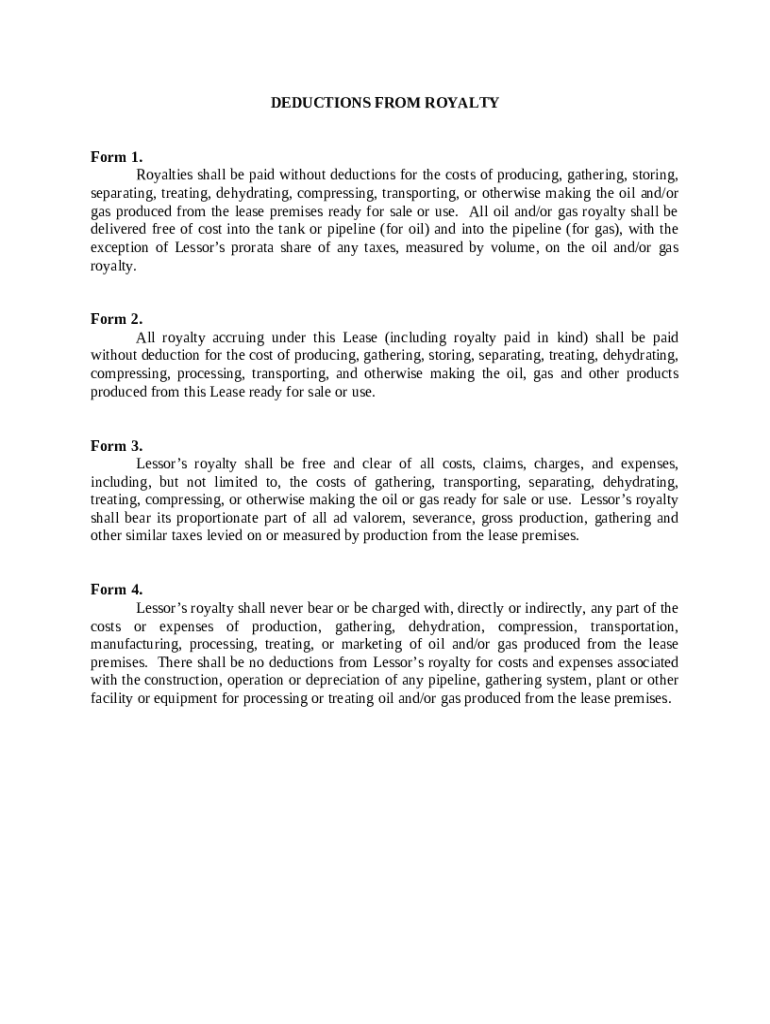

Get the free Deductions from Royalty template

Show details

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

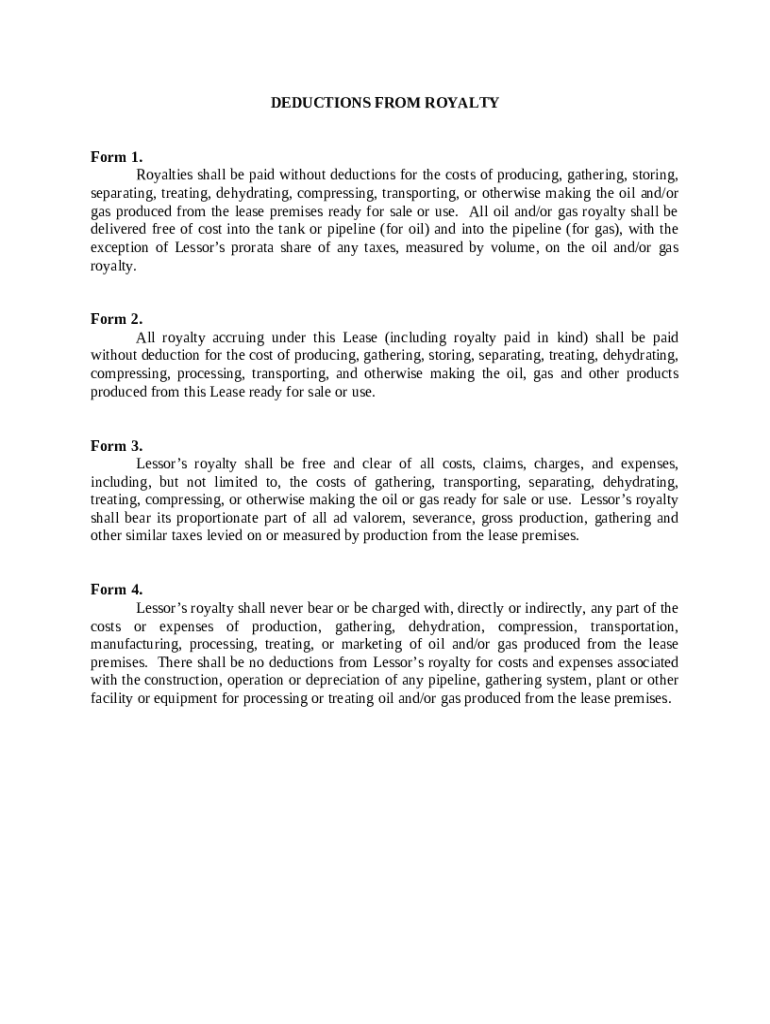

What is deductions from royalty

Deductions from royalty refer to the specific amounts subtracted from royalty payments to account for various expenses or obligations as agreed upon in a contractual agreement.

pdfFiller scores top ratings on review platforms

It makes doing my business so much easier!

Good software although a bit pricey for one off use and does have a few minor glitches but still a good overall experience

It is very simple and friendly to deal wtih PDF fille

Saved my life living abroad I was able to fill out some important documents

After trying another PDF filler, your site is wonderful. Everything about my project worked just as you stated. Thank you so much

Works well overall for me so far, but the CA FTB Form 100 is a little clunky.

Who needs deductions from royalty template?

Explore how professionals across industries use pdfFiller.

Deductions from Royalty Form Form

How can fill out a deductions from royalty form form?

To fill out a deductions from royalty form form, start by gathering all necessary documentation related to royalty payments. Carefully review the specific requirements for royalty deductions based on federal and state regulations, then input your financial data accurately into the designated fields. Finally, ensure that all collaborative reviews are completed before submission.

What are deductions from royalty payments?

Deductions from royalty payments refer to the various costs or expenses that can be subtracted from the total gross royalty income an individual or entity earns. These deductions are critical for accurately determining net income from royalty interests, and they often involve complex policies outlined in agreements and relevant laws. Understanding these deductions helps ensure compliance with industry regulations.

-

Royalty payments are compensation made to the owner of a property or resource for its use, typically calculated as a percentage of revenue generated from extraction or production.

-

Royalty payments serve as a crucial income source for landowners and stakeholders in industries such as oil, gas, and mining.

In the oil and gas industry, for instance, companies must navigate specific federal and state regulations that address what can be deducted from gross royalties. These regulations vary by region, impacting how stakeholders manage their financial reporting.

What forms are related to royalties?

Different forms govern the structure and conditions of royalty payments. Understanding these forms and their implications is essential for proper compliance and audit readiness.

-

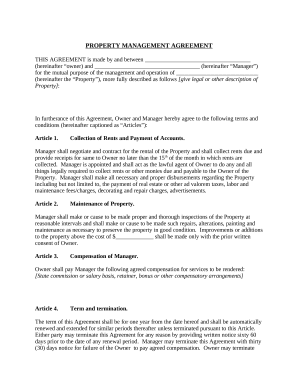

Outlines the standard payment mechanism for royalties, specifying the base terms under which payments are made.

-

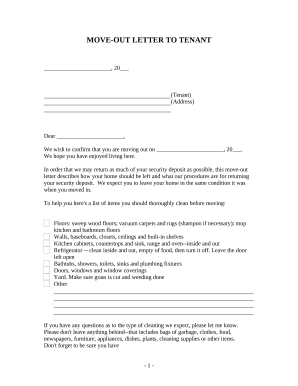

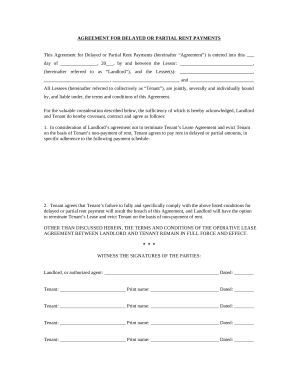

Details specific conditions under which royalty payments are made, including payment timelines and penalties for delays.

-

Indicates royalties that may be exempt from certain costs, thereby directly impacting tax obligations.

-

Outlines specific costs or expenses that cannot be deducted from gross royalty payments, critical for ensuring compliance.

What key clauses exist in royalty agreements?

Royalty agreements can include various clauses that dictate payment structures and the circumstances under which deductions can be made.

-

Focuses on payment structures that dictate how and when payments are made without deductions.

-

Examines conditions tied to payments, outlining exceptions that may apply.

-

Identifies costs that may be exempt, influencing claim processes.

-

Ensures specific costs are excluded from deductions, maintaining compliance with agreements.

What tax implications are associated with royalty deductions?

Navigating tax implications for royalty deductions is crucial for accurate financial reporting and compliance. Deductions can impact taxable income, necessitating a thorough understanding of severance and production taxes.

-

Severance taxes are imposed on the extraction of non-renewable resources, while production taxes relate to income generated from those resources; both can affect royalty income.

-

Deductions can lower taxable income, potentially leading to reduced tax burdens if accurately reported.

-

Following established guidelines can help ensure that royalty-related taxes are calculated correctly, maintaining compliance with regulatory standards.

How to manage deductions from royalties effectively?

Effective management of deductions from royalties necessitates appropriate documentation and tools to streamline the process.

-

pdfFiller provides a comprehensive platform for creating, editing, and managing royalty forms efficiently.

-

Clear instructions assist users in accurately filling out forms, ensuring compliance and accuracy.

-

Utilizing collaboration tools aids in managing document revisions, enhancing team productivity.

What challenges may arise in managing royalty deductions?

Stakeholders often face challenges, including misinterpretations of deduction clauses and conflicts with lessors. Understanding best practices can mitigate these challenges.

-

Without clear understanding, stakeholders may face disputes, leading to potential financial losses.

-

Disputes can arise over interpretations of royalty agreements, necessitating proactive communication strategies.

-

Developing clear strategies for resolving disputes can lead to better outcomes and maintain professional relationships.

What tools and resources can help with royalty forms?

A range of tools and resources is available through pdfFiller, enhancing the efficiency and effectiveness of managing royalty documents.

-

Cloud-based management enables users to access documents from anywhere, improving flexibility and collaboration.

-

pdfFiller's features facilitate easy form creation and eSigning, reducing the time and effort required.

-

Integration with compliance tools ensures that users remain up-to-date with changing regulations, safeguarding against penalties.

How to fill out the deductions from royalty template

-

1.Open the PDF form for deductions from royalty on pdfFiller.

-

2.Begin by entering your name and contact details at the top of the document.

-

3.In the designated section, input the total royalty amount before deductions.

-

4.List each deduction individually, providing a brief description for each (e.g., taxes, fees, advances).

-

5.For each deduction, enter the corresponding amount in the requested fields.

-

6.Ensure that the total deductions are calculated accurately and entered in the total deductions box.

-

7.Next, calculate the net royalty amount by subtracting total deductions from total royalty.

-

8.Review all entered information for accuracy and completeness before submission.

-

9.Once confirmed, save the filled form and follow the instructions for submitting it electronically or printing it.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.