Get the free Uni Residential Loan Application template

Show details

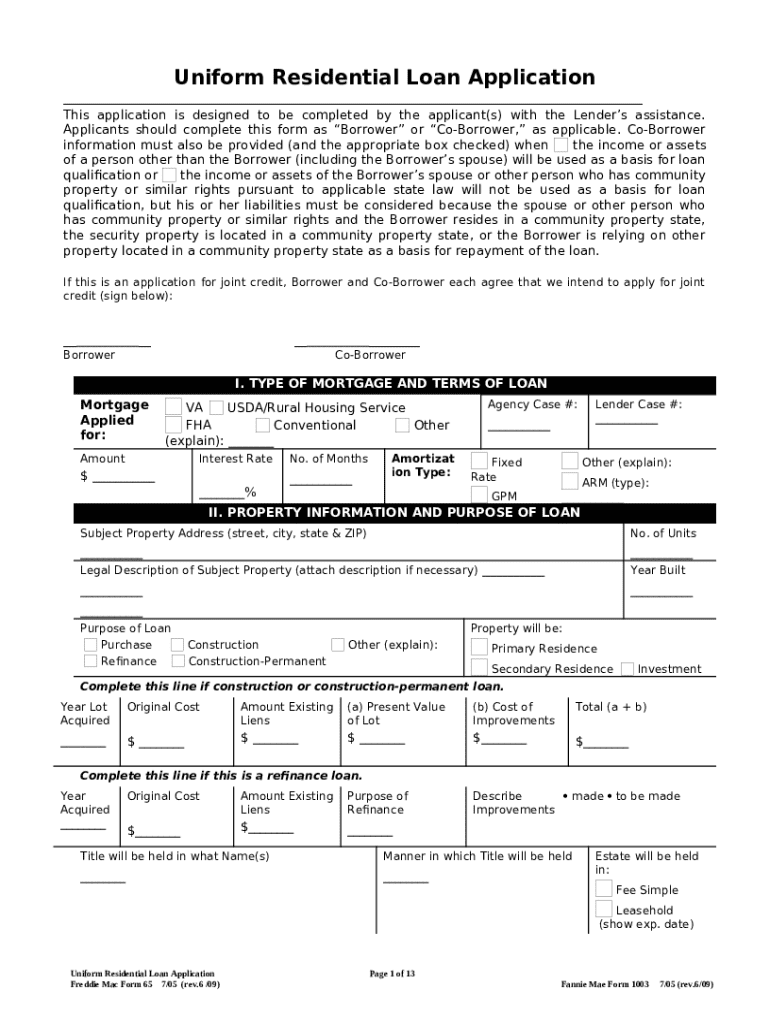

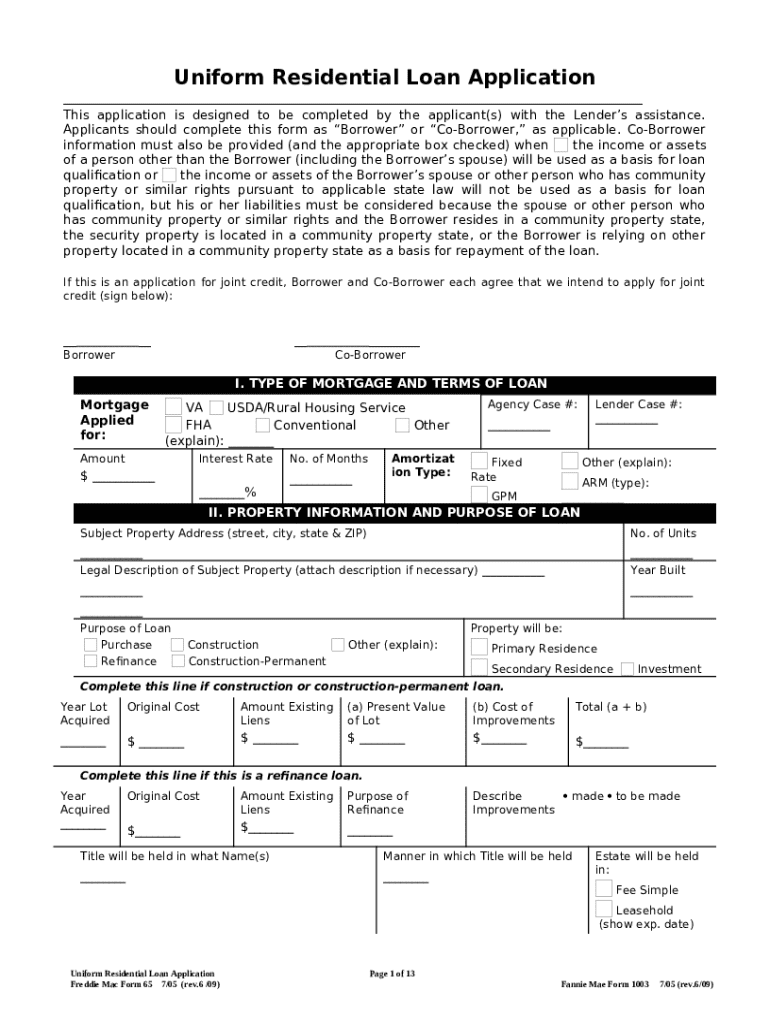

Uniform Residential Loan Application

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is uniform residential loan application

The Uniform Residential Loan Application (URLA) is a standardized form used by lenders to evaluate mortgage loan applications from borrowers.

pdfFiller scores top ratings on review platforms

Great website and resource!

Thank you Kara for wonderful customer…

Thank you Kara for wonderful customer service!

Very useful tool.

no comment

i have no comment

Excellent customer service and response…

Excellent customer service and response time. Very easy to use platform. Tons of capabilities and resources built in. Legal forms lists and easy to use e-signatures!!! This program is amazing!!! I'm an owner operator of a small construction company and can't believe I've been in business for almost 10 years without these resources so far. My success is now at my finger tips and I'm able to create bullet proof contracts, forms, notices, and change orders with e-signatures at a drop of a dime!!! Thank you pdfFiller!!!!

Very good

Who needs uni residential loan application?

Explore how professionals across industries use pdfFiller.

Uniform Residential Loan Application Guide on pdfFiller

What is the uniform residential loan application?

The Uniform Residential Loan Application (URLA) is a standardized form used by lenders to assess the creditworthiness of loan applicants. Completing this form accurately is crucial for loan qualification, as it contains vital information about your financial history and property details. Borrowers and Co-Borrowers play specific roles within this format, making it essential to understand their distinctions and responsibilities. Tools available on pdfFiller simplify the process of editing and signing this form, allowing prospective homeowners to navigate their applications more efficiently.

Who needs to fill out the application?

-

Both Borrowers and Co-Borrowers are typically required to complete this application, and must meet specific criteria based on income, credit score, and employment history.

-

In some cases, additional information about Co-Borrowers is essential, especially if they are also responsible for the mortgage.

-

Understanding the implications of community property laws is critical, particularly in states where marital assets are shared, affecting loan applications.

What are the different sections of the application?

The URLA contains several sections detailing various aspects of the mortgage process. This includes Type of Mortgage and Loan Terms and Property Information, each requiring accurate and comprehensive input. Taking the time to understand these sections can lead to a smoother loan processing experience.

Type of mortgage and loan terms

-

Common types of mortgages include VA, USDA, FHA, and Conventional loans, each with unique qualifying criteria and terms.

-

Understanding how interest rates work is fundamental; applicants should consider the differences between fixed-rate and adjustable-rate mortgages.

-

It’s essential to grasp terms like Fixed Rate Mortgages (FRM) and Adjustable Rate Mortgages (ARM) which can affect long-term financial commitments.

Property information

-

Providing the correct address and legal description of the subject property is crucial for loan approval.

-

The purpose of the loan—whether for purchase or refinance—should be clearly indicated, as this impacts the lending decision.

-

Utilizing pdfFiller to fill and organize these sections can enhance accuracy and prevent oversight.

What are common mistakes and how can they be avoided?

-

Many applicants make mistakes, like misentering income or neglecting to list all debts which can delay the approval process.

-

It's advisable to double-check all information before submission to ensure full accuracy.

-

Employing tools like pdfFiller can help identify and correct common mistakes before submission.

How can pdfFiller assist with your application?

pdfFiller provides a user-friendly platform for managing your uniform residential loan application. Users can easily upload, edit, and manage their forms. Utilizing e-signing features can significantly expedite the submission and processing of the application, while collaborative tools allow multiple parties to work on the document simultaneously.

What are the compliance considerations?

-

Borrowers must be aware of community property laws that might affect their application based on their state.

-

Compliance notes are essential for applicants needing translated versions of the application to ensure accurate understanding.

-

It’s crucial to ensure that all forms adhere to lender requirements to avoid unnecessary delays.

What further support and resources are available?

-

Reach out to lenders directly to clarify any application-related questions or issues.

-

Accessing links to related guides can provide supplementary insights into the loan application process.

-

Utilize pdfFiller’s customer support for real-time help with form-related issues.

What are final tips for a successful application?

-

Conduct thorough last-minute checks to ensure all information is complete and accurate before submitting your application.

-

Set reminders for follow-ups with lenders to maintain the momentum of your application status.

-

Keeping all relevant documents organized and accessible through pdfFiller ensures a smoother application experience.

How to fill out the uni residential loan application

-

1.Download the Uniform Residential Loan Application form from the pdfFiller website.

-

2.Open the PDF form in pdfFiller's editor interface.

-

3.Begin by entering your personal information, including your name, Social Security number, and marital status in the appropriate fields.

-

4.Fill out your current address, mailing address (if different), and number of years at the current address.

-

5.Complete sections related to employment history, including your employer's name, address, position, and duration of employment.

-

6.Input your income details provided from your job along with any other income sources.

-

7.Fill in asset information, declaring all your bank accounts, real estate holdings, and any other relevant assets.

-

8.Document your monthly expenses, including any current mortgage or rent payments, along with any other debts.

-

9.Review all entries for accuracy before submitting the application.

-

10.Use the ‘Save’ option to keep a copy of the application for your records.

-

11.Finally, print or electronically submit the completed application to your mortgage lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.