Get the free IPO Time and Responsibility Schedule template

Show details

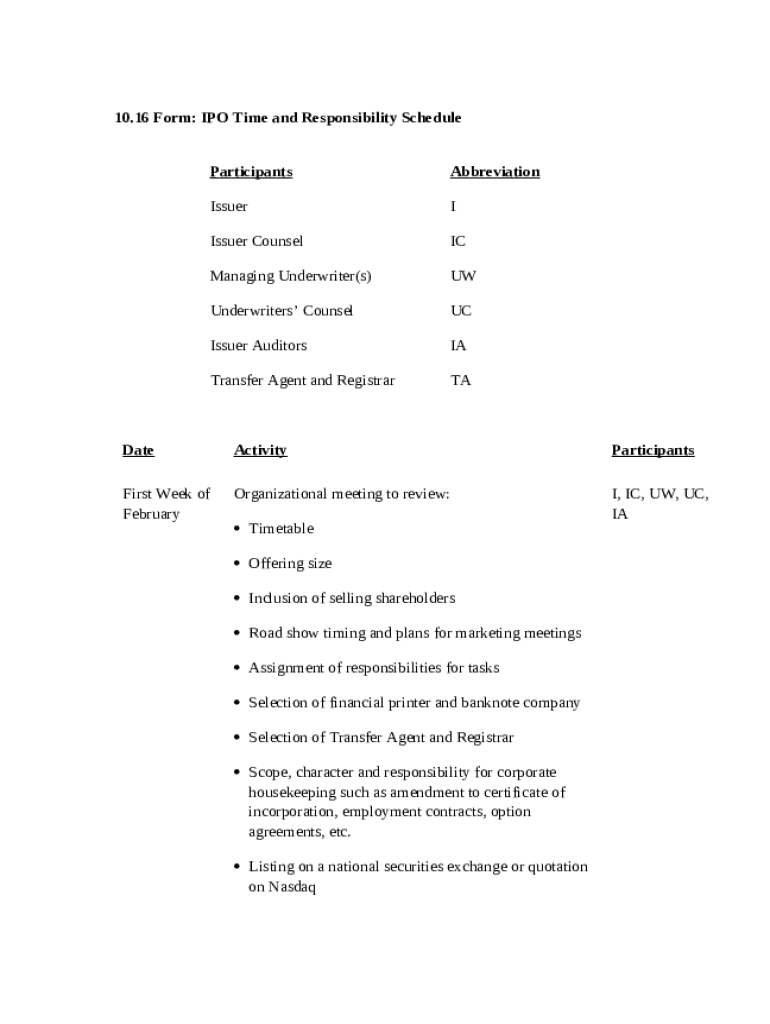

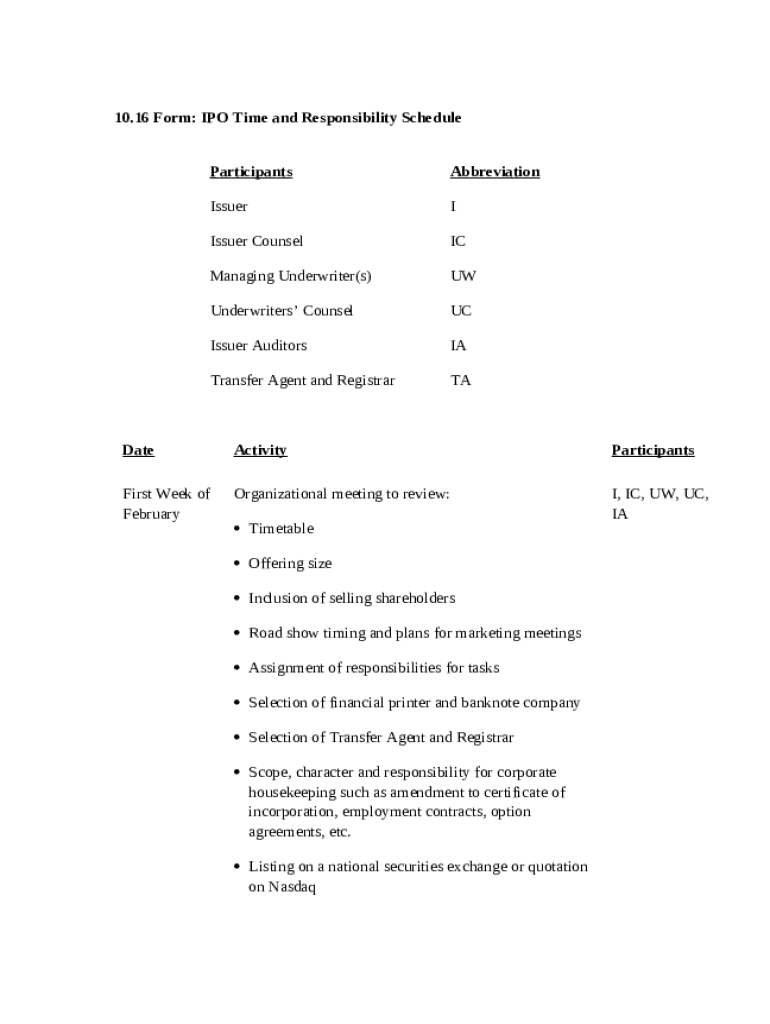

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is ipo time and responsibility

'IPO time and responsibility' refers to the allocation of tasks and timelines associated with the Initial Public Offering process.

pdfFiller scores top ratings on review platforms

So wonderful to use! I will use this again!

I stumbled onto this software product because I needed to redo a 2012 - 1099 form. Since then, I've used it for other forms and I LOVE THE SOFTWARE!! I can't tell enough other people how great it is.

Excellent, makes filling out fillible forms a breeze

Good overall. Had some difficulty with the text portion, it kept filling in lines over lines I had just typed.

Best PDF Filler I have found. Works like it should!

Would be nice if you had a feature that would allow you to duplicate an image or header type across multiple pages in a file. If it is there my apologies, but I could not easily find it.

Who needs ipo time and responsibility?

Explore how professionals across industries use pdfFiller.

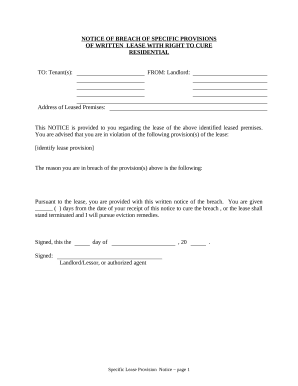

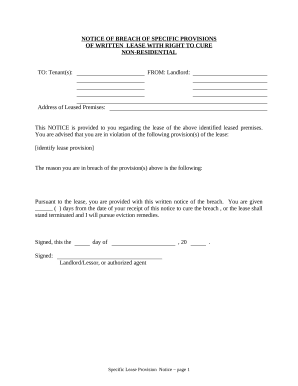

IPO time and responsibility form guide

The IPO time and responsibility form is a crucial document for managing the intricacies of the Initial Public Offering process. Knowing how to fill out this form can streamline communication among stakeholders and clarify responsibilities. This guide will provide a comprehensive overview to ensure you navigate this process efficiently.

To fill out a successful IPO time and responsibility form, begin by gathering all necessary documentation and participants involved in the process, which typically includes the issuer, underwriters, legal counsel, and auditors. Once information is organized, carefully outline the timelines and assign responsibilities to each participant.

What is the IPO process?

The Initial Public Offering (IPO) process allows a private company to become publicly traded through the sale of shares to investors. It serves as a significant event in a company's history and requires the collaboration of various key players.

-

The company that is offering its shares for sale.

-

Financial institutions that lead the IPO process and help determine the offering price.

-

Legal advisors who help ensure compliance with regulations.

-

Independent firms tasked with reviewing the company's financials and ensuring accuracy.

The time and responsibility schedule is key in managing tasks because it defines each participant's role, ensuring efficient communication and task completion.

What are the stages in the IPO timeline?

Navigating the IPO timeline involves multiple phases, each with specific tasks to fulfill. The timeline typically includes pre-filing, filing, and post-offering periods.

Pre-Filing Period: Weeks 1-6

-

Discussion of key offering details amongst stakeholders.

-

Choosing financial printers, transfer agents, and other key participants.

-

Preparation for SEC pre-filing conferences to address compliance.

Filing Period: Weeks 7-10

-

Gathering necessary financial documents and completing the registration statement.

-

Conducting legal and business assessments to mitigate risks.

-

Drafting documents to gather insights from officers and directors.

How are roles and responsibilities defined?

Clearly delineating roles and responsibilities among participants is vital for a smooth IPO process. Each team member's duties should be specified in the IPO time and responsibility form to avoid confusion and overlap.

-

Responsible for legal compliance and drafting required documents.

-

Facilitate the pricing and sale of shares.

-

Ensure financial accuracy and integrity throughout the offering.

Regular collaboration and communication can enhance the efficiency of each participant’s performance.

Why is managing complex documentation important?

Proper documentation is essential for successful IPO completion. With numerous legal documents involved, utilizing tools like pdfFiller can significantly improve efficiency.

-

Use pdfFiller to edit and eSign all relevant documents easily.

-

Collaborate with stakeholders while ensuring data privacy and security.

-

Maintain compliance by tracking document changes throughout the process.

What common challenges arise during an IPO?

The IPO process can present various challenges that need to be anticipated and managed effectively.

-

Failure to meet compliance requirements can lead to delays.

-

Unforeseen issues can impact investor confidence and interest.

-

Timely payments are crucial to avoid penalties that could hinder the IPO process.

Implementing best practices can help mitigate these risks and keep the IPO on track.

How to finalize the offering?

Finalizing an IPO requires a series of critical actions, ensuring that all legal requirements are met.

-

Ensure adherence to SEC regulations before the offering.

-

Companies must maintain continuous documentation post-offering.

-

Understand the shift from private to public company with new reporting obligations.

Properly managing these final steps is essential for a smooth transition as a publicly traded entity.

What user support is available for pdfFiller?

pdfFiller offers numerous resources to assist users throughout the IPO process.

-

Access various templates related to IPO documentation.

-

Utilize features for preparing and managing IPO documents.

-

Get assistance for any document-related questions through pdfFiller’s support.

How to fill out the ipo time and responsibility

-

1.Open the IPO time and responsibility document on pdfFiller.

-

2.Review the existing template or create a new one if necessary.

-

3.Fill in the company name and specific IPO details at the beginning of the document.

-

4.Identify key milestones in the IPO process, such as regulatory filings, marketing periods, and final pricing.

-

5.Assign responsibilities for each task to relevant team members; ensure clarity on who does what.

-

6.Set deadlines for each task, ensuring they align with overall IPO timeline requirements.

-

7.Include any necessary notes or comments for clarification on tasks or responsibilities.

-

8.Once completed, review the document for accuracy and completeness with your team.

-

9.Finally, save and export the document in your desired format for distribution or record-keeping.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.