Get the free Ination For Probate of Estate template

Show details

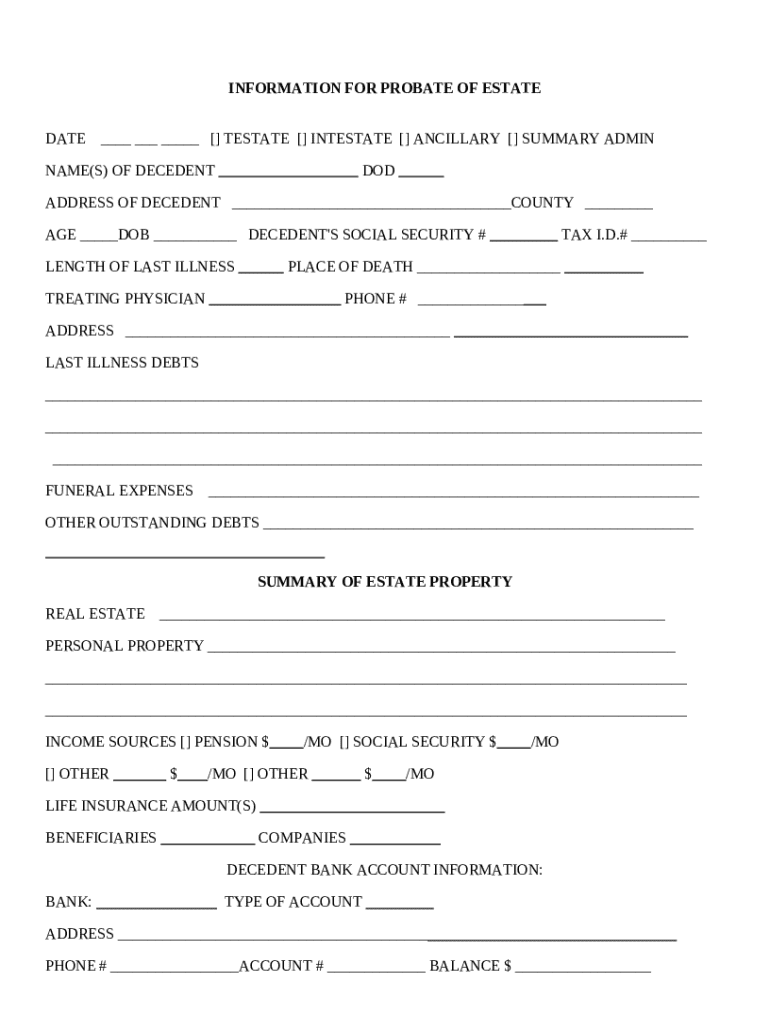

This form is used to compile the necessary information needed to prepare your probate application. This information includes personal, Heir and special instructions or notes.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is information for probate of

The document 'information for probate of' is a legal form used to gather necessary details for the probate process of a deceased person's estate.

pdfFiller scores top ratings on review platforms

Easy!!

Great product

Absolutely an cool user friendly product. Im extremely happy I found it and use it. It has saved me tons of work!

ok

super recomendable me ayudo muchisimo

filling was good , but I cannot save it to my hard drive or print it

Who needs ination for probate of?

Explore how professionals across industries use pdfFiller.

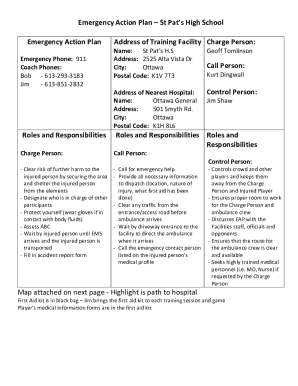

Comprehensive Guide for Probate of a Form

How to fill out a probate of a form

Filling out a probate of a form involves understanding key details such as the decedent’s information, financial obligations, and estate assets. By following a structured approach, you can ensure that all necessary data is accurately documented, making the probate process smoother.

Understanding probate: the basics

Probate is a legal process that validates a deceased person's will and oversees the distribution of their assets. It is crucial in estate planning because it determines how belongings and responsibilities are handled after death. Key forms of probate include Testate, Intestate, Ancillary, and Summary Administration, each applicable under different circumstances.

-

Occurs when the decedent has a valid will, directing how assets should be distributed.

-

Applies when the decedent dies without a will, and state laws dictate asset distribution.

-

Involves handling property located in a different state from where the decedent lived.

-

A simplified probate process for smaller estates, often requiring less legal oversight.

The probate process typically involves filing the will with the court, appointing a personal representative, notifying heirs, and settling debts before distribution. This can vary depending on local laws in your region.

What is the importance of date and initial assessment?

The correct date is vital in probate documentation as it often determines jurisdiction and eligibility for specific probate processes. Depending on the case type—be it Testate, Intestate, Ancillary, or Summary Administration—the documentation and proceedings will differ. Understanding these distinctions helps streamline the probate process.

-

Assess the nature of the probate case for accurate classification.

-

Ensure the date of death and filing aligns with state requirements to avoid delays.

What key details about the decedent should be collected?

Gathering accurate decedent information is critical to the probate process. This includes the personal details like the decedent's name, date of death, and address, as well as their age at death, date of birth, and Social Security number. Documenting the tax ID number is also essential to manage estate taxes effectively.

-

Ensure it's spelled correctly, as it’s critical for all documentation.

-

Accurate documentation helps legal proceedings and timelines.

-

Needed to address tax obligations and other financial responsibilities.

How to manage medical history and financial obligations?

Documenting the decedent's medical history, including the length of their last illness and place of death, is critical during probate. This information impacts claims through health insurance or medical debts incurred prior to death. Identifying related debts, such as those from the last illness or funeral expenses, ensures all financial obligations are settled properly.

-

Record the duration and circumstances of the last illness; it may affect claims.

-

Understand which debts must be paid from the estate before distribution.

How to summarize the estate property?

A precise summary of the estate assets, including real estate and personal property, is essential for the probate process. Assess and document all sources of income as well, ensuring that you account for life insurance claims, which can significantly affect estate value. This highlights the importance of thorough property evaluation during probate.

-

List all properties owned that are subject to probate.

-

Document items of value and any claims attached to them.

What bank account information for the decedent is necessary?

Collecting accurate bank account details, including the institution's name, account types, and balances, is vital as these accounts directly influence the estate's solvency. Properly listing all accounts enables efficient tracking during the probate process. Tools like pdfFiller enhance this process by allowing users to manage these forms securely.

-

Include all bank accounts the decedent held.

-

Identify different types of accounts, as each may be treated differently in probate.

How to designate a personal representative?

Selecting a personal representative is a critical step in the probate process. Criteria for selection should include trust, organizational skills, and the ability to manage estate tasks. Once identified, details about the personal representative's relationship to the decedent must be filled out carefully.

-

Choose someone who has a strong understanding of the decedent’s wishes.

-

Educate the personal representative about their crucial role in managing the estate.

Why is identifying heirs, devisees, and legatees important?

Documenting the details of heirs, devisees, and legatees—including their relationships and contact information—is essential to ensure smooth asset distribution. Disputes may arise among heirs, so keeping accurate records can help in resolving these issues. pdfFiller can assist by providing tools for changing documentation as circumstances evolve.

-

Record the nature of the relationship with the decedent for clarification.

-

Have a clear plan in case of disagreements among heirs.

What special instructions or notes may be required?

Utilize the section for any additional instructions or significant notes regarding the decedent's wishes. Documenting unique circumstances ensures that special requests are not overlooked. pdfFiller offers options for secure storage, ensuring these notes are easily retrievable when needed.

-

Record any specific instructions conveyed by the decedent.

-

Use secure digital platforms to store these important instructions.

How to manage client sources and fees?

Identifying the source of your clients—whether they are repeat clients, referrals, or found through resources like the Yellow Pages—is essential for maintaining relationships and expanding your business. Accurately documenting attorney fees, retainer costs, and other expenses ensures clarity in financial dealings. pdfFiller can streamline this process by providing tools for managing legal fees efficiently.

-

Record who referred the client to improve outreach strategies.

-

Keep precise records of all fees to avoid disputes later on.

How to fill out the ination for probate of

-

1.Obtain the 'information for probate of' form from your local court or online.

-

2.Read the instructions carefully to understand all required sections.

-

3.Start by filling in the decedent's full name and date of death at the top of the form.

-

4.Provide the decedent's last known address and Social Security number in the designated fields.

-

5.List the names and addresses of all heirs and beneficiaries in the next section.

-

6.Indicate the relationship of each heir or beneficiary to the decedent.

-

7.Fill in details regarding the decedent's assets, including real estate, bank accounts, and personal property.

-

8.If applicable, note any debts or liabilities the decedent had.

-

9.Review the entire document for accuracy and completeness before finalizing.

-

10.Print the document, sign it where indicated, and date it appropriately.

-

11.Submit the completed form to the probate court along with any required fees.

-

12.Keep a copy of the submitted document for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.