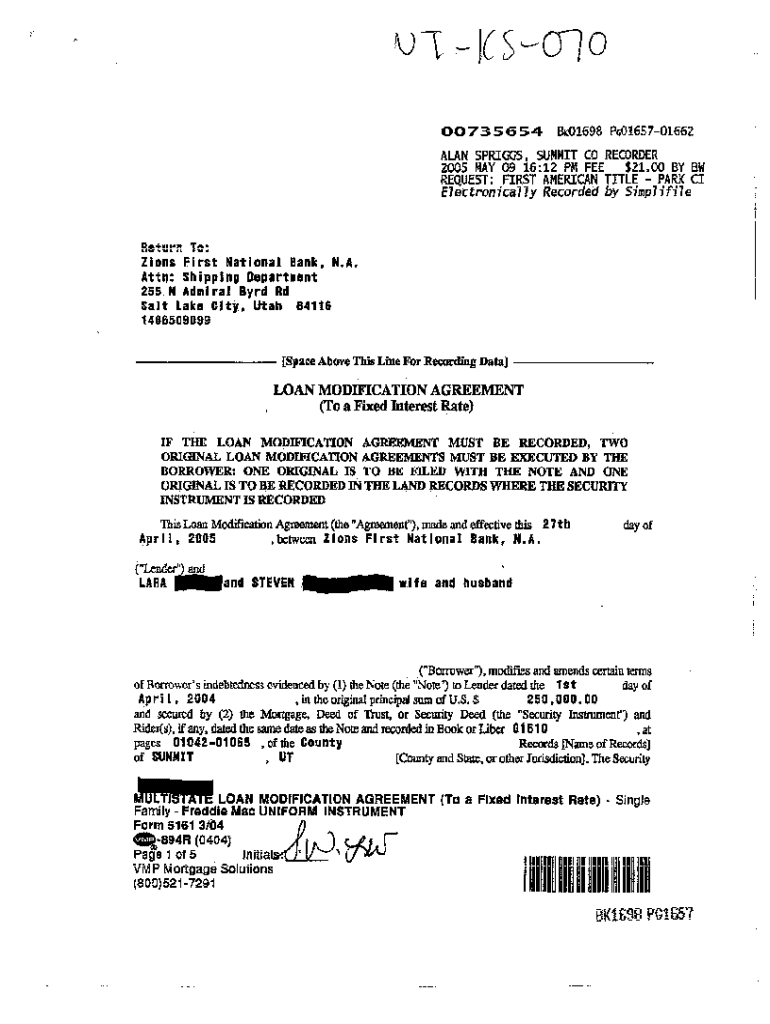

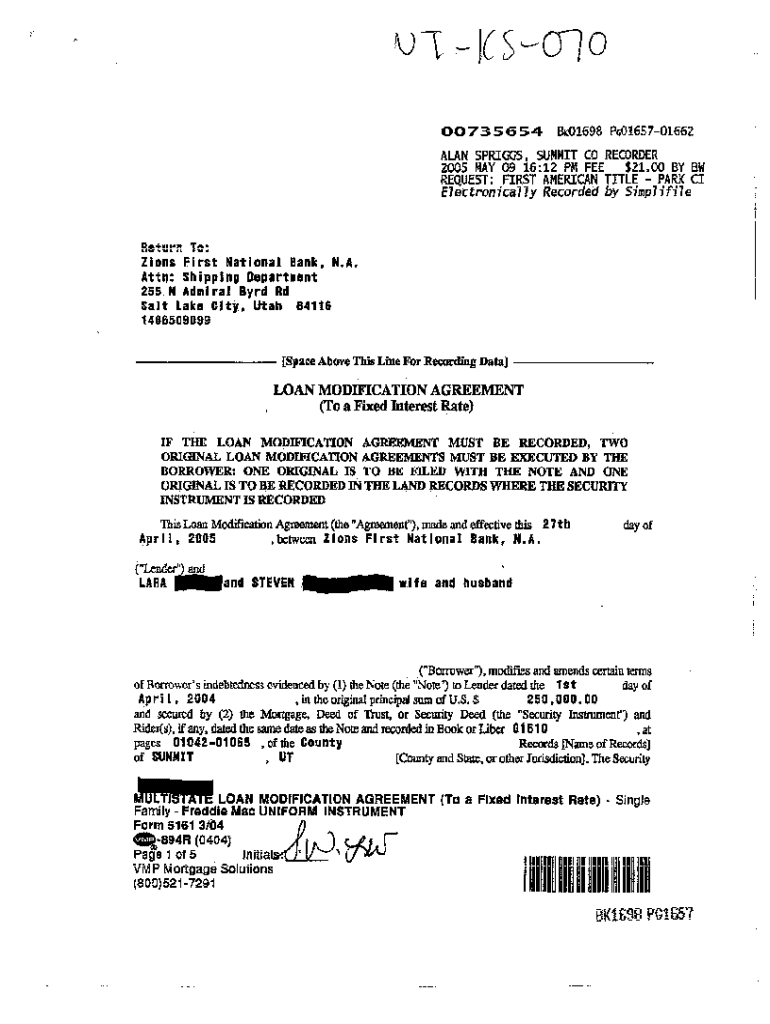

Get the free Loan Modification Agreement - To a Fixed Interest Rate

Show details

Loan Modification Agreement - To a Fixed Interest Rate

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan modification agreement

A loan modification agreement is a legal document that changes the terms of an existing loan, particularly to make payments more affordable for the borrower.

pdfFiller scores top ratings on review platforms

i love this program i will tell people about this

The fillable forms have saved me lots of time and headaches ... could not do without them!

Needed it only for single project. Not needed now.

So far so good. I don't particularly like receiving notification of pricing terms after I've done the work of filling in the form(s). You should present pricing up front. Otherwise, I appreciate the service you're providing.

I really like the fact that I can download PDF files, fill them in and save them on my computer. Once they are saved I can then print them or go in and change them.

The forms were easy to use and print. This was my first time using PDFfiller.

Who needs loan modification agreement?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Loan Modification Agreement Form on pdfFiller

How does a loan modification agreement work?

A loan modification agreement is a legal document that changes the original terms of a mortgage loan to make it more manageable for the borrower. This may include adjustments to interest rates, payment schedules, and the overall loan term itself. Such modifications often assist homeowners experiencing financial difficulties by reducing their monthly payments or extending the time they have to repay the debt.

-

Loan modification modifies existing loan terms to prevent foreclosure. It's essential for borrowers struggling with payments.

-

Homeowners often seek modifications due to job loss, medical bills, or divorce, which affect their financial situation.

-

By modifying a loan, borrowers can often avoid foreclosure, enabling them to retain their homes and continue making payments.

What are the key elements of a loan modification agreement?

Understanding the key components of a loan modification agreement is crucial for both lenders and borrowers. A well-structured agreement includes various critical elements that ensure clarity and legality.

-

Includes borrower information, formatted loan details, and the terms of modification, such as interest rates and payment amounts.

-

Specifies changes such as payment adjustments, changes in interest rates, and potential extensions in loan term durations.

-

Both parties must sign and date the agreement to validate the modifications legally.

How to navigate pdfFiller's loan modification agreement form template?

pdfFiller offers an intuitive platform to streamline accessing and customizing loan modification agreement templates. Users can quickly find what they need and make the necessary adjustments in a few clicks.

-

Start by locating the loan modification template within pdfFiller’s library for easy editing.

-

Utilize tools to edit text, add fields, and personalize your agreement to suit your particular situation.

-

Leverage interactive tools that allow for eSigning and sharing the document with relevant parties securely.

What is the process of filling out a loan modification agreement form?

Filling out a loan modification agreement form requires attention to detail to ensure accuracy. A well-completed form can significantly speed up the approval process and reduces the potential for errors.

-

Carefully input data in each section of the form, including personal information, loan number, and proposed modifications.

-

Double-check all entries for correctness to avoid any delays or rejections due to inaccuracies.

-

Watch out for typical errors such as missing signatures, incorrect dates, or incomplete information, which could hinder the process.

How to review and edit your loan modification agreement?

Prior to finalizing your loan modification agreement, reviewing it for accuracy is crucial. pdfFiller provides robust features that can help streamline this process.

-

Utilize pdfFiller’s tools to meticulously check your agreement against requirements and lender guidelines.

-

Invite others to review and provide feedback directly on the document, making adjustments easier.

-

Track changes in your document and manage different versions effectively to adhere to evolving terms or conditions.

What steps should you take to finalize and manage your loan modification agreement?

Properly finalizing and managing your loan modification agreement can ensure a smoother experience when submitting it to your lender. It is essential to keep track of what happens post-submission.

-

Use pdfFiller to eSign your loan modification agreement, ensuring that it is legally binding and ready for submission.

-

Store the signed document securely within pdfFiller’s cloud platform, minimizing any risk of losing vital paperwork.

-

Once submitted to the lender, keep track of any communications and updates, and follow up as necessary.

What compliance and legal considerations should you be aware of?

Navigating the legal landscape surrounding loan modifications can be complex. Therefore, understanding relevant regulations is critical to ensure compliance.

-

Familiarize yourself with both federal and state laws governing loan modifications, which vary significantly by region.

-

Adhering to these legal frameworks is crucial to avoid potential repercussions from the lender or troubles down the line.

-

Improperly executed agreements can result in penalties or denial of modification requests, which can severely impact one's financial situation.

How can you leverage pdfFiller for document management?

pdfFiller not only provides template solutions but also enhances overall document management capabilities. This ensures teams can collaborate effectively and stay organized.

-

Explore features beyond templates, including the ability to track document access and history.

-

pdfFiller promotes collaboration workflows, allowing teams to streamline their document processing.

-

Cloud-based access means you can work from anywhere, making modifications and approvals faster and more efficient.

How to fill out the loan modification agreement

-

1.Open the loan modification agreement template on pdfFiller.

-

2.Read through the document to understand the terms and conditions.

-

3.Begin with your personal information; enter your name, address, and contact details in the designated fields.

-

4.Next, fill in your loan information including the loan number, the original balance, and current terms.

-

5.Proceed to the modification details section and provide requested changes such as new payment amounts, interest rates, and repayment term.

-

6.Review the specific conditions laid out in the agreement; ensure all provided information is accurate and matches your financial situation.

-

7.Sign the document electronically using pdfFiller’s signature tool, making sure to also date your signature.

-

8.If applicable, have any co-signers or joint borrowers sign the agreement as well.

-

9.Download the completed agreement for your records and send it to your lender as instructed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.