Last updated on Feb 17, 2026

Get the free Subordination Agreement with no Reservation by Lienholder template

Show details

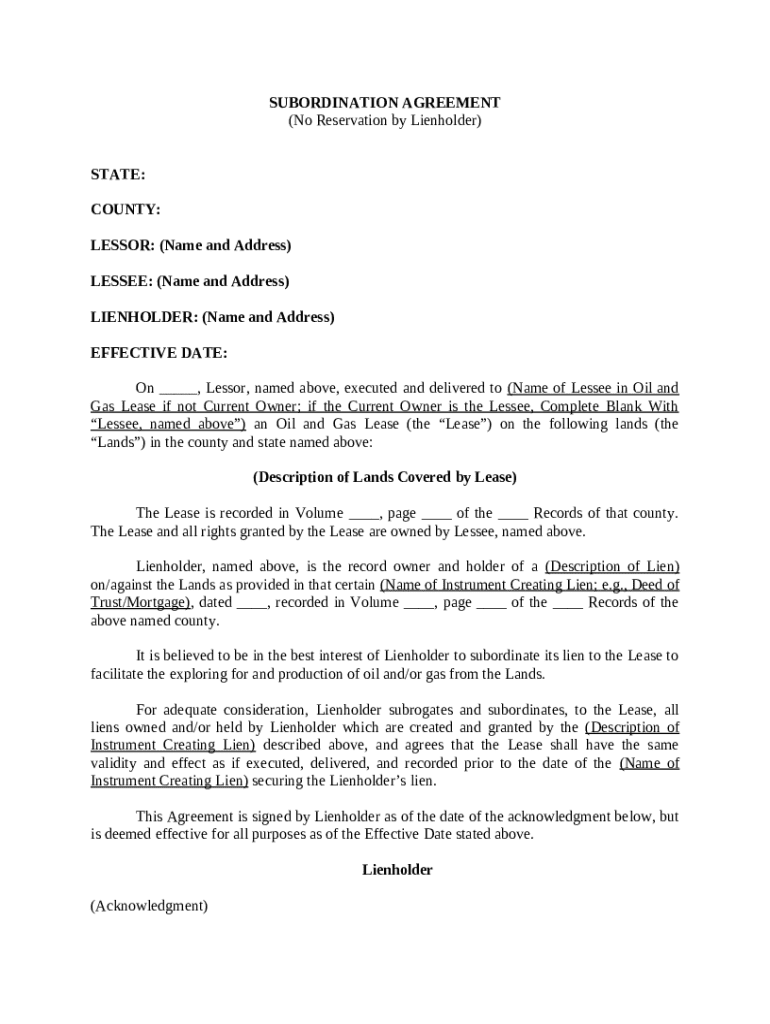

This form provides for a lienholder to subordinate all its interests in liens created by a deed of trust or mortgage, to an oil and gas lease on the lands that are the subject of the lien.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is subordination agreement with no

A subordination agreement with no is a legal document that establishes the hierarchy of debts, indicating that one debt takes precedence over another in the event of default.

pdfFiller scores top ratings on review platforms

Just a little confusing on how to get to the document

Just a bit complicated to learn how to use the system for an 'oldie' but I'm sure it would become more familiar with more frequent usage. Thank you for allowing a trial to test the systems functionality.

My experience as been wonderful and awesome

It's great to be able to fill out any pdf online. It looks so much more professional. I find the site to be very intuitive and self-explanatory. I've been able to figure out everything I needed just by doing it. I wish the subscription wasn't so expensive though because I don't feel I can afford it. The free trial is a great introduction.

Extremely easy to use and very user friendly. Does exactly what I want it to do.

PDF Filler resulted to me a very useful and agile application.

Who needs subordination agreement with no?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Subordination Agreements with No Formal Form

TL;DR: How to fill out a subordination agreement with no formal form

To fill out a subordination agreement with no formal form, begin by providing essential details about the parties involved, including the Lessor, Lessee, and Lienholder. Specify the effective date and describe the nature of the lienholder's interest in the property. Review for accuracy, and ensure all necessary signatures are obtained before finalizing.

What is a subordination agreement?

A subordination agreement is a legal document that establishes the hierarchy of claims on a property. In financial contexts, especially in the oil and gas industry, it is crucial for defining which lenders have priority over others in the event of a default. This agreement typically involves three parties: the Lessor, who owns the property, the Lessee, who leases the property, and the Lienholder, who has a legal claim against the property.

-

The property owner or landlord, granting access to the Lessee.

-

The party renting the property, often involved in resource extraction.

-

A creditor with a claim against the property that must be honored during repayment.

What are the purpose and benefits of subordination agreements?

Subordination agreements play a vital role in facilitating financial transactions by clarifying the priority of claims. For lienholders, subordinating their interest can be beneficial in situations where it allows for new financing that supports resource exploration and production. This flexibility can lead to increased investment opportunities, ultimately benefiting all parties involved.

-

Allows for effective financing options for companies in resource extraction.

-

Lienholders can secure additional financing by agreeing to subordinate their claims.

-

Useful in various scenarios, such as refinancing loans or permitting new projects.

What types of subordination agreements are there?

There are primarily two types of subordination agreements: executory and automatic. Each serves a distinct purpose based on the needs of the parties involved. Understanding the differences is crucial for ensuring the correct type is used in a transaction.

-

A negotiated agreement where terms are explicitly defined for the creditors.

-

Automatically places one creditor's interest behind another in the event of default; less negotiation required.

-

Executory requires negotiation; Automatic is generally predefined within certain frameworks.

How to fill out a subordination agreement

When filling out a subordination agreement, it is essential to include accurate information for all parties involved. Start with basic information about the state and county, followed by details for each party—Lessor, Lessee, and Lienholder. Specify the effective date, and detail the land description and nature of the lien.

-

Names and addresses of all parties, property description, and loan details.

-

Break down each section to ensure clarity for legal binding.

Accuracy is paramount; even a small mistake can lead to legal disputes or financing issues. Ensure professional oversight, especially in high-stakes agreements involving substantial financial interests.

What are the best practices for document management?

Effective document management ensures easy access and collaboration among teams. Tools like pdfFiller allow for seamless editing and electronic signatures, making it easier to handle subordination agreements efficiently. Adequate storage and organization of documents prevent loss and facilitate quick retrieval.

-

For seamless PDF editing and electronic signatures that expedite agreement processes.

-

Implement a management system for quick access and retrieval when needed.

-

Utilize cloud technology for real-time document collaboration and team feedback.

What legal considerations and compliance should be adhered to?

Legal compliance is crucial when drafting a subordination agreement. Each jurisdiction may have different requirements affecting the validity of the agreement. Understanding local laws helps prevent unenforceable claims and protects all parties.

-

Research the specific legal stipulations applicable to your area regarding agreements.

-

Evaluate how the law influences the agreement's enforceability depending on location.

-

Seek legal counsel when unsure to avoid costly mistakes and ensure compliance.

Where can find an example template of a subordination agreement?

Having access to a template simplifies the drafting process for subordination agreements. A well-structured template can highlight key sections and their purposes, ensuring that all necessary details are covered. Customizable templates are available on pdfFiller, making routine documentation straightforward.

-

Templates should be easy to follow and include all necessary clauses.

-

Ensure main elements, such as parties involved and claim details, are clearly delineated.

-

Use available resources to tailor the template for specific needs.

How to fill out the subordination agreement with no

-

1.Open the subordination agreement document on pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the names of all parties involved in the agreement in the designated fields.

-

4.Specify the details of the primary loan and any subordinate loans, including amounts and terms.

-

5.Clearly state the terms under which the subordination applies.

-

6.Include any conditions or clauses that govern the agreement, ensuring clarity on all points.

-

7.Review the document for accuracy, checking for any missed fields or errors.

-

8.Once confirmed, save your changes and choose the option to print or email the filled agreement directly from pdfFiller.

-

9.Make sure all parties sign the document where indicated to finalize the agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.