Last updated on Feb 17, 2026

Get the free Tenant Audit Provision Fairer Negotiated Provision template

Show details

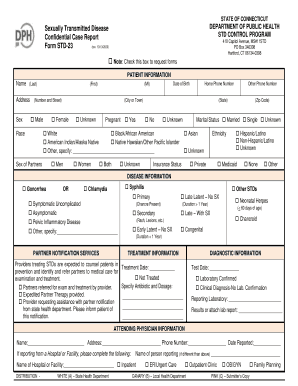

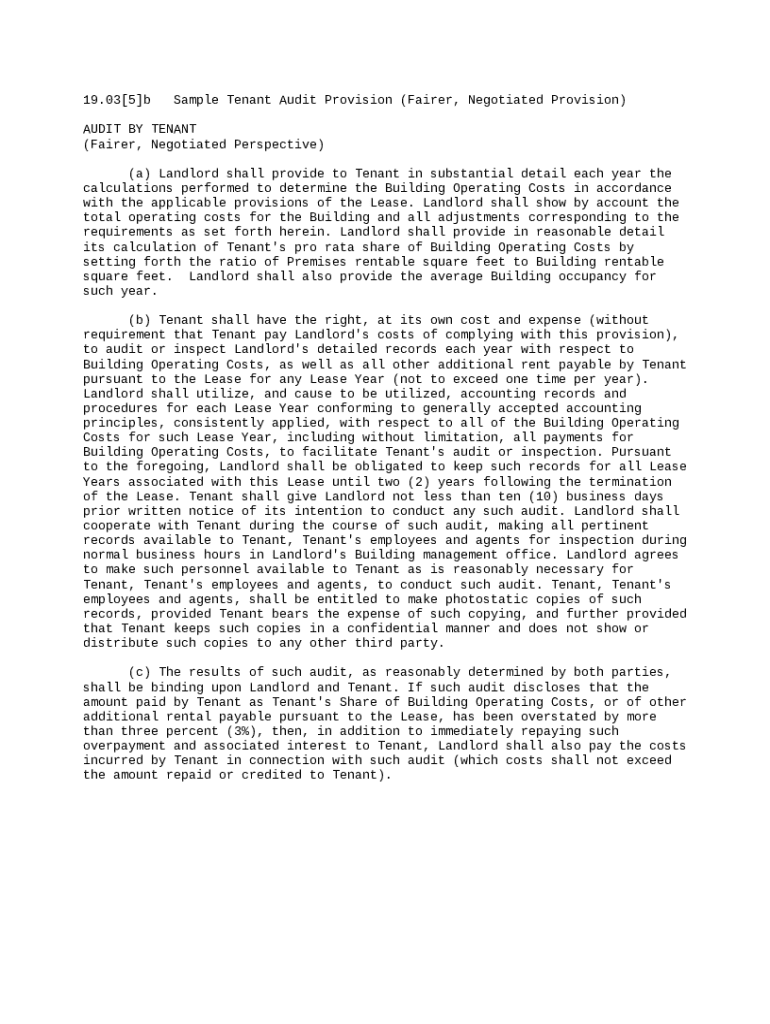

This office lease form is a provision from a negotiated perspective. The landlord shall provide to the tenant in substantial detail each year the calculations, accounts and averages performed to

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is tenant audit provision fairer

A tenant audit provision fairer ensures equitable evaluation and fairness in the auditing process of tenant leases and agreements.

pdfFiller scores top ratings on review platforms

I love PDF Filler...it is making my life much easie

I had a small learning curve but that wasn't too bad. I would like to find this document without typing in the entire web address.

I have been very pleased with the interface and chat support thus far.

PDF Filler makes sending import documents easy for me and the person I am sending it to.

it works and is helpful worth the every penny

Has made it easier to fill legal documents electronically

Who needs tenant audit provision fairer?

Explore how professionals across industries use pdfFiller.

Tenant audit provision: A comprehensive long-read guide

Understanding tenant audit provisions is essential for tenants wishing to protect their rights and ensure fair billing practices in commercial lease agreements. With a well-structured tenant audit provision, tenants can access crucial financial information from landlords, allowing them to verify that they are not overpaying for their share of building operating costs.

What is a tenant audit provision?

A tenant audit provision in a lease agreement allows tenants to review and verify the expenses charged by landlords. This process is vital for maintaining transparency in all financial dealings and ensuring that landlords adhere to the agreed-upon terms.

-

A tenant audit provision outlines the tenant's rights to access records and audit procedures concerning billing.

-

These provisions ensure that tenants can confidently manage their financial obligations and avoid inflated costs.

What are the key elements of fairer tenant audit provisions?

Fairer tenant audit provisions require landlords to provide detailed expense calculations, allowing tenants to understand their share of building operating costs. This transparency not only helps in verifying charges but also builds trust between tenants and landlords.

-

Landlords must provide clear and itemized calculations of all building operating costs.

-

Tenants should be able to determine their proportional share based on their rented square footage.

-

Landlords must keep accurate records that comply with Generally Accepted Accounting Principles (GAAP) to ensure credibility.

How does the audit process work?

Conducting a tenant audit involves several critical steps to ensure that the process is thorough and effective. From gathering necessary documents to effectively communicating with landlords, each step contributes to a successful audit.

-

Renters should collect all relevant lease agreements and operating expenses before starting the audit.

-

Ensure access to invoices, correspondence, and financial statements related to building operating costs.

-

Always inform landlords in advance about the intent to conduct an audit, ideally through written communication.

What challenges might arise during tenant audits?

Tenant audits can often face challenges such as lack of transparency, interpretation issues, or discrepancies in billing. Understanding these challenges is vital to mitigate problems and enhance the audit experience.

-

Landlords may not provide sufficient documentation, making audits difficult.

-

Vague lease terms can lead to disputes. It’s crucial to clarify all terms beforehand.

-

Ensure thorough review of figures to catch any potential overcharges or erroneous calculations.

What are the legal implications and compliance considerations?

Understanding the legal frameworks that govern tenant audits is crucial for both tenants and landlords. Each state or region may have different laws affecting tenants' rights in audit situations.

-

All states may have varying rules impacting the audit processes.

-

Certain federal laws can also affect how audits are conducted.

-

Landlords must ensure their record-keeping and audit processes comply with legal standards.

How can pdfFiller enhance the tenant audit process?

pdfFiller offers unique features that streamline the tenant audit process and promote effective communication between tenants and landlords. By leveraging interactive tools, tenants can easily manage their audit documents.

-

The platform allows for easy editing and annotation of PDF documents.

-

Tenants can securely sign documents electronically, expediting the process.

-

Enhances communication and coordination of audit processes between tenants and landlords.

What are the future trends in lease audits?

Analyzing current trends indicates that tenant audit provisions are evolving, driven by changes in technology and tenant rights awareness. Tenants need to adopt proactive strategies for future audits.

-

The increase in digital tools available for managing leases and audits can simplify the process for tenants.

-

An increase in focus on tenant protections will lead to more favorable audit provisions.

-

Tenants should remain educated and negotiate stronger audit terms.

How to fill out the tenant audit provision fairer

-

1.Open the tenant audit provision fairer template on pdfFiller.

-

2.Review the sections required for filling out the document, including tenant and landlord details.

-

3.Input the tenant's name and contact information in the designated fields.

-

4.Fill in the landlord's information, ensuring accuracy in contact details.

-

5.Include the specifics of the lease agreement such as start date, duration, and terms.

-

6.Detail any previous audits and the outcomes, including dates and findings.

-

7.Clarify the purpose of the audit provision, highlighting fairness and transparency expectations.

-

8.Once all fields are completed, review the information for accuracy and completeness.

-

9.Save the filled document on pdfFiller and choose whether to download or share it via email.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.