Get the free Clauses Relating to Capital Calls template

Show details

This sample form, containing Clauses Relating to Capital Calls document, is usable for corporate/business matters. The language is easily adaptable to fit your circumstances. You must confirm compliance

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is clauses relating to capital

Clauses relating to capital are legal provisions that define the structure and allocation of capital in a business or partnership agreement.

pdfFiller scores top ratings on review platforms

Many thanks to your "support" crew as I…

Many thanks to your "support" crew as I found the first time through this in a long time is difficult to figure out. I will be filing this form on Monday so will let you know if we got it right!

great

great thing to useeeeee

So far so good

So far so good

Really nice tool

Really nice tool, works seemingly and is very powerful!

GREAT!!!

GREAT!!! LOVE USING THEIR SERVICES

Easy to use and navigate

Easy to use and navigate

Who needs clauses relating to capital?

Explore how professionals across industries use pdfFiller.

The Essential Guide to Clauses Relating to Capital Forms

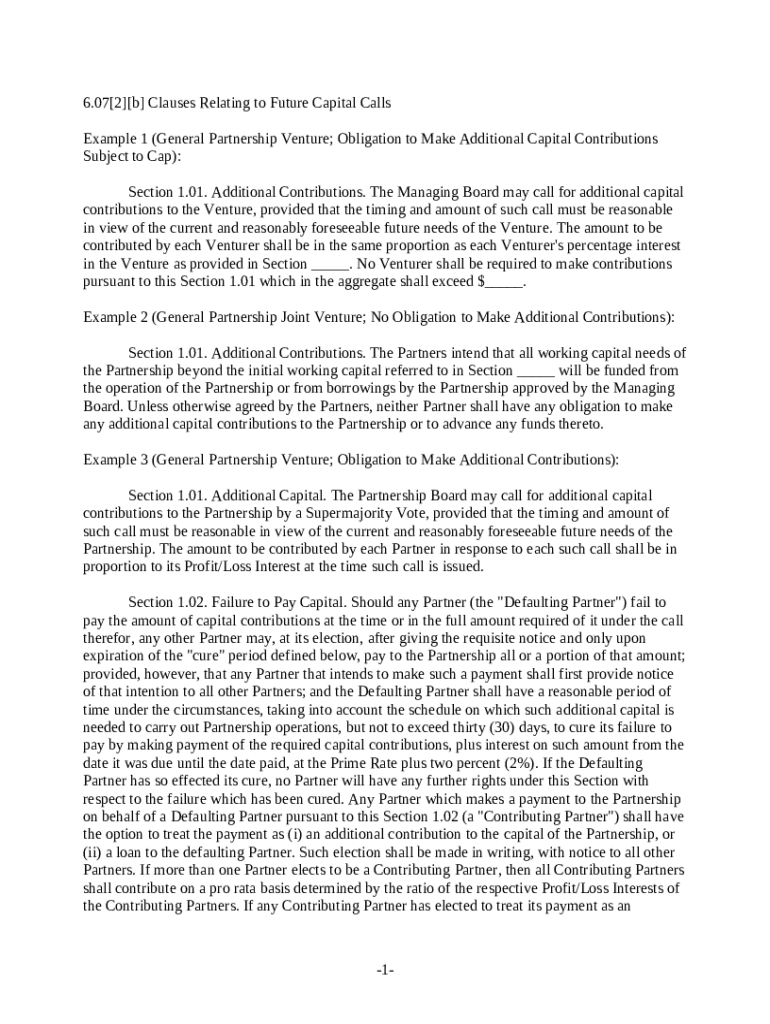

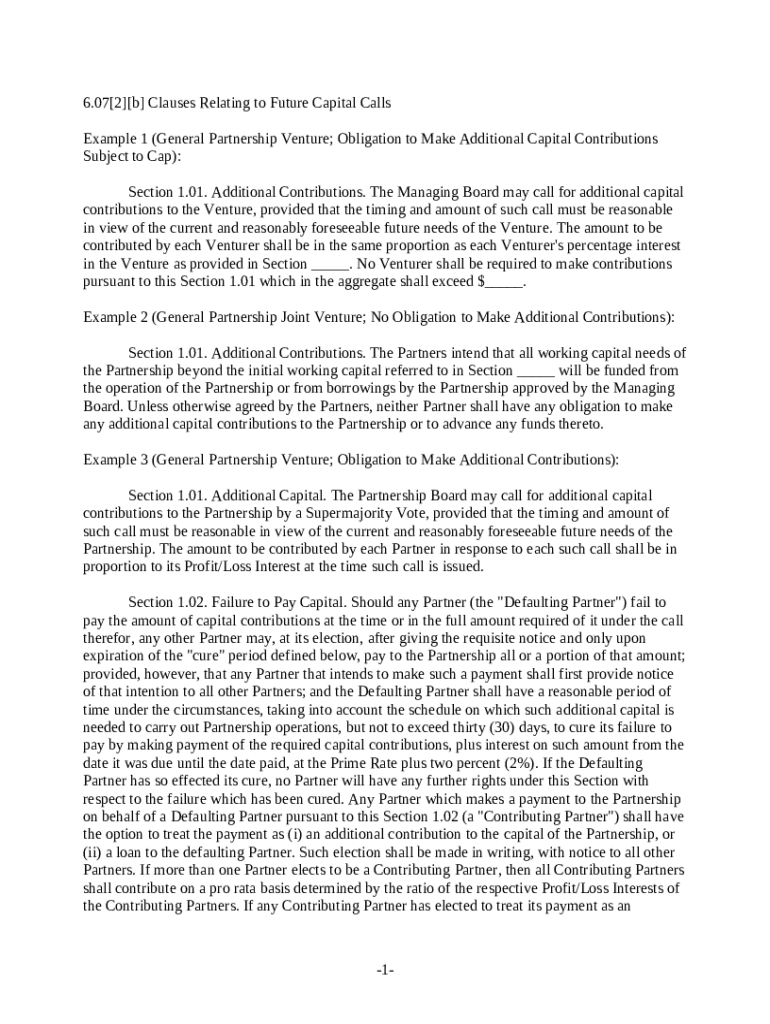

What are capital contribution clauses?

Capital contribution clauses are critical components in business agreements detailing how much capital partners are required to provide to a joint venture or partnership. These clauses establish rules for initial contributions and specify conditions under which partners may need to make additional investments. Understanding these clauses ensures that all partners know their obligations and helps prevent disputes.

-

Clear capital contribution clauses reduce misunderstandings and define the financial responsibilities of each partner.

-

Well-defined clauses help in effective decision-making regarding investments and financial planning.

What types of capital contribution clauses exist?

Capital contribution clauses can vary significantly based on the structure of the partnership or business. These can include obligations to make additional contributions, exemption conditions for partners, and the procedural framework for calling these contributions.

-

Partners must specify scenarios where further funding is necessary, ensuring all parties understand when contributions might be required.

-

Certain conditions may exempt partners from making additional capital contributions, which should be clearly articulated to prevent conflicts.

How is a typical capital contribution clause structured?

A capital contribution clause should encompass key components such as the timing of contributions, the amount required, and the necessity behind the contributions. Including specific wording that clearly defines these components can prevent ambiguity.

-

Clarity on when contributions are due and how much is required creates a foundation for accountability among partners.

-

Using precise language in capital contribution clauses ensures that all partners interpret their obligations similarly.

How can businesses manage future capital calls?

Managing future capital calls requires careful planning and communication among partners. When a need for additional contributions arises, it must be communicated effectively, ensuring that the reasons for the call are justified and reasonable.

-

Businesses should establish a schedule for future capital calls to provide transparency and anticipation among partners.

-

Ensuring that contributions are proportional to each partner's interest in the venture can maintain fairness.

What are the implications of defaulting on contributions?

A defaulting partner refers to a partner who fails to meet their capital contribution obligations. This can lead to significant implications, including the potential for dilution of their ownership interest and conflicts within the partnership.

-

Clearly defining what constitutes a default can protect compliant partners and outline remedies.

-

The partnership board should have established steps for addressing defaults to maintain overall partnership health.

What are best practices for drafting effective clauses?

Drafting effective capital contribution clauses requires adherence to best practices. Utilizing templates can provide a solid foundation, but each agreement should be tailored to the partnership's specific needs and circumstances.

-

Avoid legal jargon to ensure all parties understand their obligations and rights.

-

Including flexible terms can accommodate unexpected financial needs while protecting partner interests.

How can pdfFiller facilitate managing capital contributions?

pdfFiller provides an integrated solution for drafting, editing, and managing capital contribution clauses. This cloud-based platform allows users to collaboratively create documents, eSign them, and store them securely, ensuring all partners have access to critical agreements.

-

pdfFiller’s intuitive drafting tools make it easy to create customized capital contribution clauses.

-

Real-time collaboration allows partners to work together on agreements, preventing miscommunication.

How to fill out the clauses relating to capital

-

1.Open the PDF template for the clauses relating to capital on pdfFiller.

-

2.Begin by entering the name of the business or partnership at the top of the document.

-

3.Next, identify and describe the type of capital being addressed, such as equity or debt capital, and provide relevant amounts.

-

4.Fill out sections which detail how existing capital is allocated among partners or investors.

-

5.Specify any conditions related to additional capital contributions, including timelines and required amounts.

-

6.Indicate the process for capital withdrawal or redistribution among partners or shareholders.

-

7.Review the completed sections for accuracy, ensuring all figures and terms comply with your business agreements.

-

8.Sign the document electronically to authenticate it if required.

-

9.Save and download the completed document for your records and to share with stakeholders as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.