Get the free First Time Homebuyer Program Realtor Packet template

Show details

Sample First Time Homebuyer Program Realtor Packet: Includes Realtor Summary, Lending Guidelines, Loan Processing Summary, Property Selection and Eligibility Checklist, Disclosure to Seller with

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is first time homebuyer program

A first-time homebuyer program is a government or organizational initiative designed to assist individuals purchasing their first home by providing financial aid, education, and resources.

pdfFiller scores top ratings on review platforms

I HAVE USED A SIMILAR FORM IN THE PAST (LONG AGO)THIS IS SO MUCH IMPROVED. I LOVE IT.

Sometimes hard to find healthcare docs I need.

thought I was buying monthly fee and was charged for a full year up front.

Very handy especially with the tick function as 80% of the form just needs a tick.

you have forms that are not updated. however, for a particular project- i had to recreate forms filed in 2010. you were the ONLY place, company, resource that had these non-updated forms!! yay!!

User friendly and compatible with many platforms.

Who needs first time homebuyer program?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the First Time Homebuyer Program Form

If you're a first time homebuyer, understanding the first time homebuyer program form is crucial in navigating the home purchasing process. This guide covers everything you need to know about the program, preparing your application, the essential components of the Realtor Packet, and what to do post-application.

What is the first time homebuyer program?

The first time homebuyer program is designed to assist individuals who are purchasing their initial home. The program offers various benefits, including financial assistance and favorable mortgage terms, aimed specifically at aiding low-income applicants in their journey towards homeownership.

-

The program typically provides financial assistance that can cover down payments and closing costs.

-

First time homebuyers must meet specific income thresholds, residency criteria, and credit rating requirements.

-

Many states, including California, have local support programs that complement the state-level initiatives.

How to prepare for your application?

Preparing for your application is a critical step in the homebuying process. Gathering necessary documents early can ensure a smoother application process.

-

You'll need to prepare tax returns, pay stubs, bank statements, and identification documents.

-

Be aware of application deadlines to ensure you don’t miss opportunities for financial assistance.

-

It’s advisable to assess your financial standing, including credit score and debt-to-income ratio, to improve your chances of approval.

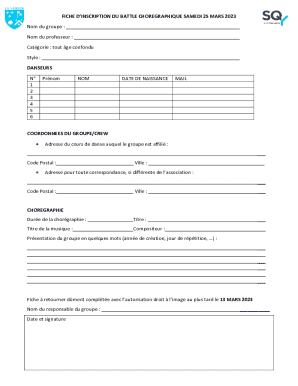

What are the essential components of the Realtor Packet?

The Realtor Packet contains vital documents and instructions necessary for proceeding with the home purchase. Understanding each component can significantly ease the homebuying process.

-

Provides an overview of the homebuying program specific to your needs, outlining which documents are necessary.

-

Detail the requirements for loan eligibility, including income limits and acceptable property types.

-

Outlines the steps involved in the loan approval process, helping you prepare accordingly.

Which key forms are included in the Realtor Packet?

Several key forms included in the Realtor Packet require your close attention. Completing these forms accurately is essential for maintaining compliance and ensuring your application is processed without delay.

-

This checklist helps you verify if a property meets eligibility before proceeding with the purchase.

-

These forms provide essential disclosures to the seller regarding the property condition and any potential risks.

-

Understanding this form ensures you comply with housing standards, especially for properties built before 1978.

What are the requirements for lead-based paint regulations?

Homes constructed before 1978 have specific regulations regarding lead-based paint, which is crucial for the safety of your household. Adhering to these regulations is not just a legal requirement but also a significant step towards ensuring a safe living environment.

-

Sellers are required to inform buyers about potential lead-based paint hazards in the property.

-

The Lead-Based Paint contract contingency language must be a part of the sales agreement if the home is in question.

-

Conducting visual assessments and risk reduction is vital to ensure the property is safe before moving in.

How to submit the purchase agreement?

Submitting your purchase agreement accurately is fundamental for finalizing your home purchase. Making sure you follow the right steps will help avoid any unnecessary delays.

-

Ensure that you have filled out the Property Selection and Eligibility Checklist completely.

-

Reach out to the county for any assistance regarding the Purchase Agreements if unclear.

-

Understand the significance of the Acquisition Notice to Seller to facilitate transparent communication.

What are the post-application steps and follow-up?

After you submit your application, the next steps are crucial in maintaining momentum in the homebuying process. Knowing what to expect can help alleviate anxiety during this waiting period.

-

You can check the status of your application through the county’s website or directly via contact.

-

Understand what happens once you receive approval and what is expected from you moving forward.

-

Educate yourself on your rights and responsibilities as a new buyer to avoid potential pitfalls.

In conclusion, understanding the first time homebuyer program form is essential for any prospective homebuyer. This comprehensive guide provides you with all the information needed to navigate the application process seamlessly. By utilizing pdfFiller, you can easily manage these forms while enjoying the benefits of a cloud-based platform that empowers you to edit, eSign, and collaborate on important documents.

How to fill out the first time homebuyer program

-

1.Access the pdfFiller platform and log in to your account.

-

2.Locate the first time homebuyer program form within the templates.

-

3.Select the form and click on 'Fill' to open the editing interface.

-

4.Thoroughly read the instructions provided on the form before starting.

-

5.Fill in your personal information in the required fields, including name, address, and contact details.

-

6.Provide financial information, including income, assets, and any existing debts where applicable.

-

7.Review the eligibility requirements and check the boxes to confirm your understanding and compliance.

-

8.Attach any required documentation such as pay stubs or tax returns using the upload function.

-

9.Double-check all entered information for accuracy and completeness before submission.

-

10.Once completed, click 'Save' to retain a copy of your application, and then submit the form as directed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.