Get the free pdffiller

Show details

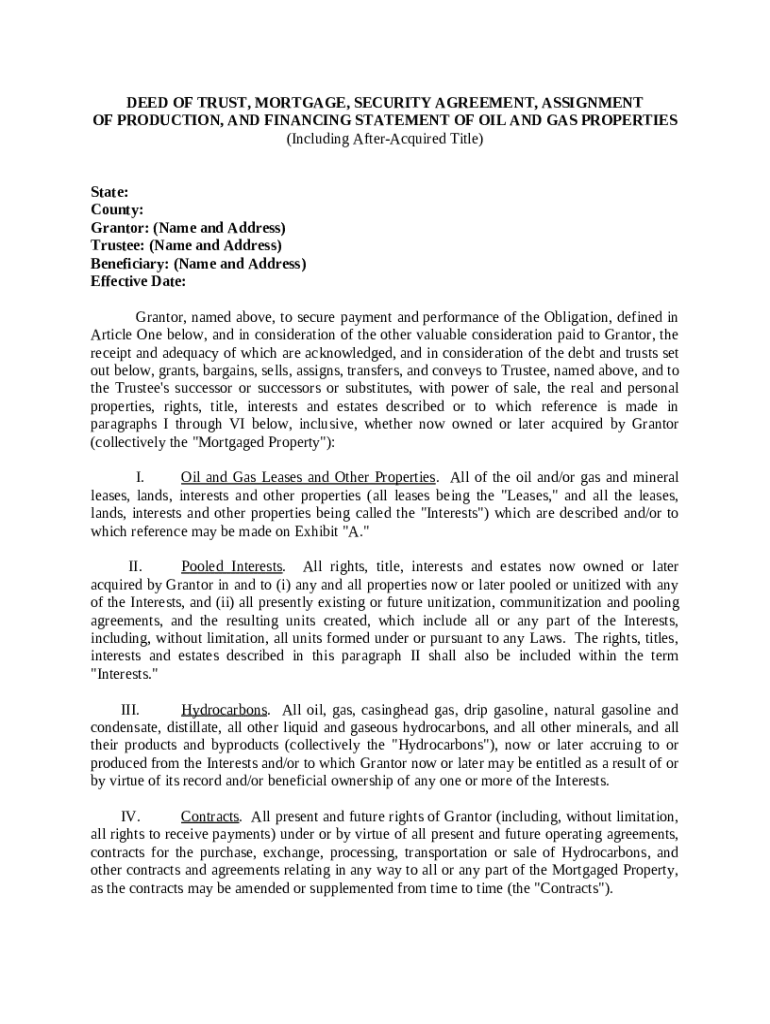

This form is used when the Grantor, in consideration of the debt and trusts listed, grants, bargains, sells, assigns, transfers, and conveys to the Trustee, and to the Trustee's successor or successors

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed of trust mortgage

A deed of trust mortgage is a legal document that secures a loan by transferring the title of a property to a trustee until the borrower repays the loan in full.

pdfFiller scores top ratings on review platforms

It is a great PDF's editor and convertor but sometimes it changes a little bit the format and the speed is not the best :3

een okay, wish you could save more forms in file such as several Proposal with changed name.

I've only used it a few times, but I think that I might be using it more over the next couple of years, as my daughter finishes high school and goes through the college application process! She's also on a couple of sports teams which require the same forms every year; it will be nice to have the info already entered and just modify some dates!

So far has been ok. IRS schedule D page 2 seems to be incorrect compared to form downloaded from IRS.gov.

too many pop up survey ads EVERY TIME I go to use it!!!!!

PDFfiller made everything so much easier.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Deed of Trust Mortgage Form

How to fill out a deed of trust mortgage form

Filling out a deed of trust mortgage form is crucial for securing loans against a property. The process involves gathering essential information about the parties involved and accurately completing the form. It's important to review the common pitfalls to avoid errors that can affect the validity of the document.

What is a deed of trust mortgage?

A deed of trust is a security instrument used in real estate transactions to secure a loan. It involves three parties: the borrower (grantor), the lender (beneficiary), and a third-party trustee who holds the title until the loan is repaid. This arrangement differs from a traditional mortgage where the borrower directly offers the property as security to the lender.

-

A deed of trust acts as a collateral agreement between the borrower and the lender, securing the loan with the property.

-

Unlike mortgages, deeds of trust use a trustee to hold the title, providing a smoother foreclosure process if the borrower defaults.

-

Having a formal deed of trust is essential for legally protecting lenders' interests and ensuring proper recourse in case of loan default.

What are the components of a deed of trust?

A deed of trust consists of several key components which ensure clarity and legality. These components detail the roles and responsibilities of each party involved in the transaction.

-

The person who borrows the money and gives the property as collateral.

-

An impartial third party who holds the title to the property until the loan is repaid.

-

The lender or financial institution that grants the loan.

-

Accurate descriptions and valuations of the property are crucial to prevent legal complications.

How do you fill out a deed of trust mortgage form?

Filling out the deed of trust mortgage form can be streamlined by following a systematic approach. Here’s a comprehensive step-by-step guide.

-

Collect vital details such as the names and addresses of the grantor, trustee, and beneficiary.

-

Pay special attention to the effective date and ensure the property description is precise, usually attached as 'Exhibit A'.

-

Ensure information is complete and correctly identifies all parties involved. Misidentifications can delay the process.

What types of property are covered under a deed of trust?

Deeds of trust can secure a variety of property types, each with specific implications. Understanding these types is integral for appropriate use.

-

These properties often have distinct lease agreements. It is important to understand the legal implications involved.

-

Defined as collective ownership of resources, pooled transactions can complicate agreements and introduce unique legal challenges.

-

Properties involving hydrocarbons enhance the complexity of deeds of trust due to fluctuating market values and associated risks.

How to manage and edit your deed of trust on pdfFiller?

pdfFiller provides a powerful cloud-based platform to manage your deed of trust mortgage form efficiently. Its array of features simplifies documentation tasks.

-

Use pdfFiller’s editing tools to make adjustments easily, ensuring that your document reflects all necessary changes.

-

Send the deed of trust for electronic signatures, streamlining the validation process and reducing paper trail complications.

-

Share documents securely with necessary parties while setting access permissions according to the intended audience.

-

Easily store and retrieve completed forms for future use, ensuring they are readily accessible when needed.

What legal considerations are there for deeds of trust?

Deeds of trust are subject to regional regulations, making it essential to understand local laws that affect their validity and acceptance.

-

Each state may have distinct laws governing deeds of trust, therefore, verifying compliance with state-specific requirements is crucial.

-

It's essential to keep comprehensive records of all changes to the deed of trust, including documentation of obligations met or changes in signatories.

What are common scenarios related to deeds of trust?

Understanding potential scenarios associated with deeds of trust can prepare you for unforeseen circumstances in property transactions.

-

In case of default, the trustee may initiate foreclosure proceedings to recover the owed amount.

-

Once the obligations are fulfilled, procedures must be followed to release the deed and clear the property title.

-

Deeds of trust can be modified post-execution, but this typically requires mutual consent and adherence to legal channels.

How to fill out the pdffiller template

-

1.Open the document template for the deed of trust mortgage on pdfFiller.

-

2.Start by entering the date of the transaction at the top of the document.

-

3.Fill in the names and addresses of the borrower(s) and lender.

-

4.Provide the legal description of the property being mortgaged.

-

5.Enter the loan amount in the designated section.

-

6.Specify the interest rate and repayment terms clearly.

-

7.Include any additional provisions or conditions as required.

-

8.Double-check all entered information for accuracy and completeness.

-

9.Use the pdfFiller tools to adjust fonts and layouts as necessary.

-

10.Once completed, save the document and send it for required signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.