Get the free Release of Lien Claim template

Show details

This form provides for a release of any type of materialman_x0019_s, mechanic_x0019_s or other contractor_x0019_s lien that may have been filed against an owner_x0019_s interest.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

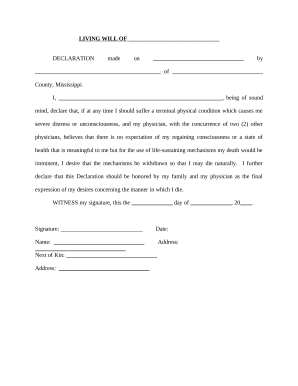

What is release of lien claim

A release of lien claim is a legal document that removes a lien from a property, indicating that a debt has been satisfied.

pdfFiller scores top ratings on review platforms

very easy to use and you can send it right away when your finished . Also all your forms are in one place. I like it a lot, I would definitely recommend

Wonderful experience so far. I just need to learn all the features of the program to better utilize the program.

Great useful application, I use it for keeping my exercise log for the 'Get Active' programme.

It is taking me some time to learn the in's snd out's of the program. It seems to be a good program.

i like it. I'm just not sure how to use everything. i wish they had video tutorials. i guess i'll check youtube.

LITTLE DIFFICULT SAVING MULTIPLE OF SAME FORM......BUT LOVE THE FILL IN FORMAT

Who needs release of lien claim?

Explore how professionals across industries use pdfFiller.

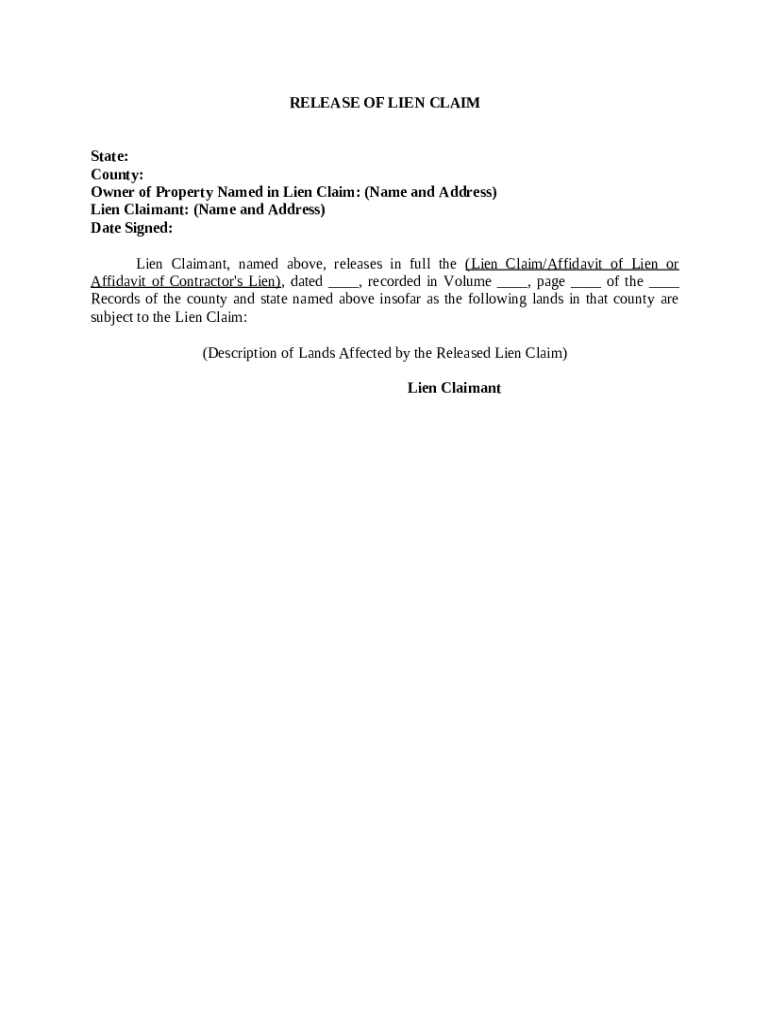

A comprehensive guide to the release of lien claim form form

How do you define a release of lien claim form?

A release of lien claim form is a legal document that indicates the removal of a lien from a property. Liens can be placed on a property to secure a debt or obligation. Once the debt is settled, this form acts as proof that the claim against the property has been released, thus allowing the owner to regain clear title.

What is the purpose and importance of this form?

The primary purpose of a release of lien claim form is to formally acknowledge that a lien has been satisfied. This is crucial for property owners seeking to sell or refinance their property, as having an unresolved lien can hinder these processes. Furthermore, it provides peace of mind to both the property owner and the lien claimant, ensuring that all obligations are fulfilled.

When is a release of lien claim applicable?

-

When a debtor pays off the outstanding amount that resulted in the lien.

-

When work is satisfactorily completed, a contractor may sign off to release the claim.

-

Sometimes liens are released due to negotiated terms between parties.

What key components should you include?

-

Critical information such as the state, county, owner of the property, lien claimant, and date signed must be included.

-

This includes information about the debt or obligation that the lien was securing.

-

An accurate description of the property should be provided to clarify what the lien release pertains to.

How can you effectively fill out the form?

Filling out a release of lien claim form can be straightforward if approached systematically. Begin by gathering necessary documents that pertain to the lien and property. Utilize tools like pdfFiller for a cloud-based solution that simplifies the process through features like auto-fill and templates.

What are common mistakes to avoid?

-

Leaving mandatory fields blank can result in delays or rejection.

-

Erroneous descriptions can lead to legal complications or confusion.

-

Failure to sign can nullify the validity of the form.

How to manage your form using pdfFiller?

-

Edit PDF documents effortlessly with pdfFiller's user-friendly interface.

-

Easily authorize your documents digitally, ensuring speed and convenience.

-

Enable team members to provide feedback and make adjustments in real-time.

What legal considerations should you keep in mind?

Understanding the legal implications of a release of lien claim form can vary by location. Different states may have specific rules surrounding the format and filing of the form. Always verify that your form adheres to local laws and consider consulting legal counsel if unsure.

What steps should you take for finalizing and submitting your form?

-

Ensure the form is properly signed and dated to validate it.

-

Determine where to submit the completed form; options often include local county offices.

-

Maintain a record and follow up to confirm the release has been processed.

How do conditional vs. unconditional waivers relate to releases?

-

This type is contingent upon payment being made. It provides protection to the claimant until conditions are verified.

-

These waive the lien without any conditions or requirements. It offers immediate release but can pose risks if payment isn't secured.

-

Evaluate both options based on the project’s specifics and possible risks involved.

What common questions arise regarding the release of lien claim form?

How to fill out the release of lien claim

-

1.Open the release of lien claim document in pdfFiller.

-

2.Begin by entering the name and address of the lien claimant in the appropriate fields.

-

3.Fill in the date when the debt was satisfied, ensuring accuracy.

-

4.Provide the property owner's details, including their name and address.

-

5.Include a legal description of the property to clearly identify it.

-

6.Check all information for accuracy and completeness before proceeding.

-

7.Sign the document where indicated, either electronically or by printing it out for manual signing.

-

8.Date your signature to validate the document.

-

9.Once completed, download the finalized document or share it directly through pdfFiller’s share options.

-

10.Make sure to file or provide a copy of the release of lien claim to relevant parties, such as the property owner and local authorities.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.