Get the free Partial Release of Mortgage / Deed of Trust template

Show details

This form provides for a partial release of a mortgage/deed of trust on lands.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is partial release of mortgage

A partial release of mortgage is a legal document that releases a portion of the property from a mortgage lien while retaining the lien on the remaining portion.

pdfFiller scores top ratings on review platforms

New but love the ease and the way the…

New but love the ease and the way the fonts adjust! Great program!

The best so far

The best so far. Web based Great idea

Easy to use and enabled me to use a PDF…

Easy to use and enabled me to use a PDF workbook for a course online - without having to print it out.

SO FAR SO GOOD

SO FAR SO GOOD. EVERYTHING IS PERFECTLY SET UP.

Great resource but a little pricey for…

Great resource but a little pricey for a monthly subscription

good stuff

good stuff. just starting but this is simple to use and what I need

Who needs partial release of mortgage?

Explore how professionals across industries use pdfFiller.

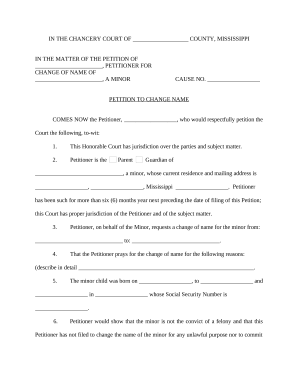

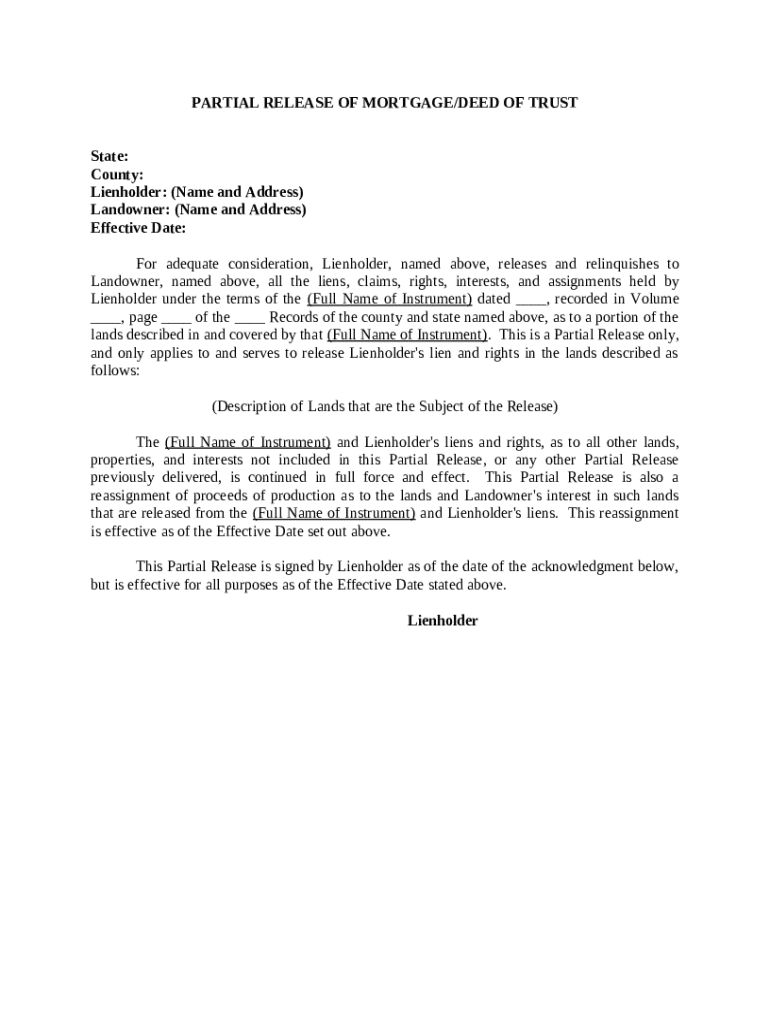

Navigating the Partial Release of Mortgage Form

Filling out a partial release of mortgage form is essential for any property owner looking to remove specific properties from a mortgage agreement without fully discharging the mortgage. This guide covers everything you need to know to complete the form efficiently.

What is a partial release of mortgage?

A partial release of mortgage refers to the process of releasing specific properties from a mortgage claim while keeping the remaining properties under the mortgage agreement. This is commonly used when a borrower sells a part of the mortgaged property but wants to keep the rest secured.

-

The partial release allows property owners to selectively remove properties from the mortgage without fully discharging the agreement.

-

Unlike a complete discharge, which ends the mortgage entirely, a partial release retains the original agreement for remaining properties.

-

Common scenarios include selling a portion of land or refinancing only part of the mortgage.

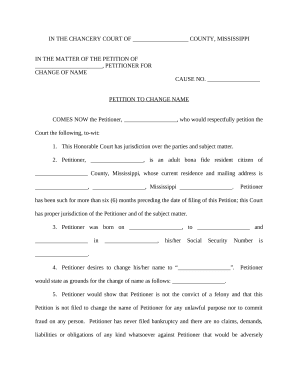

What are the essential components of the form?

-

Include information such as State, County, Lienholder, and Landowner to properly identify the concerned parties.

-

Document the effective date for legal compliance, as it determines when the partial release takes effect.

-

Clearly outline which properties are subject to release, including legal descriptions to avoid ambiguity.

How do fill out the form step-by-step?

-

Before you start, ensure all property and borrower details are readily available.

-

Follow the prompts for each field carefully to ensure compliance and accuracy.

-

Accurate descriptions are vital; imprecise information can lead to disputes over property ownership.

What digital tools can help in managing my document?

-

Use pdfFiller's online platform to easily edit your partial release of mortgage form.

-

Quickly obtain signatures for approvals, saving time in the submission process.

-

Share documents with relevant parties directly through the ecosystem for efficient workflows.

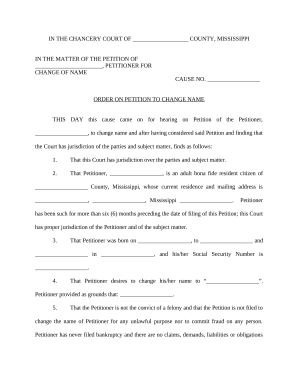

What are the compliance and legal considerations?

-

Each state has unique regulations; check local laws to ensure compliance.

-

Mistakes often occur in lien referencing or missing critical information, leading to legal complications.

-

Filing a partial release incorrectly can lead to litigation or unresolved claims.

How do review and finalize my partial release?

-

Ensure all necessary information has been filled out accurately before submission to avoid delays.

-

Notarized documents carry more weight legally; ensure compliance with state notary requirements.

-

Submit the finalized document to your local county offices, adhering to their procedures.

What additional related forms should know about?

-

Consider exploring other relevant forms, such as mortgage release requests or lien holder notices.

-

This document is beneficial in certain circumstances where collateral needs to be released.

-

Access customizable templates that cater to your specific state's regulations.

How to fill out the partial release of mortgage

-

1.Open the PDFfiller website and log in to your account.

-

2.Select 'Create New' and choose 'Upload Document' to upload your partial release of mortgage form.

-

3.Once uploaded, use the ‘Text’ tool to fill in the borrower’s information, including name and address.

-

4.Locate the section for property description and enter relevant details about the property being partially released.

-

5.Fill in the mortgage lender’s name and the details regarding the amount of the mortgage being released.

-

6.Review all entered information for accuracy to ensure compliance with legal requirements.

-

7.Once completed, save the document by clicking on 'Save' and choose your preferred file format for downloading or printing.

-

8.If necessary, share the form directly from PDFfiller for e-signatures or send it to your lawyer for final review.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.