Last updated on Feb 17, 2026

Get the free Employee Benefits Covenant template

Show details

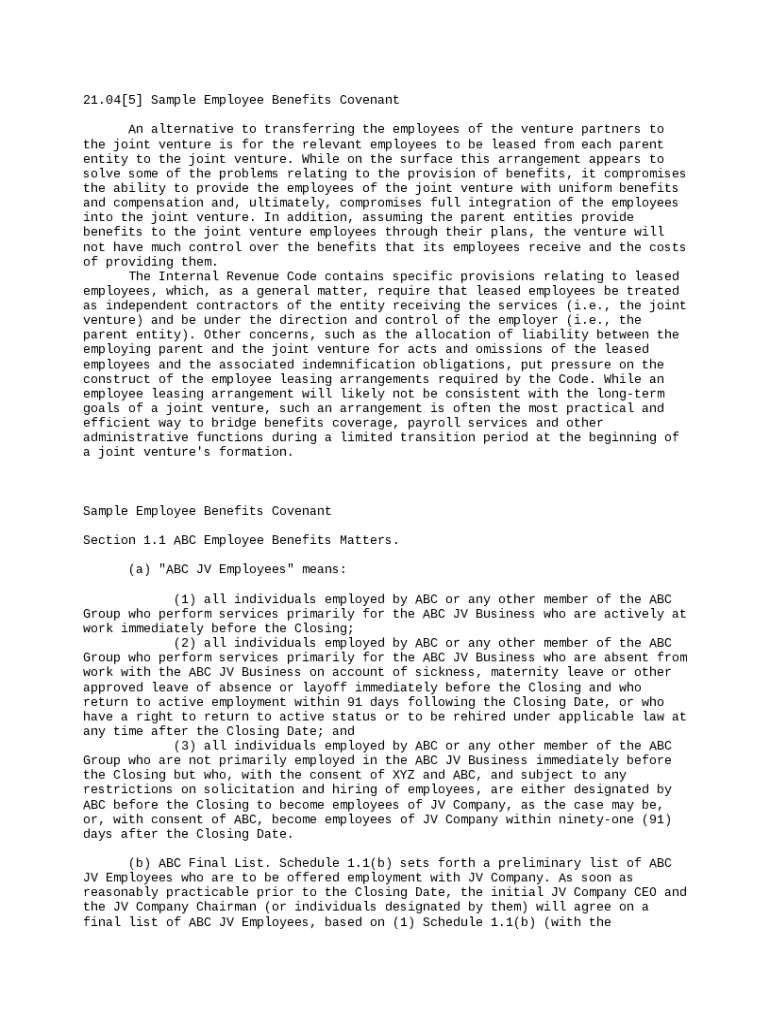

This is an example of an Employee Benefits Covenant for a Joint Venture that leases employees from the parent entities to the joint venture.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

Kristen helped me with trying to secure conncection by telling me I needed to clear out browser, cookies, etc...Thank you.

The program was easy to use. Allowed for different type of outputs. Form modification was a one stop shop. I highly recommend this program.

I like it very much. My only issue thus far is inserting the proper signing fields when using the app.

PDFfiller has SAVED my life! I don't have to waste time on re-typing files. I can get work done quickly and efficiently.

Life saver!!! PDF Filler deserves every penny that I spent.

You have been great. I count on you more and more.

Comprehensive Guide to Employee Benefits Covenant Form at pdfFiller

What is an Employee Benefits Covenant?

An Employee Benefits Covenant is an essential agreement that outlines the benefits provided to employees, especially in joint ventures. Understanding this covenant is pivotal for businesses that leverage employee leasing arrangements, ensuring compliance with relevant laws and standards. These agreements are integral to managing the expectations and rights of workers within any contractual framework.

Why are Employee Benefits Important in Joint Ventures?

Employee benefits play a crucial role in attracting and retaining talent in joint ventures. Well-structured benefits ensure that employees feel valued and secure in their roles, which enhances productivity. Joint ventures must pay particular attention to how they integrate benefits to maintain employee morale and operational efficiency.

Leasing Employees vs. Direct Employment: An Overview

Deciding between leasing employees or opting for direct employment influences various business strategies, particularly in cost management and compliance. While leasing can provide flexibility and reduce overhead, direct employment tends to foster loyalty and a closer company culture.

What are the Key Components of an Employee Benefits Covenant?

-

This section articulates specific benefits to be provided, such as healthcare, retirement plans, and paid time off, ensuring clarity for all parties involved.

-

Consistency in benefits across employees involved in the joint venture is critical to avoid resentment and confusion.

-

Detailing how benefits extend to leased employees versus directly employed workers helps in establishing fair practices.

When Should Businesses Consider Employee Leasing?

Businesses may opt for employee leasing when they seek to scale their workforce quickly without long-term commitments. This strategy can provide access to specialized talent without the overhead of full-time employment. It is particularly beneficial for projects requiring specific skills for a limited duration.

What are the Benefits and Risks of Employee Leasing?

-

Increased flexibility and reduced administrative burden are primary advantages, allowing businesses to focus on their core activities.

-

Employee leasing can create ambiguities regarding benefit provision, which may lead to legal disputes if not managed carefully.

What are the Legal Implications under the Internal Revenue Code?

Legal compliance is vital when engaging in employee leasing arrangements. The Internal Revenue Code provides regulations that must be adhered to, including taxation of employee benefits. Not understanding these implications could result in financial penalties and loss of employee trust.

How to Navigate the Challenges of Leasing Employees?

-

Understanding where control lies between the parent companies and the joint venture is essential to manage employee benefits effectively.

-

Clearly defining liability among entities for employee claims can protect joint ventures from unforeseen legal issues.

-

Including indemnity clauses in the covenant protects parties against financial losses resulting from employee-related claims.

What is Involved in Transitioning to Joint Venture Employee Coverage?

-

Creating a clear transition plan is key to ensure continuity of benefits during organizational changes.

-

Efficient payroll management during transition minimizes disruptions and maintains employee satisfaction.

-

Ensuring that administrative tasks are effectively managed during the transition reduces operational headaches.

How can pdfFiller’s Features Help in Document Management?

pdfFiller provides a seamless platform for managing employee benefits covenants, offering tools for editing, eSigning, and collaboration. This empowers teams to work efficiently on documentation and ensures that all compliance requirements are met swiftly. Utilizing these features can significantly streamline the management process.

What Can We Learn from Case Studies on Successful Employee Benefits Covenants?

-

Analyzing successful joint ventures that utilized employee leasing reveals strategies that enhance employee satisfaction.

-

Identifying effective practices from these ventures provides a framework for others looking to implement similar covenants.

-

Numerous regions have unique legal landscapes that inform how benefits can be structured, providing valuable insights for local businesses.

How to Fill Out the Employee Benefits Covenant Form?

-

Begin by gathering all necessary information about the employees and their respective benefits, then fill out the form as directed.

-

Ensure that all details are accurate and double-check for missing information, as this can delay the process.

-

Utilize pdfFiller’s cloud storage features to keep your form secure and accessible for future reference.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.