. Each section should be approached with diligence to secure precision and adherence to legal requirements.

What are common pitfalls to avoid?

-

Double-check to avoid typos or incorrect figures.

-

Ensure you know what document needs to be submitted.

-

All parties must sign for the document to be valid.

How to ensure compliance and accuracy?

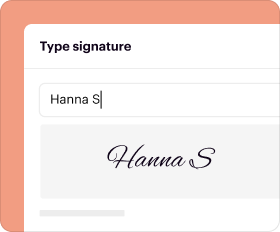

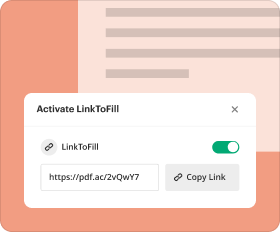

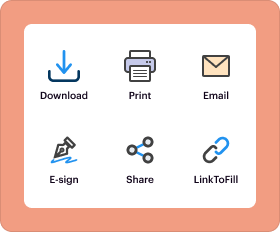

Verifying compliance involves regularly cross-referencing the entries with existing documentation and guidelines. Using digital tools, like those provided by pdfFiller, can streamline this process and enhance the accuracy of the completed form.

How to navigate the verification process?

The verification process necessitates thorough due diligence and may include obtaining a new title opinion from experts. It’s essential for all parties to be diligent in confirming that documentation is valid and accurate to avoid future discrepancies.

What are the benefits of using pdfFiller?

pdfFiller offers cloud-based document management solutions that make editing and signing the interest verification form seamless. Its interactive tools allow users to draft documents from anywhere, streamlining the process of handling various property documents and ensuring users maintain flexibility.

What are the final thoughts on using the interest verification form?

In conclusion, utilizing an interest verification form is fundamental in property transactions, ensuring all parties are informed of their rights and responsibilities. Emphasizing the importance of accurate documentation cannot be overstated, and leveraging tools like pdfFiller can make this process much more efficient.

How to fill out the interest verification template

-

1.Access pdfFiller and upload the interest verification form you need to complete.

-

2.Fill in your personal details such as name, address, and contact information in the designated fields.

-

3.Provide information regarding the asset in question, including account numbers or property details, in the appropriate sections.

-

4.Attach any necessary documentation that supports the interest being verified, such as account statements or titles.

-

5.Review all entered information for accuracy, ensuring that all required fields are completed.

-

6.Once confirmed, digitally sign the document if required, or prepare it for physical signatures if necessary.

-

7.Save the filled form in a secure location and send it to the relevant party requesting verification, either via email or direct upload.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.