Get the free pdffiller

Show details

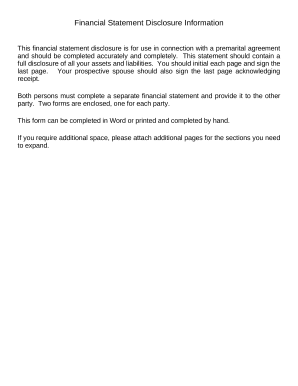

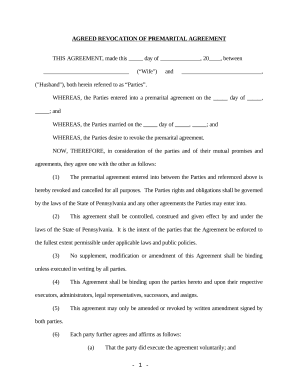

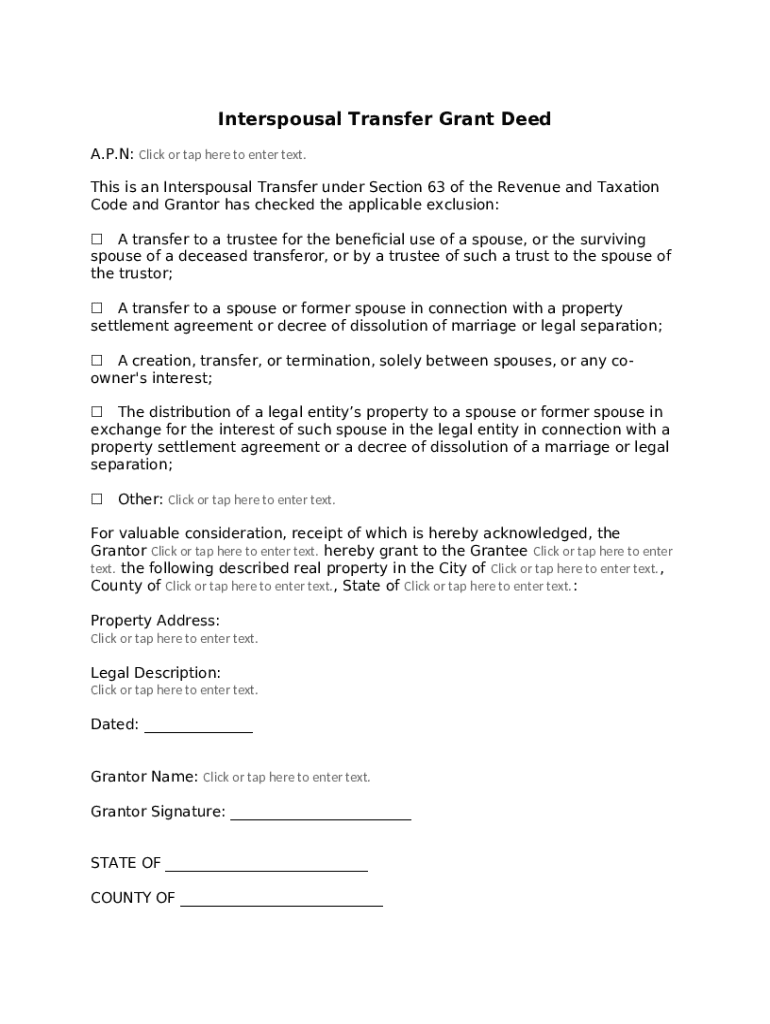

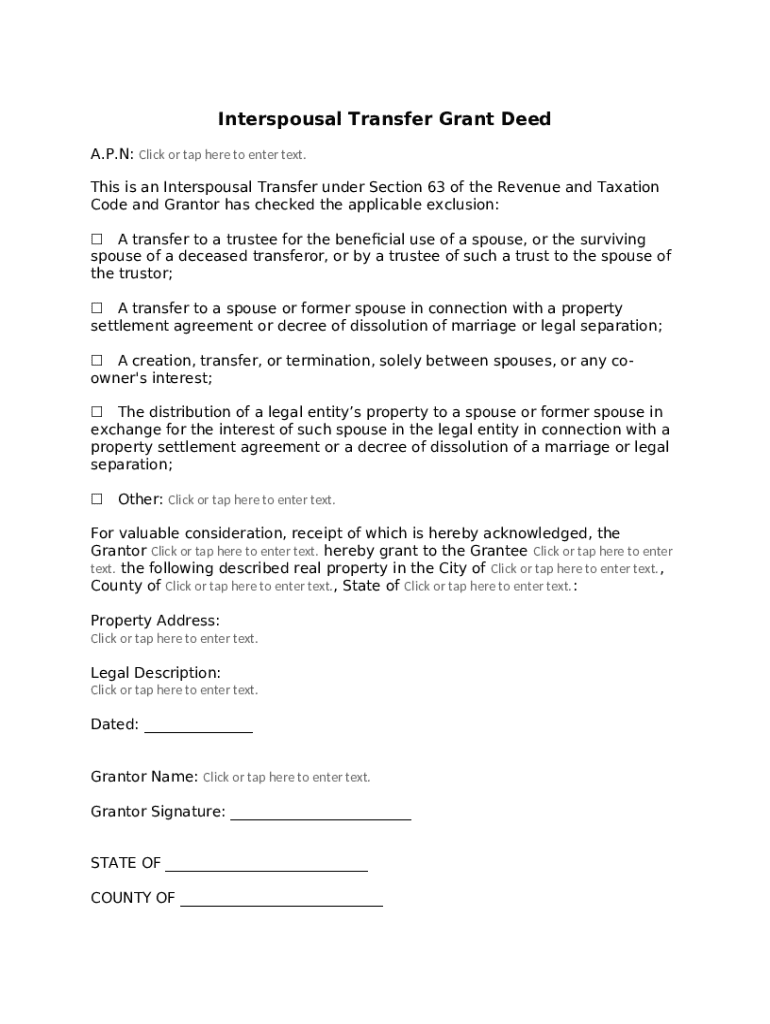

This is a sample Interspousal Transfer Grant Deed. This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Interspousal Grant Deed (Individual),

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is basic interspousal transfer grant

A basic interspousal transfer grant is a legal document allowing spouses to transfer property ownership without incurring tax consequences.

pdfFiller scores top ratings on review platforms

I appreciate the style and content of the form I used and look forward to using this product again.

I HAVE NOT NICE HANDWRITING, SO THIS IS VERY GOOD APP AND HELP ME TO FILL ANY FORM. THANKS.

Very useful tool. Like it. Easy to use.

Easy to use

I mainly use it to complete tax documents for my business and personal

It would help to have some sort of tutorial outlining the all the functions. Having been offered a webinar during the 30 day free trial would've been helpful.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Navigating the Basic Interspousal Transfer Grant Form

How do understand the interspousal transfer grant deed?

An Interspousal Transfer Grant Deed is a legal document that facilitates property transfers between spouses without incurring additional taxes. This deed is particularly crucial in California due to specific legal frameworks in the Revenue and Taxation Code that govern property transfers. Understanding this deed allows couples to manage their real estate holdings during marriage or in divorce proceedings efficiently.

-

The Interspousal Transfer Grant Deed is designed for married couples, allowing property to be gifted or transferred without taxation impacts.

-

This deed enables seamless transitions of ownership, which can be helpful for estate planning or ensuring smooth marital property exchanges.

-

California law specifies how and when this deed can be used, including regulations that protect both parties' interests in property transactions.

What key fields are included in the interspousal transfer grant deed?

Filling out the Interspousal Transfer Grant Deed correctly is essential for ensuring its legal validity. Each field serves a unique purpose, and understanding these elements helps prevent costly mistakes during property transfers.

-

This section asks for details about the person transferring the property, ensuring accurate identification.

-

Details about the spouse receiving the property must be clearly outlined to establish ownership.

-

A precise description of the property, including legal address and boundaries, is necessary to identify the asset in question.

-

Clear legal identification and location details help avoid disputes that could arise from vague descriptions.

-

It’s important to note the reasons for the transfer to comply with tax laws and maintain transparent records.

How do fill out the interspousal transfer grant form step-by-step?

Completing the interspousal transfer grant form may appear daunting, but breaking it down into manageable steps can simplify the process. Ensuring that you follow each step carefully promotes accuracy and legal compliance.

-

Start by collecting all relevant documents, such as property deeds and personal identification to streamline the process.

-

Provide full names and contact information without any abbreviations to avoid confusion.

-

Utilize the legal description sourced from your title documents to specify the property’s boundaries accurately.

-

Clarify whether the motive is for estate planning, divorce settlements, or other specific reasons to maintain transparency.

-

Ensure all signatures are visible – consider consulting a notary for proper verification.

How can utilize pdfFiller for managing my interspousal transfer grant form?

pdfFiller's cloud-based platform simplifies the process of managing your interspousal transfer grant form. You can edit, sign, and share documents effortlessly, making it an effective tool for busy individuals.

-

Use pdfFiller's tools to modify your form directly, ensuring it meets all your needs.

-

Sign the document electronically within the platform, saving time and reducing the need for in-person meetings.

-

Easily share your document with team members or legal advisors for their input before finalizing.

-

From the dashboard, you can save, print, and send your completed form all in one place.

What common mistakes should avoid when completing the grant deed?

Mistakes during the completion of the Interspousal Transfer Grant Deed can lead to legal complications and invalidation of the document. Awareness of common pitfalls helps ensure a smoother process.

-

These errors can render the document invalid, necessitating re-filing and potential delays in the transfer process.

-

California law often requires specific witness signatures or notarization for validity.

-

Leaving out details about the reason for transfer can complicate tax implications and lead to audits.

How to fill out the pdffiller template

-

1.Visit the pdfFiller website and log in or create an account if you don't have one.

-

2.Search for the 'basic interspousal transfer grant' template in the document library.

-

3.Select the template and click on 'Fill Online' to open the form in the editor.

-

4.Begin filling out the required fields, including the names of both spouses, the date of the transfer, and a description of the property.

-

5.Ensure correct legal names are used as they appear on official documents.

-

6.Add additional information if required, such as addresses, tax identification numbers, or marital status.

-

7.Review the completed document for accuracy and necessary information.

-

8.Once satisfied, save your document and consider printing it for signatures.

-

9.Share the document electronically or provide hard copies to ensure both spouses can sign.

-

10.After signing, retain copies for personal records and file with any relevant authorities if required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.