Get the free of Parent Guaranty template

Show details

This form is a model adaptable for use in partnership matters. Adapt the form to your specific needs and fill in the information. Don't reinvent the wheel, save time and money.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is form of parent guaranty

A form of parent guaranty is a legal document where a parent agrees to assume responsibility for the obligations of their child, typically in financial agreements or leases.

pdfFiller scores top ratings on review platforms

Great and a great tool, I have used several aspects already and am excited to see more in the future....

Making the fillable PDF form available is the biggest asset and, with the signature and check-box feature the form is 100 percent complete and ready to print. This is a great product.

This program worked for me when I had to do a state specific purchase & sale agreement/real estate. All six signers lived in different states and so had to digital sign. Easy to walk them through it.

ok but font kept changing without our input

I believe most of my problem is that I am not computer smart. Your chat contact was very patient and took a lot of time to help me. Thanks, Karl

Once you spend the time to learn the program it has become a helpful tool in our reports.

Who needs of parent guaranty template?

Explore how professionals across industries use pdfFiller.

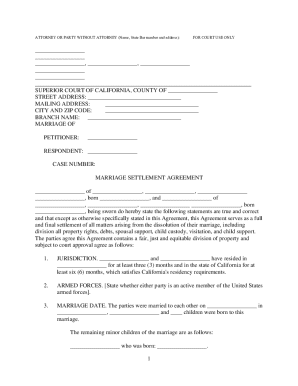

Detailed Guide to Form of Parent Guaranty Form

Filling out a form of parent guaranty form is crucial in various business transactions where assurance for obligations is required. This guide provides a comprehensive overview of how to properly complete one of these forms, ensuring all necessary components are addressed.

What is the parent guaranty form?

A parent guaranty form is a legal document that serves as a promise from a parent company to assume responsibility for debts or obligations of a subsidiary or related entity. Its primary purpose is to provide security to lenders and partners in financial transactions, ensuring they can reclaim owed amounts even if the primary company defaults.

-

The form is used to legally bind one entity to the financial responsibilities of another, offering stakeholders a layer of protection.

-

Understanding terms like 'Guarantor' (the parent company), 'Guaranteed Party' (the lender), and 'Joint Venture' (collaborative entity) is essential.

-

This form is commonly utilized in joint ventures, partnerships, and financing situations where financial reliability is crucial.

What are the components of the parent guaranty form?

A well-crafted parent guaranty form consists of several key components essential for legal clarity and enforceability.

-

Including the date is vital as it marks the beginning of the agreement and can affect the terms of enforcement.

-

Clearly identifying the parties involved, such as Parent Inc., Participant A Inc., and Participant B Corporation, is necessary for legal recognition.

-

Providing context by explaining the joint venture and any existing operating agreements establishes a foundation for the guarantee.

-

This section outlines the specifics of the guarantee, including the obligations on behalf of the parent company.

How do fill out the parent guaranty form?

Filling out a parent guaranty form efficiently requires attention to detail and a methodical approach.

-

Following a clear outline for each section helps minimize errors.

-

Be cautious of leaving blank fields, misidentifying parties, or using incorrect dates to ensure legal compliance.

-

Leveraging tools for editing and eSigning allows for a smoother process and ensures all components are filled.

-

Explore interactive features available on pdfFiller to enhance the filling experience.

What legal considerations should be aware of?

Understanding the legal implications is critical when dealing with a parent guaranty form to protect your interests.

-

Ensure compliance with local laws as they vary by region, impacting how guarantees are enforced.

-

By signing, the guarantor may expose themselves to liabilities; thus, understanding your obligations is imperative.

-

Maintain up-to-date knowledge about joint venture regulations to facilitate ongoing compliance.

How can manage the guaranty document?

Proper management of the parent guaranty form ensures its availability and security over time.

-

Choose secure digital storage solutions for easy access and organization.

-

Regularly review the document for needed changes and ensure it reflects any new agreements or conditions.

-

Utilize pdfFiller's features to keep your documents secure and confidential throughout the management process.

How to fill out the of parent guaranty template

-

1.Open the form of parent guaranty in pdfFiller.

-

2.Begin by entering the parent's full name in the designated field.

-

3.Fill in the address of the parent to ensure correspondence is directed appropriately.

-

4.Provide the date when the agreement is being signed.

-

5.Next, enter the child's full name and any additional required details to establish the relationship.

-

6.Specify the obligations the parent is guaranteeing, such as rent or loan payments, clearly outlining terms.

-

7.Sign the document in the provided signature field, ensuring it is legible.

-

8.If required, add a witness signature in the designated space by a neutral party.

-

9.Review the filled form for any errors or missing information.

-

10.Finally, save and download the completed form from pdfFiller to ensure it is ready for submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.