Get the free Subordinaton of Mortgage Lien to Easement and Right of Way template

Show details

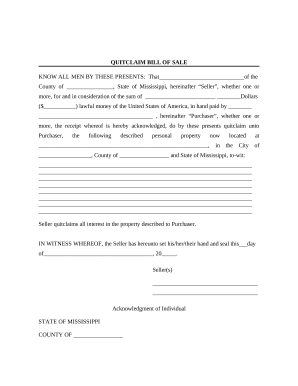

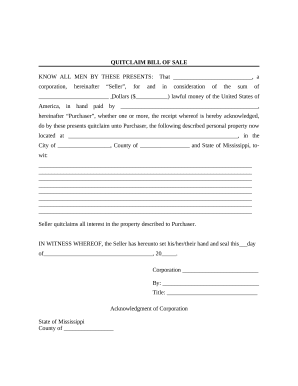

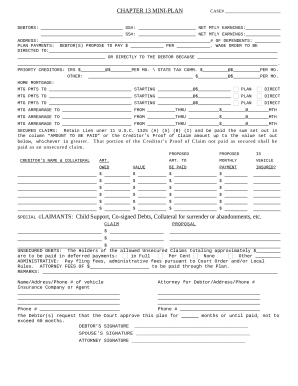

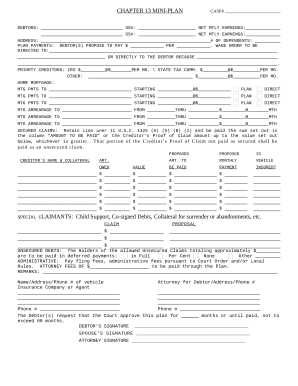

This form is a subordination of mortgage lien to easement and right of way.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is subordinaton of mortgage lien

Subordination of mortgage lien is a legal process that changes the order of priority among multiple liens on a property, establishing one as subordinate to another.

pdfFiller scores top ratings on review platforms

easy to use even in the hands of a relative novice computer user.

I was misled by your ad of free templates. In order to use them or share them or print them one must actually pay.

This website has helped me create excellent documents. It has been exactly what I needed.

This is the easiest software to work with and best I have ever used.

i like it but its a little confusing finding templates

in a nutshell: sooooooooooo much better than adobe acrobat. i'm a new user, but this was just infinitely less frustrating (and i'm hoping less expensive) that dealing with adobe.

Who needs subordinaton of mortgage lien?

Explore how professionals across industries use pdfFiller.

Subordination of Mortgage Lien Form Guide

Understanding how to fill out a subordination of mortgage lien form is essential for property owners and lenders. This process helps clarify the priority of mortgage liens on a property, ensuring that the rights of all parties involved are respected.

What is subordination of mortgage liens?

Subordination of mortgage liens is a legal process where a lien on a property, such as a mortgage, is re-prioritized below another lien. This is crucial for property owners seeking to refinance or sell their homes, as it affects the order in which creditors are paid.

-

This process can enhance a property owner's financing options and can assist lenders in securing a more favorable position on mortgage loans.

-

The legal benefits include having documented agreements that facilitate the working relationships between mortgagee and mortgagor.

What are the key components of the subordination of mortgage lien form?

-

This identifies the jurisdiction under which the lien is subordinated, which can vary significantly across regions.

-

Accurate identification of the mortgagor (borrower) and mortgagee (lender) is essential for the legality of the document.

-

Including specifics about any easements related to the property helps to clarify property rights.

-

Citing prior legal documents can aid in validating the subordination agreement.

-

Details pertaining to the terms of the subordination, including dates and signatures, are mandatory for legal enforceability.

How do fill out the subordination of mortgage lien form?

-

Follow clear steps to ensure all required information is accurately provided, avoiding common pitfalls.

-

Errors such as mismatched names or incorrect legal descriptions can invalidate the form.

-

Utilize pdfFiller's features to complete and edit your form efficiently, ensuring accuracy in submissions.

How to edit and manage the subordination of mortgage lien form?

-

Leverage document editing tools to make necessary adjustments and correct any errors swiftly.

-

pdfFiller allows multiple users to collaborate on the form, ensuring that all parties can provide their input seamlessly.

-

With pdfFiller, you have the convenience of electronically signing your document, making the process quicker and more efficient.

What are the compliance and legal considerations?

-

Be aware that different states may have unique rules regarding lien subordination, which should be strictly followed.

-

Utilize proper terminology to avoid ambiguity in legal documentation, reinforcing the agreement's clarity.

-

Failure to comply with legal standards can result in documents being deemed invalid, leading to complications for all involved parties.

What are the final steps after completing the form?

-

Submit the completed subordination of mortgage lien form to your local government office for official recording.

-

Ensure that you receive confirmation from the appropriate office that your form has been filed correctly.

-

Keep a copy of the completed form and any acknowledgment received for your records and future reference.

How to fill out the subordinaton of mortgage lien

-

1.Start by downloading the Subordination of Mortgage Lien form from the appropriate website or source.

-

2.Open the PDF file in pdfFiller and ensure you have all necessary information ready.

-

3.Enter the property address in the designated field at the top of the form.

-

4.Provide the name and contact information of the current lien holder that you wish to subordinate.

-

5.Next, fill in the details of the new first lien holder, including their name and contact information.

-

6.Include the loan amount and the interest rate of the new mortgage if required.

-

7.Review your entries for accuracy, ensuring all names and numbers are correct.

-

8.In the section for signatures, prepare to sign yourself and have the necessary representatives from the involving parties sign.

-

9.Once completed, save your changes and download the filled form as a PDF.

-

10.Follow any specific local filing procedures to submit your completed form to the relevant authority.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.