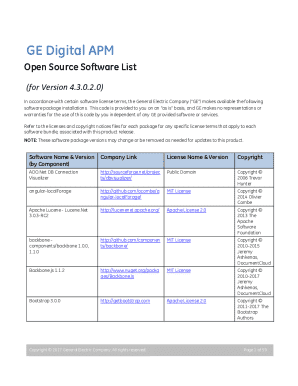

Get the free Provision Allocation Risks and Setting Forth Insurance Obligations of Both the Landl...

Show details

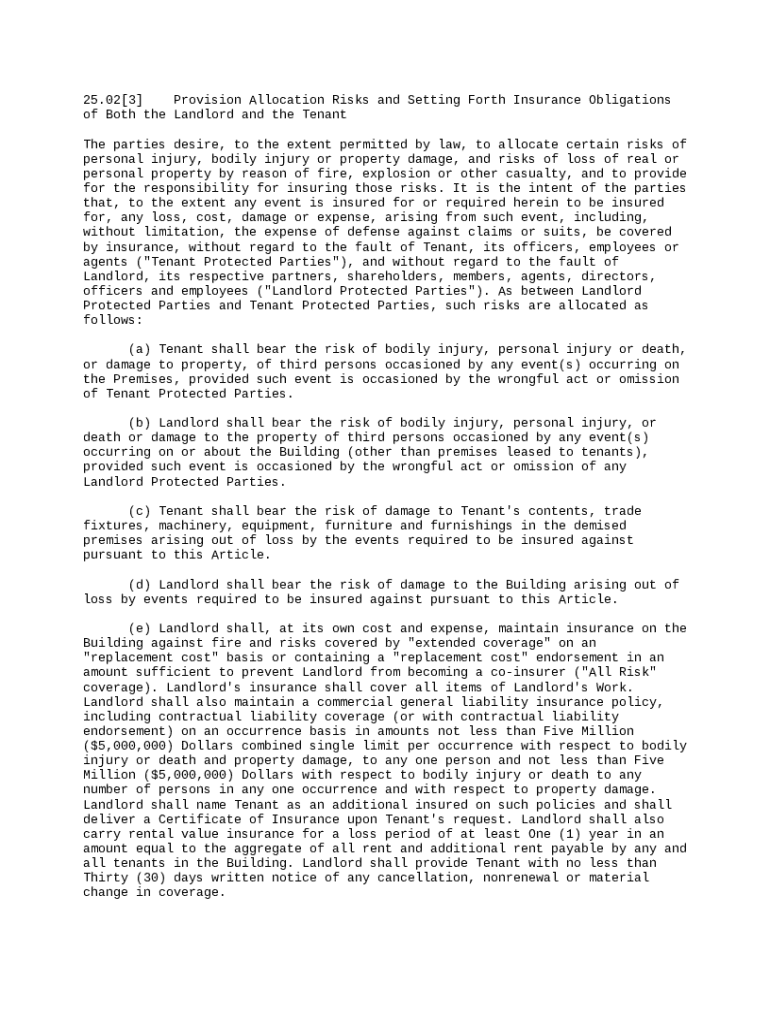

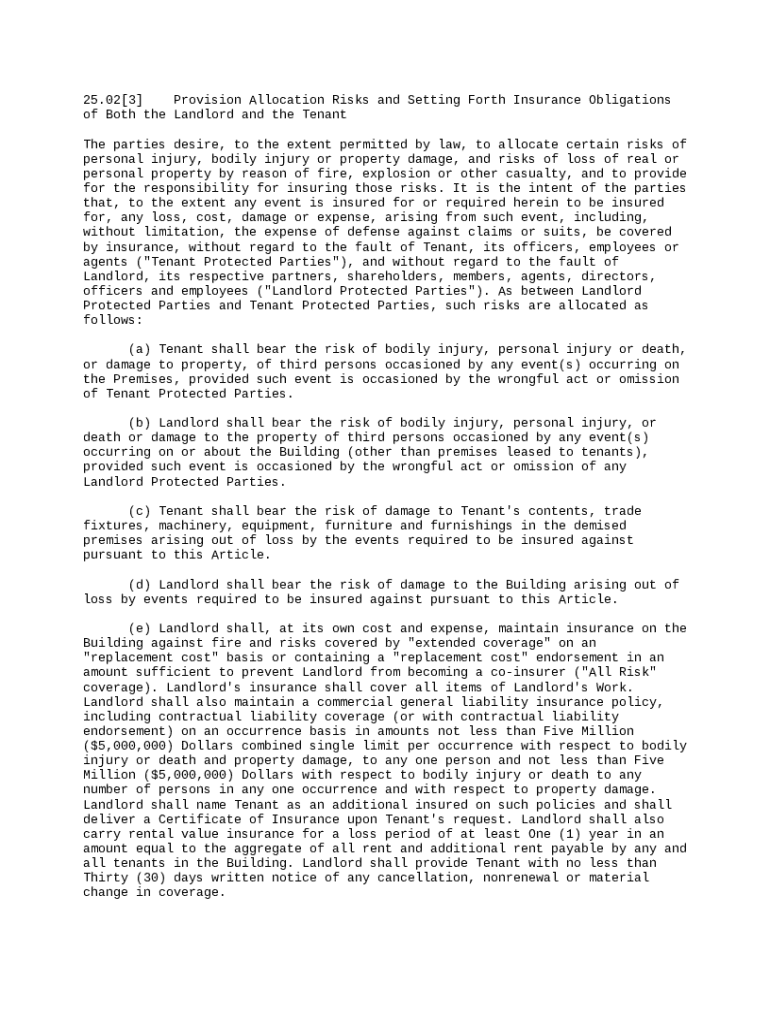

This office lease provision states that the parties desire to allocate certain risks of personal injury, bodily injury or property damage, and risks of loss of real or personal property by reason

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is provision allocation risks and

Provision allocation risks refer to potential issues that can arise when distributing financial resources or reserves for specific liabilities or future expenses.

pdfFiller scores top ratings on review platforms

PDFfiller is so easy to use!! PDF's are so often difficult to manipulate when you need to complete a form. PDFfiller makes it simple to do!

This is a great program, easy to use and is going to be a great asset

So far I 'am totally amazed @ what I can accomplish!

this is a very easy and efficient system.

Very user friendly-excellent and professional solution to my needs!

Great! my first time using this product and it works just fine, better control of my sheets

Who needs provision allocation risks and?

Explore how professionals across industries use pdfFiller.

Navigating Provision Allocation Risks: A Comprehensive Guide

Understanding how to manage provision allocation risks and form a well-structured lease agreement is crucial for landlords and tenants alike. This guide explores the intricacies of risk allocation in leasing, providing valuable insights and practical strategies.

What are provision allocation risks?

Provision allocation risks refer to the potential financial and legal implications involved in distributing responsibilities for liabilities, particularly regarding property leasing. This pertains to risks associated with personal injuries or property damage during the lease term.

-

Inadequate risk allocation can lead to significant financial burdens for either party in the event of an incident.

-

Failure to appropriately define responsibilities in the contract may expose landlords or tenants to legal actions.

-

Poorly allocated risks might leave either party underinsured, further complicating claims and liabilities.

What are the key components of risk allocation clauses?

Risk allocation clauses outline the distribution of risks and responsibilities between landlords and tenants, essential for minimizing disputes and ensuring clarity. These clauses help define who is responsible for damages and the necessary insurance obligations.

-

Clauses such as indemnification, liability limitations, and force majeure are common in lease agreements, directing specific responsibilities.

-

These clauses must operate within the legal guidelines prevalent in the property leasing sector to ensure enforceability.

-

Both landlords and tenants have specific insurance responsibilities that must be acknowledged, detailing what coverage is needed.

How can you negotiate risk allocation effectively?

Negotiating risk allocation is an essential skill for landlords and tenants aiming to safeguard their interests. Effective negotiation involves open communication, understanding mutual needs, and drafting terms that reflect agreed-upon allocations.

-

Know your limits and requirements ahead of time to negotiate effectively.

-

Always document the negotiation process to resolve future disputes easily.

-

Be willing to adjust terms to satisfy both parties without compromising on essential protections.

How are risks allocated in leasing agreements?

In the context of 'Provision Allocation Risks and Setting Forth Insurance Obligations', risks are allocated based on predefined clauses addressing both tenant and landlord responsibilities.

-

These individuals or entities may include guests or contractors, with specific liabilities outlined in the lease.

-

Typically consist of the property owner and their interests in ensuring the asset’s integrity and safety.

-

Clauses should specify who is responsible for bodily injury or property damage, clarifying each party's obligations.

What insurance obligations are essential for landlords and tenants?

Understanding mandatory insurance types is critical for effective risk allocation. Both landlords and tenants must be aware of what coverage is necessary to protect against potential claims.

-

This coverage protects against claims of bodily injury or property damage on the premises.

-

Landlords should ensure coverage for physical damages to the property itself.

-

Tenants are recommended to purchase this to safeguard their belongings and personal liability.

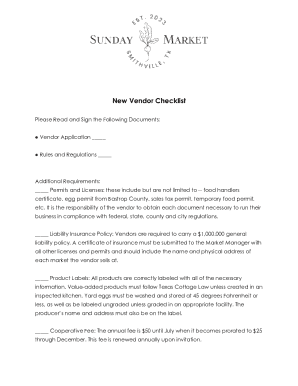

What are some practical steps for drafting effective risk allocation clauses?

Creating detailed risk allocation clauses requires careful drafting and consideration of local laws. Important aspects include clarity, flexibility, and thoroughness.

-

Begin by identifying risks specific to your agreement and address them clearly in the clause.

-

Factor in regulations related to property and contract law that may dictate certain provisions.

-

Allow for adjustments to meet future needs of both parties as situations change.

How can pdfFiller enhance lease management?

pdfFiller offers a user-friendly platform that simplifies document management for lease agreements. It enables seamless editing, digital signing, and collaboration, making it an efficient tool for teams.

-

Users can effortlessly edit PDFs to include crucial risk allocation terms and ensure clarity.

-

Facilitates teamwork by allowing multiple users to work on the same document simultaneously.

-

Documents can be accessed at any location, enhancing the flexibility of managing leases.

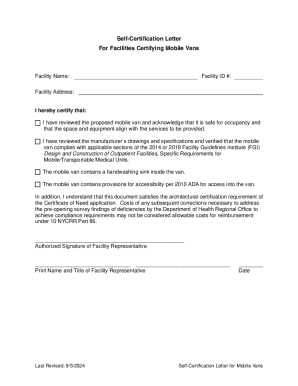

How to fill out the provision allocation risks and

-

1.Access the pdfFiller platform and log into your account.

-

2.Locate the section for 'Provision Allocation Risks and' in your document management area.

-

3.Download the template for 'Provision Allocation Risks and' if it's not already in your documents.

-

4.Open the template in pdfFiller by clicking 'Edit' or 'Fill Out' as needed.

-

5.Begin by entering the relevant company or project information at the top of the document.

-

6.Move to the section that outlines the types of provisions you are allocating, entering the necessary details for each category.

-

7.Ensure you assess and include any potential risks associated with each provision, utilizing clear language and concise points.

-

8.Once you have filled out all required fields, review your information for accuracy and completeness.

-

9.Finally, save the filled document, either exporting it to PDF format or saving it within your pdfFiller account for sharing or printing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.