Get the free Deed in Lieu of Prior Deed to Correctly Identify the Amount of Interest intended to ...

Show details

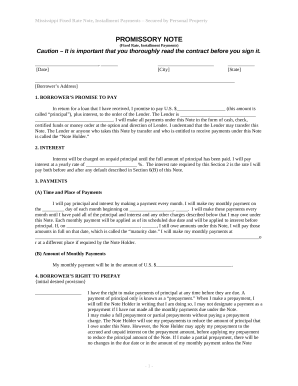

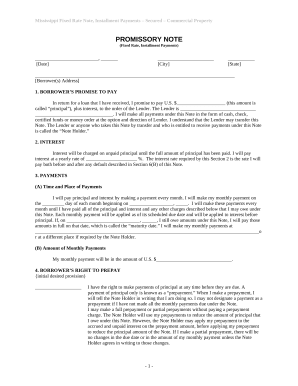

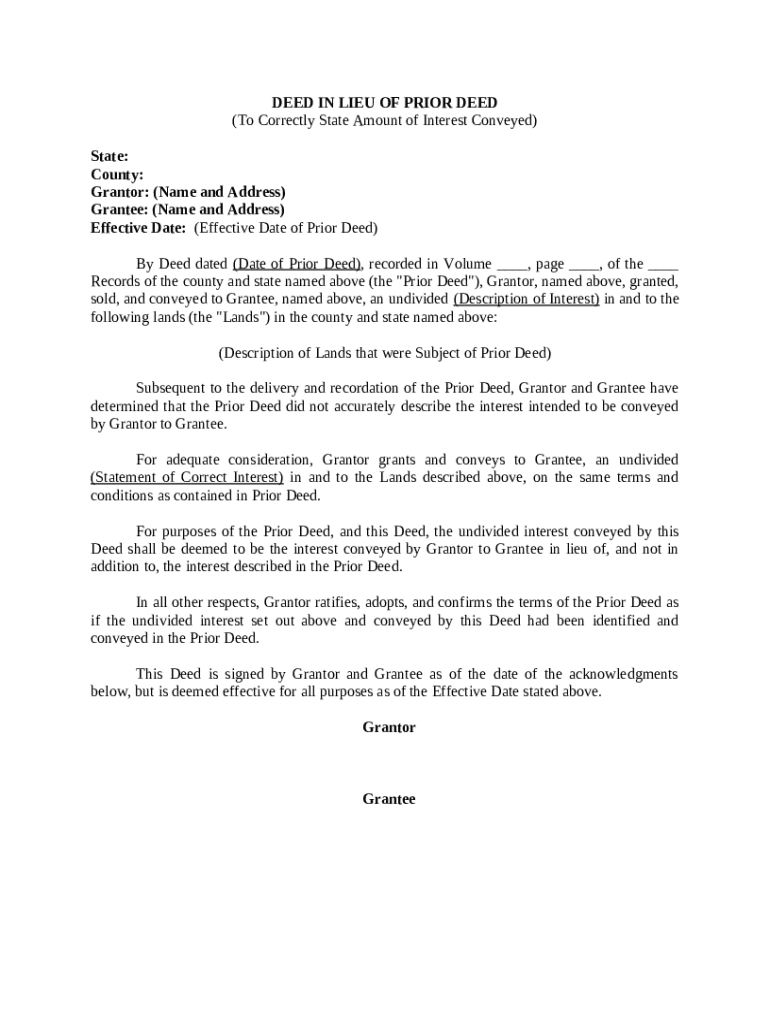

This form addresses the situation where a deed has been granted, only to determine that the interest described in the deed was incorrect. Rather than executing and delivering another deed, which

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed in lieu of

A deed in lieu of is a legal document where a borrower voluntarily transfers the title of their property to a lender to avoid foreclosure.

pdfFiller scores top ratings on review platforms

Amazed with the fast responses and…

Amazed with the fast responses and willingness to help. Thank you!

worked well thank you

Professional Done (save money)

Not having to write down on my documents. PDF Filler made it easier to type in digitally get the job done successfully. There software is professional and I love the notarize app as well. Without paying per stamp. Why not get a monthly subscription? Get it now. Thank you!

Really liking it smooth system

Pdf

Good

Easy to use, quick and efficient processes

Don't need it on regular basis so paying monthly for the service is not beneficial to me

Competitiveness in the market with PDF Filler

Editor of great autonomy, has added values of great importance to my daily tasks, robust and practical, I am quite satisfied with PDF Filler.

It is a great online Pdf editor, objective and competitive, compared to other Editors found in the market, its autonomy is of excellent quality in the conversion of PDF documents and electronic signatures.

It has a positive history with PDF files, it helps me with everyday tasks, how to convert documents to Pdf and send documents to a specific program for my work, I use SEI, it is also excellent in the electronic signature operation.

Who needs deed in lieu of?

Explore how professionals across industries use pdfFiller.

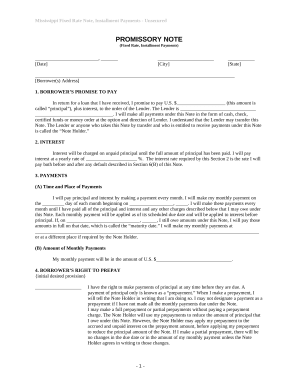

Understanding the deed in lieu of foreclosure process

What is a deed in lieu of foreclosure?

A deed in lieu of foreclosure is a legal document in which a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. This process allows the borrower to mitigate losses by relinquishing the property instead of undergoing a lengthy foreclosure process. Understanding the deed in lieu process is crucial for homeowners facing financial hardships.

What are the differences between a deed in lieu and a foreclosure?

While both a deed in lieu and foreclosure involve the transfer of a property due to non-payment, they differ significantly in execution and impact. In a foreclosure, the lender must go through a legal court process to reclaim the property, often resulting in a longer and more public procedure. Conversely, a deed in lieu enables the borrower to voluntarily transfer the property, usually with fewer legal complications and sometimes less damage to the borrower’s credit score.

When is a deed in lieu preferable?

-

If homeowners are unable to meet their mortgage payments, a deed in lieu can provide a way to exit their mortgage obligations without a foreclosure on their record.

-

If the property's market value has declined significantly below the mortgage value, a deed in lieu may be a beneficial alternative.

-

Borrowers often prefer a deed in lieu due to its expedited process compared to the drawn-out foreclosure process.

Who are the key players in the deed in lieu process?

The process involves two primary parties: the grantor, typically the borrower, and the grantee, which is the lender. Understanding their roles is crucial for a smooth transaction. The grantor voluntarily hands over the property, while the grantee accepts the property and cancels the mortgage debt.

Why is legal representation important?

Having legal representation is essential for both parties in the deed in lieu process. Legal professionals can ensure all requirements are met, clarify terms, and mitigate potential conflicts or misunderstandings during the transaction.

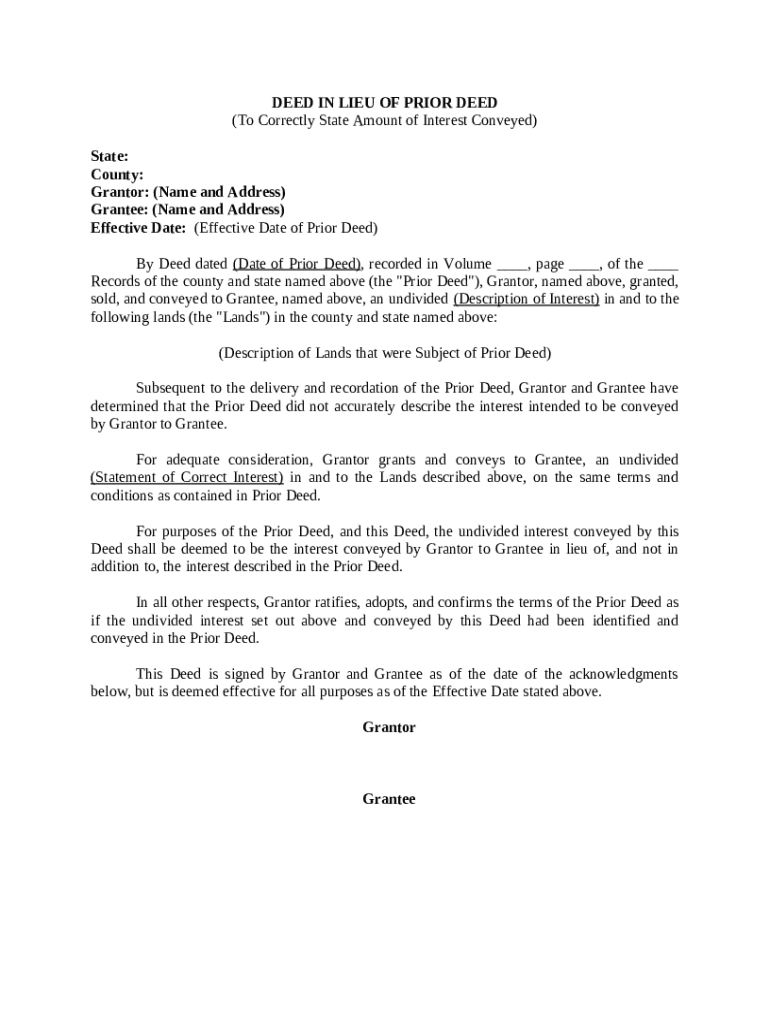

What components are essential in a deed in lieu document?

-

The deed must include accurate information such as the state, county, and description of lands involved.

-

Clearly identify the grantor and grantee, including the effective date of the deed.

-

The document should specify the interest being conveyed from the grantor to the grantee.

How do you fill out the deed in lieu form?

Filling out the deed in lieu form correctly is vital for its acceptance. Gather all the required information and documentation, and make sure to fill out each section thoroughly.

What common mistakes should you avoid?

-

Ensure all necessary fields are filled out to prevent rejection of the document.

-

Double-check all dates for accuracy as legal documents require precise timings.

What are the legal implications of a deed in lieu?

The deed in lieu of foreclosure can significantly impact the borrower’s credit score, typically causing less damage than a foreclosure. Moreover, there may be tax consequences based on the lender writing off the remaining debt, and state-specific laws might impose additional stipulations on the process.

How should you manage and store your deed in lieu document?

It is crucial to keep a digital copy of the deed in lieu for future reference. Using pdfFiller’s cloud-based platform ensures secure storage and easy access when needed.

What are the benefits of using electronic signatures?

Using electronic signatures streamlines the process, providing added convenience for all parties involved while ensuring the document's legality and security.

What concerns might arise during the deed in lieu process?

-

What to do if a lender rejects the deed in lieu? It’s essential to understand the reasons for rejection and address them quickly.

-

The timeline from submission to acceptance can vary; understanding the process will help set realistic expectations.

-

After the deed is executed, borrowers should clarify the next steps concerning remaining obligations or responsibilities.

How can pdfFiller assist you?

pdfFiller provides interactive tools for document management, helping users create, edit, and eSign their deed in lieu of form form effortlessly. Accessing customer support can also guide users through the process, ensuring conflicts are minimized.

Conclusion

Navigating the deed in lieu of foreclosure process effectively can ease the transition for homeowners in financial distress. By understanding the key aspects of the deed in lieu of form form and utilizing available resources like pdfFiller, borrowers can tackle challenges confidently and with informed strategies.

How to fill out the deed in lieu of

-

1.Obtain the deed in lieu of form from a reliable source, like pdfFiller.

-

2.Open the document in pdfFiller and select 'Edit' to start filling out the form.

-

3.Enter the names of the parties involved, including the borrower and lender.

-

4.Provide the property address and detailed legal description of the property.

-

5.Indicate the reason for the deed in lieu, such as financial hardship.

-

6.Include any necessary dates, such as the date of the agreement.

-

7.Review all entered information for accuracy before submitting.

-

8.Complete the required signatures from both parties to execute the document.

-

9.Save the completed document in a secure location for your records.

-

10.Consider consulting with a legal professional to ensure everything is in order.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.