Get the free Gross up Clause that Should be Used in an Expense Stop Stipulated Base or Office Net...

Show details

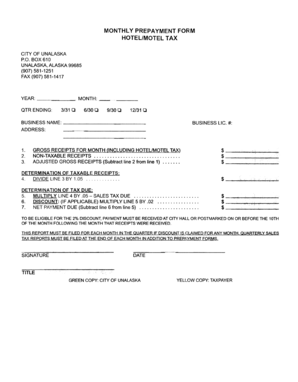

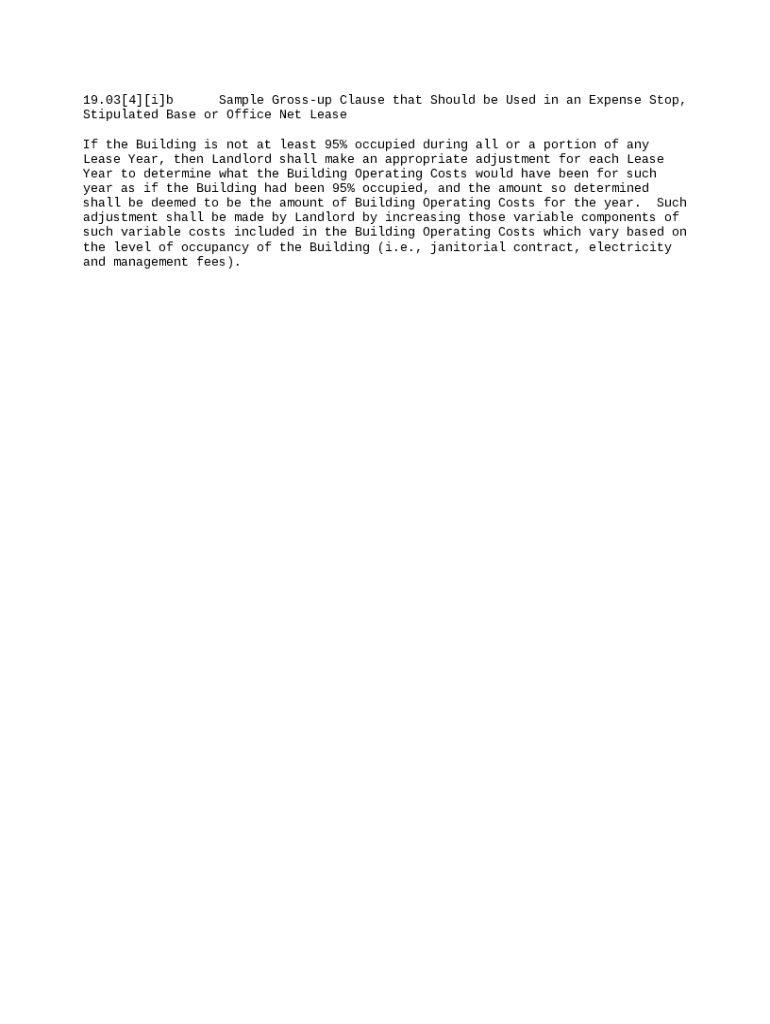

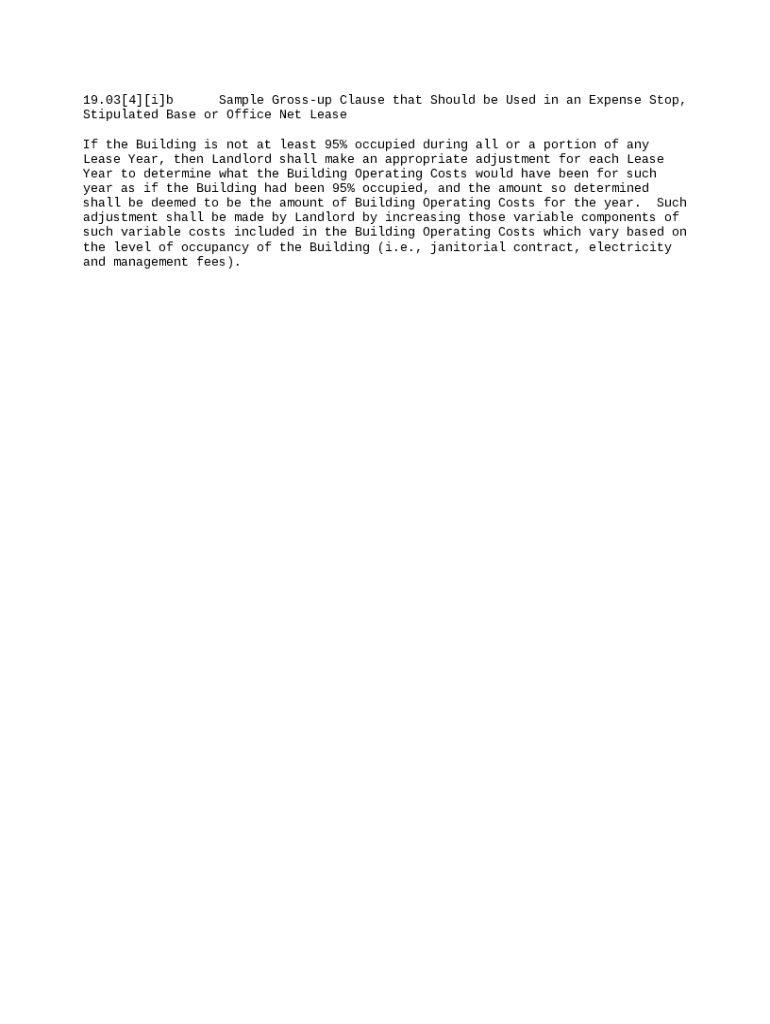

This office lease clause should be used in an expense stop, stipulated base or office net lease. When the building is not at least 95% occupied during all or a portion of any lease year, the landlord

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is gross up clause that

A gross up clause is a contractual provision ensuring that the payee receives a specified net amount after accounting for taxes or other deductions.

pdfFiller scores top ratings on review platforms

I have enjoyed this platform but so much more I need to learn.

still learning but it's useful so far, albeit a bit pricey

Easy to use and facilitate my office work.

good experience, easy to use so i recommanded this website

Easy to use. Worth every penny.

It has been good

Who needs gross up clause that?

Explore how professionals across industries use pdfFiller.

Gross Up Clause in Expense Stop, Stipulated Base or Office Net Lease

What is a gross-up clause, and why is it important?

A gross-up clause is a provision in a lease agreement that allows landlords to adjust operating expenses to reflect a full occupancy scenario, even if the property is not fully leased. This clause is significant in commercial leasing as it ensures that landlords can cover their costs while also protecting the financial interests of tenants by establishing a clear understanding of expense allocations.

How is the gross-up clause applied in lease agreements?

-

Used in specific contexts such as commercial leases where expenses need to be allocated fairly.

-

Example scenarios include multi-tenant office buildings where common areas incur variable costs.

-

Typically refers to a threshold, often around 95% occupancy, smoothing the impact of fluctuations in tenant presence.

How are gross-up amounts calculated?

The gross-up amount is calculated using a formula that takes into account the actual occupancy levels and the total operating costs. Factors influencing these calculations include variable costs such as maintenance and utilities, and tenant occupancy rates. Understanding how these factors interact is crucial for accurate gross-up calculations.

What components of building operating costs impact gross-up calculations?

-

Variable costs such as janitorial services, electricity, and management fees may increase with occupancy.

-

Certain operating expenses fluctuate with tenant levels, affecting the overall cost allocation to each tenant.

-

High operational efficiency can benefit tenants by reducing apportioned costs and allowing better budget management.

What are the common mistakes to avoid with gross-up clauses?

-

Misinterpretation of how the clause affects total expenses which may lead to disputes.

-

Landlords and tenants often misunderstand the implications of occupancy levels on charges.

-

Best practices include regularly reviewing lease provisions to ensure mutual understanding and compliance.

How to effectively manage your lease documents with pdfFiller?

pdfFiller provides a user-friendly solution for editing, customizing, and eSigning your lease agreements. With its cloud-based platform, users can collaborate effectively and manage documents efficiently, ensuring that all necessary changes are recorded and signed off without physical paperwork hassle.

How to fill out the gross up clause that

-

1.Begin by accessing the pdfFiller platform and uploading your document containing the gross up clause.

-

2.Locate the section of the document where the gross up clause is to be inserted or modified.

-

3.Click on the text field where the gross up clause will go, and ensure it's selected for editing.

-

4.Input the necessary details, including the net amount you want the payee to receive and the applicable tax rate or deductions.

-

5.Review your input for accuracy; check that all figures align with the agreed terms of the contract.

-

6.If applicable, add any additional terms or definitions related to the gross up clause in adjacent text fields for clarity.

-

7.Utilize the preview feature to ensure the document looks correct and the gross up clause is clearly stated before finalizing it.

-

8.Once satisfied, save the adjusted document, and make sure to download it or send it directly to the relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.